Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

With the final earnings report for Q3 2023 released by the last of the big three public Cruise Corporations yesterday, they all continued to show strong post-pandemic recovery and resilience. Most cruise operators not only met their targets, but surpassed the guidance and expectations set in the last quarter’s earnings reports.

By example, Royal Caribbean Group posted a higher-than-anticipated earnings per share (EPS) of $3.85— a significant 12% increase over its July 2023 guidance, which projected EPS to be between $3.38 and $3.48. Buoyed by the Q3 results, the company has revised its full-year 2023 adjusted EPS forecast upward, from $6.58 to $6.63, effectively doubling the original annual projection. Net yields are now anticipated to grow from 12.9% to 13.4%, with projected Q4 revenues reaching $2.6 billion.

Carnival Corporation also outperformed its second-quarter forecasts with notable margins. Its projected Q3 occupancy was pegged at 107% or more, and the adjusted net income was estimated to be between $0.95 billion and $1.05 billion. The actual Q3 figures tell an even more successful story, with occupancy climbing to 109% (a 2% increase over Q2 guidance) and adjusted net income reaching $1.18 billion (surpassing the higher end of their estimate by $130 million).

These figures show that cruise operators have even surprised themselves with exceptional performance since last quarter. This bulletin outlines several themes that have helped each operator achieve these figures, such as:

These themes are highlighted below in more detail and specific information, graphic visualizations, and more are provided.

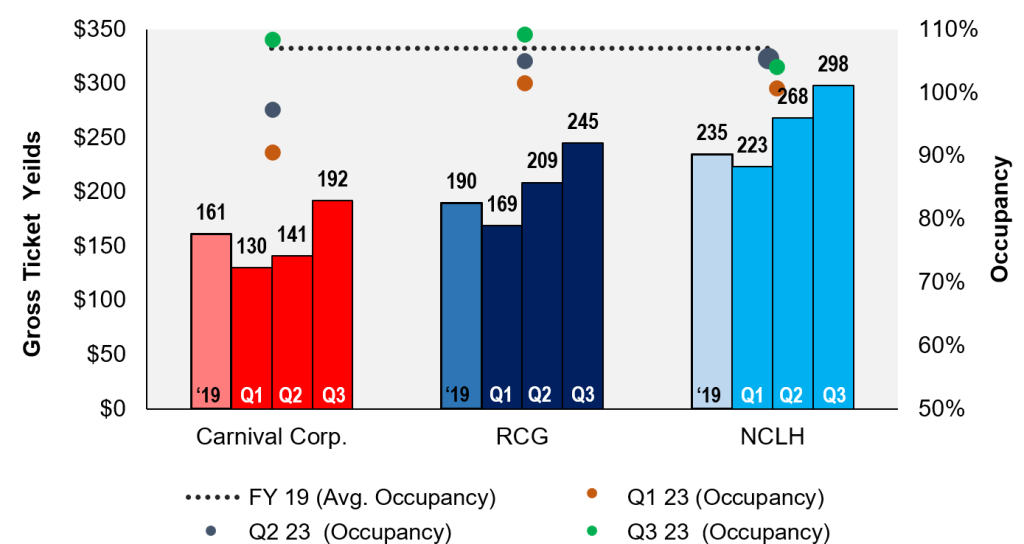

In 2019, a benchmark year for the industry, Carnival Corp., RCG, and NCLH reported load factors of 107%, 108%, and 107%, respectively, along with substantial gross ticket yields of $161, $190, and $235. As a note, gross ticket yield measures the average amount of revenue earned per berth, per day, before expenses. It is a critical indicator of a cruise line’s revenue-generating ability and efficiency.

Compared to 2019, these top 3 cruise operators have seen sequential increases in both load factors and ticket prices throughout 2023. In the latest quarter, all three have surpassed their 2019 levels, although Norwegian’s load factor remains slightly below due to a strategic shift toward longer, more port-intensive voyages—a trend expected to continue into the future.

The improvement in pricing since the first quarter has been dramatic, with Carnival Corp., RCG and NCLH experiencing increases of 48%, 45%, and 33%, respectively. These price surges, which were not anticipated, have been accelerating with each quarter. Jason Liberty, CEO of Royal Caribbean, commented, “The strong performance in the third quarter and continued acceleration in the booking environment is positioning us well to deliver over 13% [net] yield growth for the year and earnings per share that is twice our original guidance for the year.”

