Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

With the last of the big three public companies wrapping up their Q2 2023 earnings reports in the past weeks, it’s time for BA’s summary of the key takeaways and themes trending today.

Net yield is a crucial metric for cruise companies as it gives insights into how effectively they are monetizing their available capacity. A higher net yield indicates that the company is generating more revenue per available passenger day, which can be a result of higher ticket prices, increased onboard spending, or effective cost management.

Carnival, Royal Caribbean & Norwegian reported net yields of $166, $238, and $267, respectively. In percentage terms in constant currency over 2019, this represents a slight decline for Carnival but a high single-digit increase for Norwegian Cruise Line and a low double-digit increase for Royal Caribbean. Each cruise company commented on the distinct strategies they have employed to grow yields.

Norwegian is shifting its strategy to target premium guests by focusing on high-yield deployments. The company’s CEO, Harry Sommer, mentioned that “we strategically shifted our deployment to longer, more immersive itineraries at the Norwegian Cruise Line brand and increased our concentration of premium destinations while reducing our Caribbean deployment”.

In 2023, compared to 2019, Norwegian has expanded its capacity in Alaska and Europe by 3% and 6% respectively, while reducing its presence in the Caribbean by 9%. This strategic move aims to boost net yields by 5-6% in 2023 compared to 2019. Furthermore, this approach is anticipated to lead to a longer booking window and minimize reliance on last-minute, unpredictable bookings.

This was distinctly different from Royal Caribbean’s update where they pointed to the strength of the North American consumer in both Europe and the Caribbean. Voyages to “Perfect Day” at Coco Cay were highlighted by Royal Caribbean International’s CEO, Michael Bayley. “It is driving a lot of the demand and people are booking the ships and the itineraries that sail to Perfect Day.”

Due to its strong focus on the Caribbean, Royal Caribbean anticipates a net yield growth of 11-12% in 2023 compared to 2019. In 2023, 65% of their capacity is allocated to the Caribbean, with plans to increase this in 2024. This expansion will be supported by Utopia and Allure, which will offer year-round short cruises from Miami and Port Canaveral. To accommodate this growth, CocoCay will see the addition of Hideaway Beach, opening in December. The company projects the number of visitors to “Perfect Day” at CocoCay to rise from 2.5 million to 3.5 million by 2025.

Carnival, similar to Royal Caribbean, emphasized the ongoing robust demand from North American travelers, with a rapidly strengthening European market. Carnival’s CEO, Josh Weinstein, commented that “demand for our European brands has continued to strengthen and is now outpacing 2019 booking volumes at a rate that’s comparable to our North America brands”. He highlighted that P&O, Aida, and Carnival Cruise Line have been particularly strong performers. As a result, Carnival anticipates a net yield growth of 5-6% in 2023 compared to 2019.

Carnival is also leaning in on the strength of the North American market; Carnival is expanding Half Moon Cay and launching its largest development in the Caribbean, Grand Bahama Port. With the completion of Grand Bahama Port, Carnival expects its Caribbean destinations will grow from 5.5 to 7.5 million passengers. With these additional developments, they expect to drive higher revenue yield and margins while also delivering lower fuel consumption itineraries due to the proximity to regional homeports on the US East Coast.

