Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

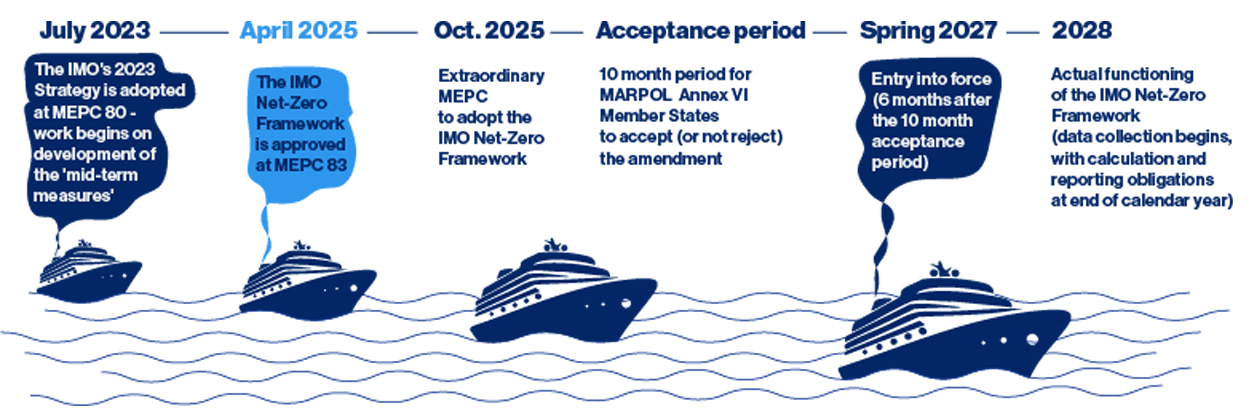

In April 2025, the International Maritime Organization (IMO)—the United Nations agency responsible for regulating international shipping—made history by approving the first-ever global regulatory framework specifically designed to drive the shipping industry's transition to alternative fuels and zero-emission technologies. Known as the IMO Net-Zero Framework, this groundbreaking mandate introduces a mandatory fuel standard requiring ships over 5,000 gross tons—responsible for around 85% of shipping emissions—to progressively reduce their greenhouse gas intensity starting in 2028. The emission reduction targets become more ambitious over time, with specific thresholds currently defined through 2035. New targets will be set every five years to guide the industry's continued decarbonization.

