Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

The Caribbean is gearing up for a record breaking 2024. Below, is a detailed look at what is driving this success, utilizing BA’s 2024 cruise itinerary database. BA examined the Caribbean’s itinerary breakdown, types of vessels responsible for maintaining and propelling the Caribbean’s large market share and which ports of call are poised to welcome the most visitors in 2024.

As discussed in our last bulletin, BA Cruise Itinerary Insights, there has been a notable increase in the Caribbean’s market share post-pandemic. For 2024, the Caribbean passenger market share of worldwide total capacity is expected to remain elevated, at ~42% (up from 39% in 2019).

This growth trajectory is buoyed by strategic shifts toward North American passenger segments featuring short cruises, along with China's gradual market re-entry and instability in Europe due to geopolitical events. The strategic shift towards offering short-duration cruises has been instrumental, driven by increasing demand for shorter, flexible itineraries. This shift is also aligned with operational strategies designed to reduce fuel costs—a major expense for cruise operators. Such strategies not only cut costs but also boost revenue by enabling ships to double their passenger capacity weekly, thereby maximizing efficiency and profitability.

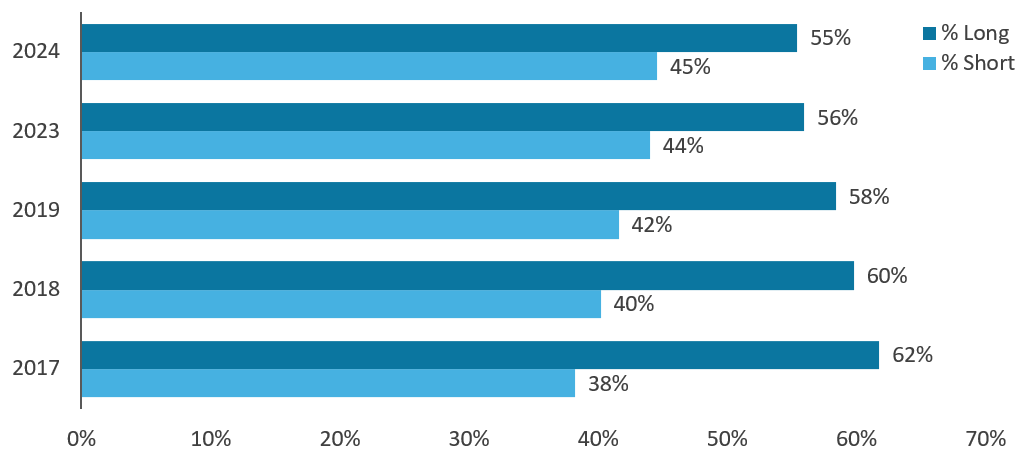

The below graph indicates the percentage of short Caribbean capacity that is expected to rise to 45% of the total Caribbean market share (“short” defined as a cruise of 5 or fewer nights). Our data indicates that the short cruise market has fueled most of the Caribbean’s capacity growth since 2017, with a CAGR of ~8%. Meanwhile, the long cruise Caribbean market has remained relatively stable since 2017 (~3% CAGR). This shows that the long Caribbean market (concentrated on ports deeper into the Caribbean) is not declining, just growing at a slower rate than the short cruises, that are taking advantage of cruise line private island facilities and ports of call closer to the primary Florida and Gulf homeports.