This data is shown below – indicating the progression over this year in both occupancy and gross ticket yield, with 2019 shown as a baseline.

A second theme seen across each of these cruise operators is that they have now characterized their revenue streams as ‘recurring, visible, and predictable.’ This is in part attributed to the robust pre-cruise reservation systems and booking pipelines, which provide visibility into future occupancy levels and revenue trends. Furthermore, the cruise corporations pointed out that a loyal customer base and the habituated nature of cruise vacations contribute to a steady stream of repeat business, reinforcing the regularity and dependability of their core income over time.

Carnival Corp. provided a clear illustration of how the company’s revenues embody these qualities. Throughout the call, Carnival leadership underscored the consistency in revenue generation, mainly attributable to strong customer loyalty and repeat business, with 55% of their guests being repeat cruisers. Carnival reported that over 50% of the demand for the next twelve months is already booked, and approximately 40% of onboard revenues come from pre-cruise sales. These increasingly advanced bookings allow them to anticipate future earnings and make strategic pricing decisions, enhancing revenue visibility.

RCG reported that approximately 70% of their guests made pre-cruise purchases at significantly higher average per diems (APDs) – or the average amount of money each passenger spends per day — than in previous years. Additionally, they revealed that customers who purchased onboard experiences before their cruise spent 2.5 times more than those who made purchases once they were already on board. Looking ahead to 2024, RCG has already booked more than double the amount of pre-cruise revenue compared to the current year, indicating a growing trend of guests engaging and spending more before their cruise, often at higher prices. With these guests typically spending more once they get onboard, this bodes well for 2024 revenues.

NCLH posited that the bookings environment continues to experience healthy consumer demand with the cumulative booked position heading into Q4 2023 ahead of 2019 levels at higher pricing. On a 12-month forward basis, the company also continues to be within its optimal booked position and at higher pricing. The advance ticket sales balance this quarter was 59% higher than the Q3 2019. In addition to more advanced ticket sales, Norwegian’s gross onboard revenue per passenger cruise day surged by approximately 30% when compared to the same quarter in 2019, with pre-cruise onboard revenue purchases standing at over 80% higher than the levels recorded in 2019.

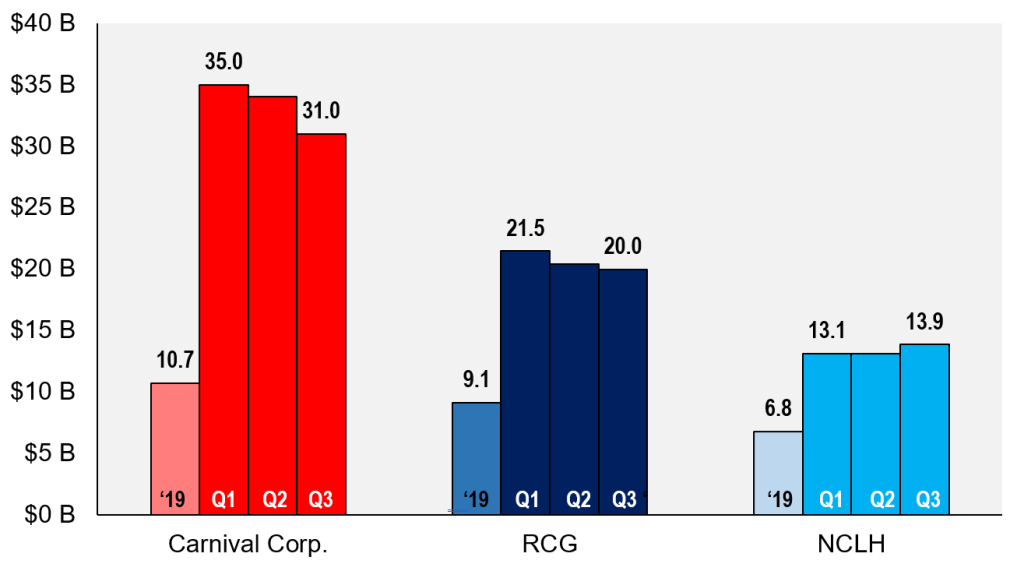

BA has referenced the significant debt loads each cruise corporation took on during the pandemic, and that each are actively pursuing debt reduction strategies. Carnival Corp. is leading the way by achieving $4 billion in total debt reductions in 2023, or an 11% reduction over Q1 2023. As a result, Carnival now anticipates year-end debt to be slightly below $31 billion, which is lower than the previous projection of $33 billion. However, this is still close to three times the total debt Carnival had at the end of 2019 ($11 billion).