The IMO Net-Zero Development Timeline

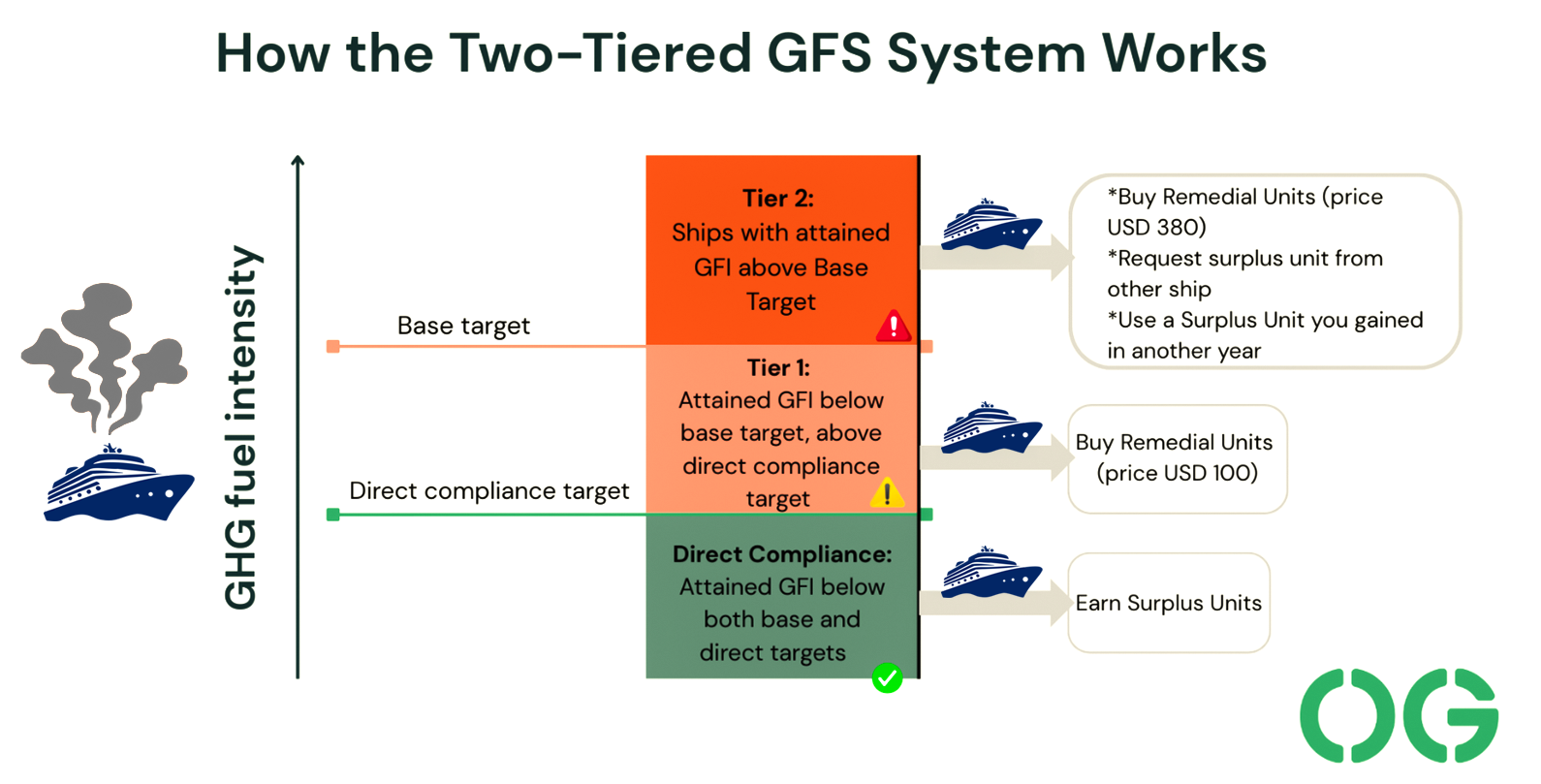

A defining feature of the IMO Net-Zero Framework is its dual approach: a mandatory fuel standard paired with a global carbon pricing scheme. Once in effect, ships will be assessed annually based on how their greenhouse gas intensity compares to required thresholds. Those that exceed their limits must purchase “remedial units,” while those that outperform can generate “surplus units.” These units are traded through the IMO Net-Zero Fund, which reinvests proceeds into clean fuel innovation, technology development, and support for developing nations.

For example, a cruise ship running on heavy fuel oil with scrubbers and minimal onboard efficiency upgrades may fall short of its emissions target and be required to purchase remedial units. In contrast, a newer ship using alternative fuels such as LNG and equipped with advanced energy efficiency technologies could outperform its target and generate surplus credits. This combination of mandatory fuel standards and market-based incentives establishes the first legally binding carbon pricing system for the global shipping industry.

As such, this approach fundamentally alters cruise economics. Fuel is no longer just an operating expense—it’s a compliance variable with direct cost and credit implications.

This BA Perspective unpacks what the Net-Zero Framework means for the cruise industry—and how ports can start preparing to support its implementation.

This is a global regulation that will impact all cruise ships and cruise regions. Importantly, it isn’t about replacing the conventional fleet overnight. Cruise operators now face two main compliance pathways: improving energy efficiency across ship design and operations, and—more critically—adopting alternative fuels such as LNG (in the short to mid-term), methanol, ammonia, hydrogen or advanced biofuels, which offer the greatest compliance gains and cost savings.

The economic pressure will ultimately make continued use of higher-carbon fuels too costly compared to alternatives, serving as a key mechanism driving the industry’s fuel transition. That is because the new carbon pricing mechanism makes traditional marine fuels like heavy fuel oil (HFO) a and marine gas oil (MGO) significantly more expensive—even for vessels equipped with scrubbers, which reduce sulfur oxides (SOx) but not greenhouse gases.

MGO and HFO are not outright banned, but under the framework, operators who continue using them will incur financial penalties that will increase over time, incentivizing a switch to cleaner fuels.

In contrast, ships running on lower-emission fuels will largely avoid these charges. However, simply having an LNG-capable ship is no longer enough—compliance depends on actually operating with the cleaner fuel. Many LNG-ready cruise ships still rely on conventional fuels due to cost pressures or limited bunkering infrastructure. Older vessels or those that cannot be retrofitted will face steep and rising financial penalties, accelerating the need for fleet modernization and long-term fuel strategy alignment.