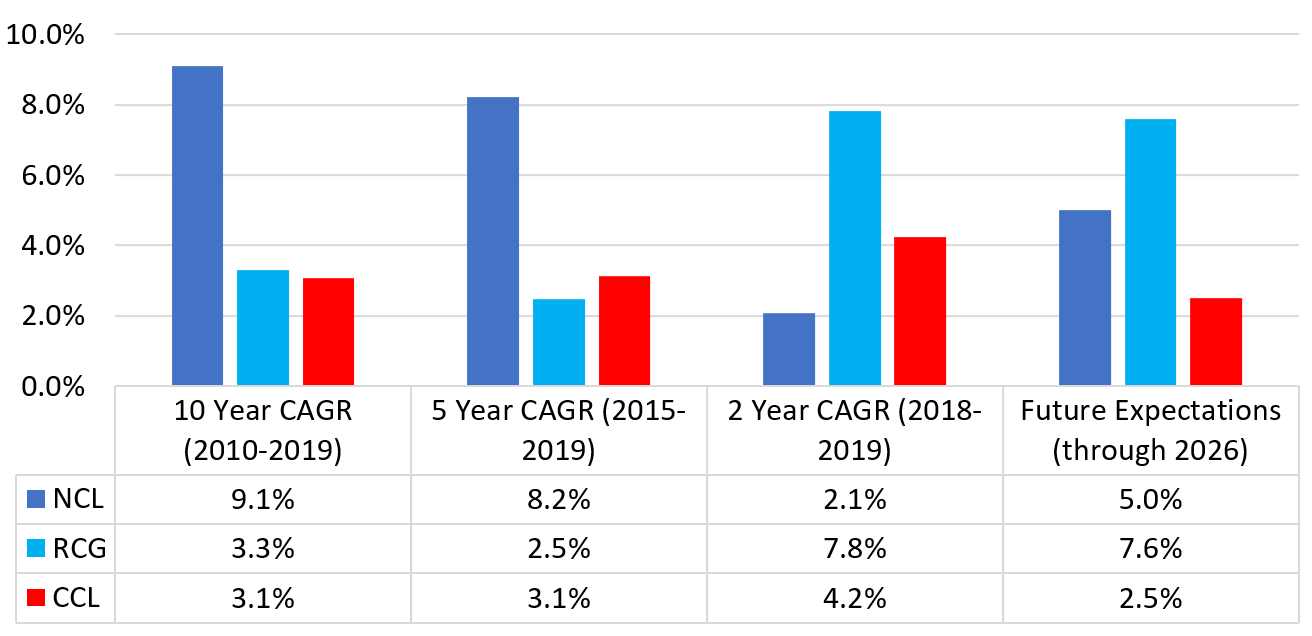

Pre-pandemic, over a 10- and 5-year period, Norwegian had the largest percentage capacity growth albeit of a lower base than the larger competitors Carnival and Royal Caribbean. Over that same 10- and 5-year period, both Carnival and Royal Caribbean steadily grew capacity at around 2.5-3.3% CAGR.

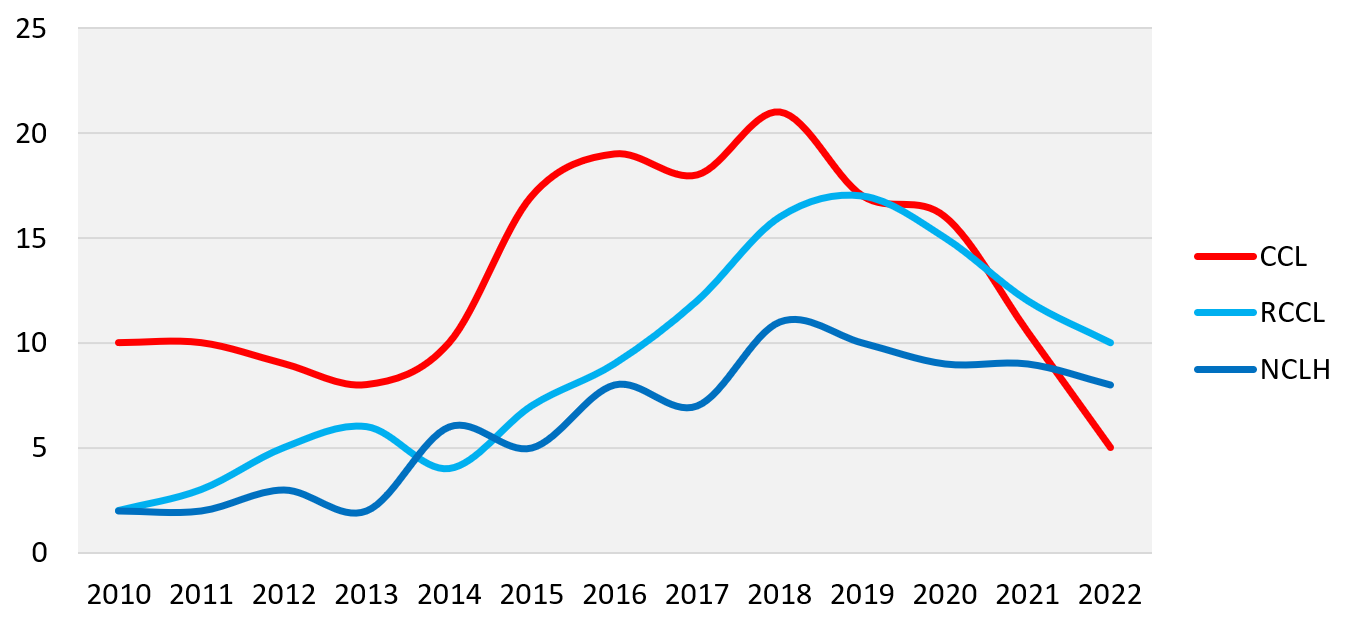

This is likely stemming from the fact that these three companies have more than doubled the amount of total debt. As a result of the debt, operators have reduced and temporarily halted planned capital spending on non-essential projects. Looking at the chart below, these operators have slowed/halted new ship orders as they pay down debt and rebuild their balance sheets.

Carnival has announced a more conservative plan, with capacity growth projections (measured in APCDs) indicating a growth rate of 2.5% through 2026. Carnival currently has four ships on order (with average lower berths of 4,250) through 2026 – the lowest number they have had on order in more than 10 years. Since 2016, they have averaged 4 ships a year to be delivered. On the call, Weinstein commented that the low-capacity growth will help “deliver outsized returns through yield-driven revenue growth while maintaining our industry-leading cost structure.”