Royal Caribbean Group emphasized its commitment to strengthening the balance sheet, with plans to retire over $3.5 billion in debt by the end of the year. This move would decrease Royal Caribbean’s total debt to $18 billion, double the figure of the pre-pandemic debt level in 2019. In Q3, they achieved a 7% reduction in debt over Q1 2023. This financial discipline aligns with their aim to achieve investment-grade metrics and will be further focused on by their Trifecta Program. The Program is designed to achieve three financial goals by the end of 2025: (i) increasing adjusted EBITDA per available passenger cruise day to triple digits, to exceed the prior record of $87 in 2019; (ii) increasing adjusted EPS to double digits, to exceed the 2019 record of $9.54; and (iii) achieving return on invested capital in the teens, topping 2019’s 10.5% through optimizing capital allocation and enhancing operating income.

In contrast, Norwegian Cruise Line Holdings experienced a slight increase in total debt during the third quarter (up 6% from Q1 2023), primarily due to refinancing their operating credit facility, increasing their revolver, and issuing new debt to repay existing debt. Similar to Royal Caribbean, Norwegian is expected to end the year with double the debt they had in 2019. However, during NCLH’s quarterly call they emphasized that a key near-term priority is to refine the multi-year plan to reduce leverage levels and de-risk the balance sheet to drive shareholder value. They expect a significant organic reduction in net leverage from current levels driven by ongoing cash generation and normal course amortization payments.

Includes long-term debt plus the current portion of long-term debt

The latest earnings reports reveal a compelling story of cruise industry revival and resilience, marked by notable positive trends and accomplishments. A key theme has been the impressive progress in achieving full load factors and elevated ticket prices. Gross ticket yields are one indication of how well the cruise corporations are maximizing potential revenue from ticket sales, taking into account factors like occupancy rates and pricing strategies. High gross ticket yields indicate strong demand and pricing power, whereas lower yields might signal the need for pricing adjustments or promotions to attract more passengers. Given that Carnival Corp., RCG, and NCLH have consistently improved load factors and ticket prices throughout 2023, this signifies the industry’s significant recovery and growth potential, setting a positive tone for the future.

A key to the return to full load factors and elevated prices has been the prioritization of ‘recurring, visible, and predictable’ revenues. Cruise corporations are investing in advanced pre-cruise reservation systems and cultivating strong customer loyalty. Carnival’s loyalty-driven, advanced booking strategies; Royal Caribbean’s substantial pre-cruise purchases and forward bookings; and Norwegian’s robust bookings and onboard revenue generation all attest to the rising trend of guest engagement and increased spending before embarking on voyages.

As pricing and occupancy continue to increase, debt will be reduced, which will be a key focus for the next several years. While large debt loads remain, which may impact or delay planned growth strategies, particularly as it relates to investments in ships, technology, and the expansion of land-based developments; Cruise Corporations will continue to look towards streamlining business models to maximize profit and reduce cash demand. Markets and ports that can deliver profitable destinations, safe environments, and reduced fuel consumption will be the winners.

As we wrap up the analysis of Q3 reports and look ahead to the year’s end, just a short two months away, BA confidently concludes that the cruise industry is on course to exceed the passenger numbers of the record-setting year of 2019. Data confirms that, within the first three quarters of 2023, these leading operators have already welcomed over 300,000 more passengers than the same period in 2019. While not a publicly traded corporation, it must not be forgotten that MSC Cruises (the third largest cruise corporation in the world with 2 brands and 23 ships is part of MSC Group, a privately held Swiss-based shipping and logistics conglomerate) has also made significant strides and contributed toward the resurgence of the cruise industry during 2023 with ~4-million cruise passengers by years end. This surge, coupled with the current trends and the sector’s robust order book, shows a promising trajectory of growth for the coming years.