Source: Cruise Industry News & BA’s 2023/2024 Itinerary Database

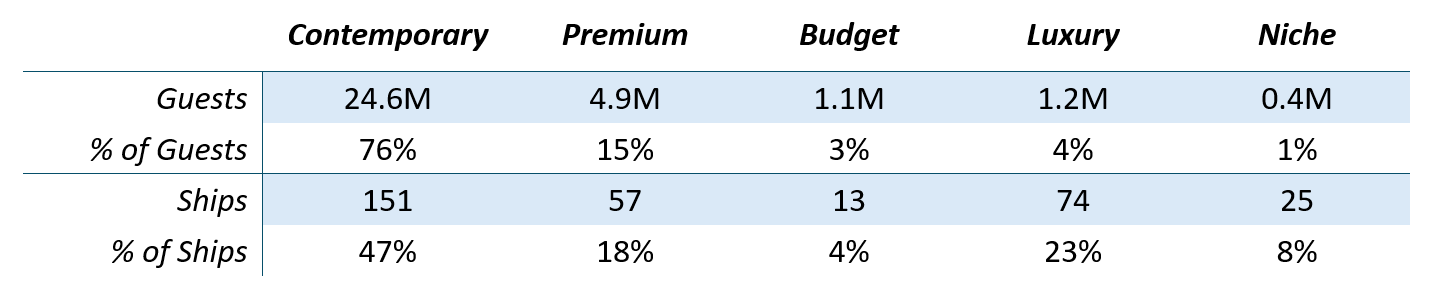

The Caribbean is heavily influenced by the offerings of contemporary brands, which are successfully attracting the lion's share of cruisers with their diverse onboard entertainment and dining options and private island appeal. Cruise segments, such as premium, budget, luxury, and niche, while important, play a more complementary role in the market, catering to specific itinerary preferences and passenger demographics that seek alternative experiences other than those provided by most contemporary brands.

The capacity breakdown by segment further highlights this trend, with contemporary brands anticipated to accommodate over 24 million guests in 2024, significantly more than all other segments combined. The size of this combined fleet of 151 ships also underpins the segment’s ability to offer much higher capacity in the region.

While other segments represent the remaining share of the market, none approach the sheer volume of the contemporary brands. The luxury segment, despite its considerable number of ships (74), only accommodates a fraction (1.2M guests, 4%) of the capacity when compared to contemporary brands.

Source: BA’s 2024 Itinerary Database

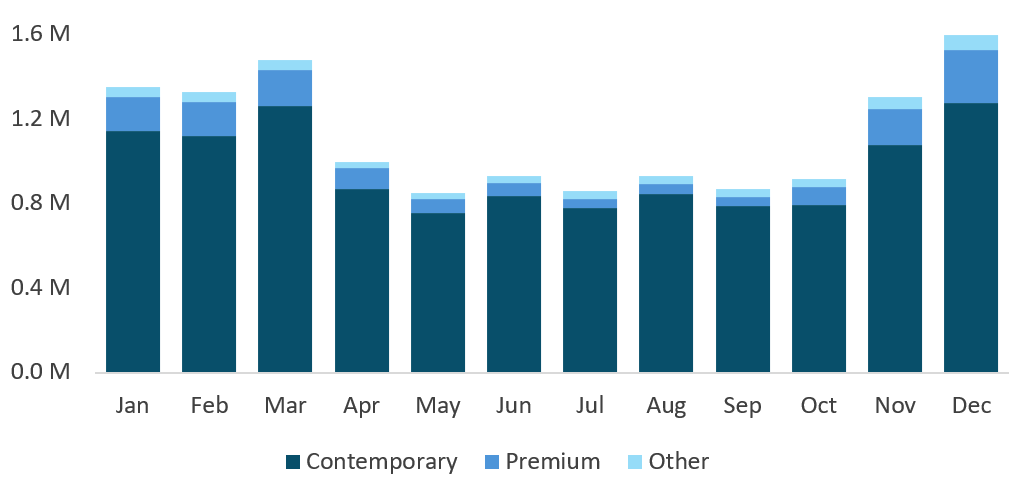

Contemporary brands are not just leading the way in the region; they are commanding an 86% share of Caribbean deployment in 2024.

Most notably, during the summer season, which is traditionally quieter in terms of Caribbean deployment, contemporary brands capture an even higher percentage of the market, nearing 90%. This spike in market share is partly due to other cruise segments—such as budget, expedition and niche, luxury, and premium—redeploying their ships to alternative high-demand summer destinations, with 25% of their lower berth capacity heading to Alaska, 22% to Northern and Western Europe, and 20% to the Mediterranean. Meanwhile, contemporary brands capitalize on this opportunity with family-friendly offerings and a diverse range of activities that appeal broadly to the summer vacation crowd, thus filling the void left by other segments and affirming their dominance in the Caribbean. This all occurs while the same brands also deploy vessels to other regions based upon consumer demand due to their larger fleets overall.