Norwegian plans to grow its capacity at a rate of 5% through 2028 through its six ships on order (with average lower berths of 2,700) through 2028.

Royal Caribbean’s trajectory and more robust capacity growth stem from its ten ships on order (with average lower berths of 4,100). While not disclosed on the call, BA used a similar methodology as the other brands and calculated a projected 7.6% increase through 2026. The elevated growth rate versus its peers is due in large to it having at present, the largest orderbook that includes four large Icon & Oasis Class ships.

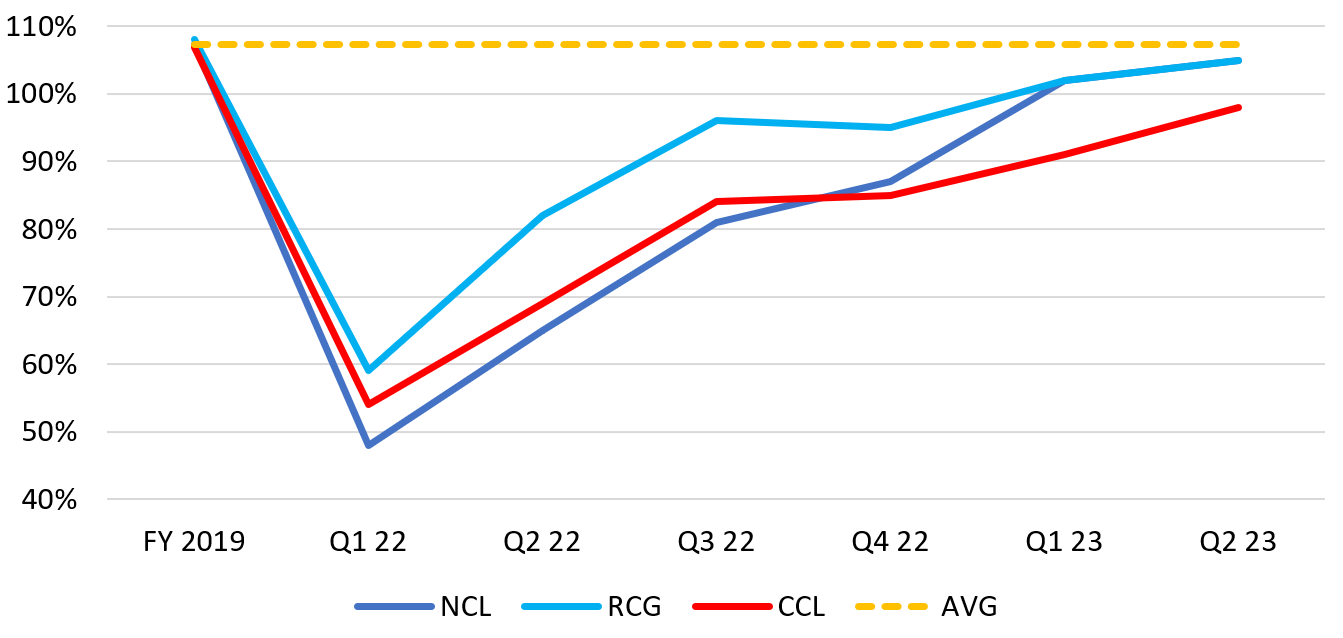

As anticipated, the three companies reported stronger occupancy levels versus Q1 2023 with Norwegian and Royal Caribbean at 105% (3% higher for NCL and RCG) and Carnival at 98% (7% higher for Carnival).

While Q2 was slightly lower than the pre pandemic average of 107%, Carnival in Q3 2023 now expects to reach 107% occupancy catching up with Royal and Norwegian who achieved the 105% in Q2.

The Q2 2023 earnings reports from leading cruise companies underscore the cruise industry’s remarkable resilience and adaptability. These mid-year insights reveal a vigorous resurgence, with many operators achieving or even surpassing their 2019 net yields and occupancy rates. This rebound can be attributed to shifts in deployment strategies – mostly due to a focus on high-yield itineraries, strategic deployment adjustments, a strong North American market, and a strengthened European market.

While financial considerations have led to a temporary deceleration in ship orders among the big three to manage debt, the industry’s outlook remains promising. The current cruise ship order book boasts 59 new vessels, offering ~127,000 lower berths – only 20 of these ships, accounting for approximately 58% of the berths, are from the major three operators.

This order book promises to expand the industry’s capacity, accommodating an additional 6 to 7 million passengers from 2023 to 2028. And while the current order book concludes in 2028, there’s a prevailing sentiment that more orders will be placed for subsequent years, especially for deliveries in 2026 and beyond. This includes orders not just from the major players but also from the diverse range of smaller brands currently operating.

In essence, while the pandemic has slowed ship orders in the short term, it is evident that this trend will reverse (and already has among smaller brands – Accord, Four Seasons, etc. – who have placed orders this year). The temporary lull should not be misconstrued as a long-term decline. The cruise industry is poised for sustained growth in the long term, and the horizon looks promising.