The framework’s design also allows a company’s alternative-fuel ships that exceed emissions targets to generate surplus credits, which can be used to offset underperformance elsewhere in that company’s fleet. This gives operators with more modern, fuel-flexible vessels some short-term flexibility. Nonetheless, the overall cost burden is expected to rise during the transition, and operators may be forced to pass some of these costs on to consumers, potentially raising ticket prices.

Operators already investing in energy efficiency, alternative-fuel ships, and carbon management strategies are at an advantage. As of mid-2025, only 25 vessels in the global cruise fleet are equipped to operate on alternative fuels, with the majority powered by LNG.

But the pipeline tells a different story: according to CLIA’s 2024 Net Zero report, nearly half of all cruise capacity on order through 2028 will be dual-fuel capable, designed to operate on LNG, methanol, and renewable fuels—including biofuels and green hydrogen—with flexibility for synthetic variants.

Importantly, this transition is not limited to vessels. Current industry projections estimate that up to 87% of the cost burden will fall on land-based infrastructure, primarily in fuel production, storage, and delivery systems. Only 13% will stem from ship modifications or newbuild investments.

For ports, the most consequential opportunity in the fuel transition is enabling alternative fuel bunkering—specifically for LNG, methanol, and advanced biofuels. These fuels not only allow cruise operators to comply with the IMO Fuel Standard but also become tradeable assets under the regulation’s emissions credit structure.

However, infrastructure to support these fuels remains limited—creating a meaningful opening for new entrants and forward-looking ports to differentiate themselves. As cruise lines reevaluate routes and fleet deployment based on fuel access and compliance costs, ports that can adapt early will have a distinct advantage.

Several key dynamics are emerging that ports should closely consider:

Still, the ability of ports to act on these opportunities hinges on one critical factor: access to shore power and alternative fuels.

The shift to low-emission fuels faces a classic chicken-and-egg dilemma: producers of emerging fuels like e-methanol are hesitant to invest in supply infrastructure without long-term purchase agreements, while cruise lines are reluctant to sign those agreements without clear signals on fuel access, pricing, and reliability.

Ports can play a pivotal role in breaking this stalemate by coordinating early commitments between cruise operators and fuel suppliers, enabling future bunkering operations. While a few first movers—mainly in Europe—are beginning to unlock early production, broader adoption will depend on three key enablers:

Although most alternative fuel bunkering will be handled via ship-to-ship transfer using bunker barges or vessels, this process still requires close coordination with fuel suppliers and regulators. U.S. Jones Act requirements may limit the ramp-up and availability of qualified U.S.-built barges, adding further complexity and cost to domestic rollout. Similar cabotage laws in other countries could also impact bunker barge availability and operations, though the specifics vary by jurisdiction.

By aggregating demand and aligning stakeholders, ports can serve as the critical driver—positioning themselves not just as destinations, but as strategic infrastructure partners in the maritime energy transition.

One promising entry point is participation in cruise-focused green corridor initiatives, which bring together fuel producers, operators, and ports to pilot alternative fuel deployment on specific routes.

A notable example is the Pacific Northwest to Alaska Green Corridor (PNW2Alaska) project, which aims to assess the feasibility of operating green methanol-powered cruise ships on Alaskan itineraries by the early 2030s. The project is a collaborative partnership between the major cruise lines, homeports, and several ports of call in the Alaska cruise market to work together to explore low and zero- greenhouse gas (GHG) emission cruising from between Washington, British Columbia, and Alaska. This collaborative effort allows ports to work closely with fuel producers and cruise operators, reducing commercial risk and ensuring infrastructure investments are targeted and viable.

The transition to low-emissions cruising is well underway. Even before this new framework, all major cruise operators were already investing in fuel-flexible ships and adapting their fleets to align with the global goal of carbon neutrality by 2050. As the pace of change accelerates with more stringent economic impact for operators, port infrastructure will be central to enabling the cruise industry’s decarbonization goals.

Ports are uniquely positioned to support this shift—by facilitating access to alternative fuels, coordinating with suppliers, and aligning with cruise lines’ evolving deployment strategies. These actions are not only essential for compliance, but also offer an opportunity to strengthen long-term partnerships and enhance port competitiveness.

The coming years will require deliberate planning and collaboration across the maritime value chain. For ports, the ability to align with the industry’s fuel strategy will be an important marker of future readiness—and a pathway to remain relevant in a changing cruise landscape