Source: BA’s 2024 Itinerary Database

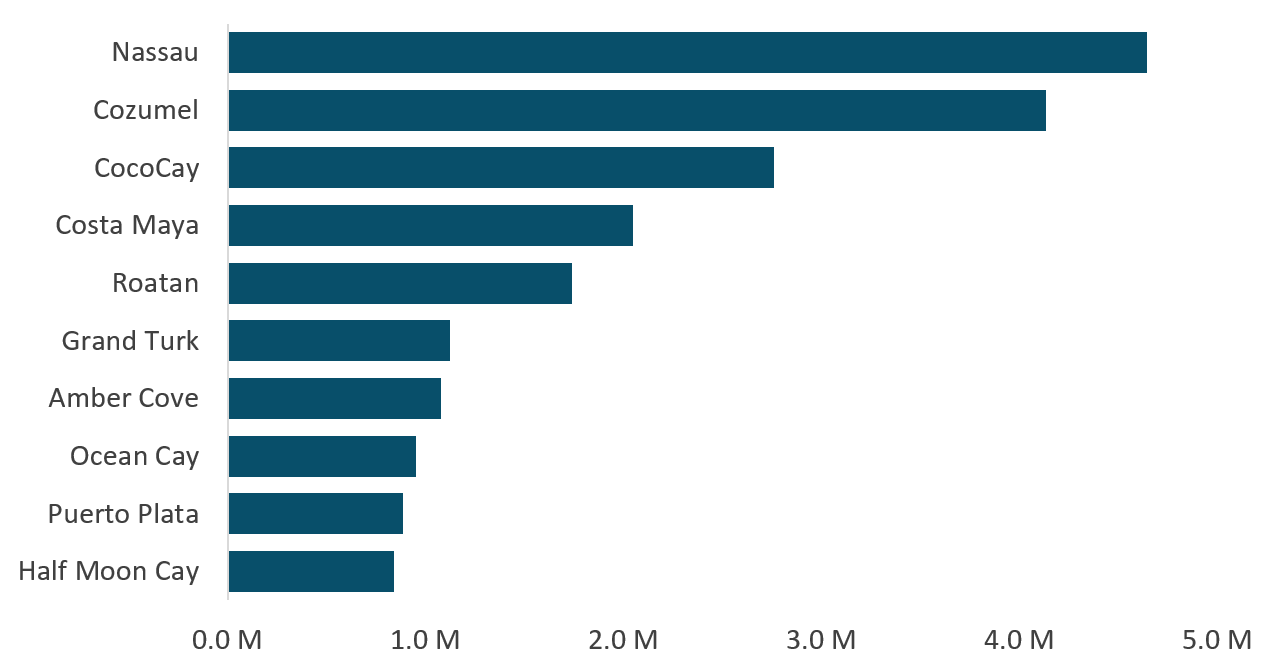

BA examined the key ports of call poised to capture the most traffic in 2024. The dominance of Caribbean ports within a cruising day of key homeports in Texas and Florida is clearly reflected in the 2024 data, with four out of the top five destinations—Nassau, Cozumel, CocoCay, and Costa Maya—strategically located within easy sailing of the key homeports of Galveston, Port Canaveral, Port Everglades and PortMiami.

Furthermore, there is significant capacity directed towards private island facilities in the Bahamas, such as Ocean Cay, Half Moon Cay, and CocoCay. Cruise lines are funneling a substantial number of visitors towards these exclusive destinations, offering more structured, and premium experiences. This move not only serves the guests' growing appetite for exclusive retreats but also exemplifies how cruise lines are leveraging private destinations to enhance their competitive edge in the short cruise segment.

Source: BA’s 2024 Itinerary Database

As the Caribbean prepares for a record-setting 2024, the expansion in cruise deployment capacity signals several significant impacts on the region. First, the current (and anticipated) growth highlights the need to develop new destination options to accommodate an increasing number of visitors and to offer new experiences that enrich Caribbean itineraries.

Second, to support the future growth of the global fleet and those new ships deployed to the Caribbean, there is a need for more cruise berth options. Expanding existing ports and constructing new ones are essential steps in ensuring the Caribbean can continue to host the latest and largest cruise ships. In conjunction with this, the development of soft tourism infrastructure, such as enhanced shore excursions, venues, and commercial enterprises must be develop in tandem to cater to the needs of guests, while also spurring economic growth by creating jobs and supporting local businesses.

By proactively meeting these needs, the Caribbean will be in a position to welcome additional capacity, see continued, and maintain its standing as the leading cruise destination.

Stay tuned for more BA Perspectives as we delve deeper into the future of cruising in our upcoming BA Database Spotlight series. If you're eager to explore what lies ahead for the cruise market, stay tuned for more or connect with us at Seatrade (booth #2215). At BA, we're excited to guide you through the evolving landscape of cruising and how it impacts future cruise tourism infrastructure development choices.