Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

The leading public cruise corporations—Carnival, Royal Caribbean, and Norwegian—concluded 2023 on a high note, as demonstrated by their Q4 earnings reports.

This bulletin delves into key themes that have contributed to the outstanding performance of the three major publicly traded brands during 2023:

These themes are highlighted below in more detail and graphic illustrations.

In 2023, the leading cruise companies—Carnival, Royal Caribbean, and Norwegian—successfully outperformed the high-water mark set in 2019, showcasing their adaptability to the evolving post-pandemic market landscape. This recovery highlights the continuous allure and robust demand for cruise vacations. It also sets an optimistic tone for the prospect of continued growth in both profits and capacity.

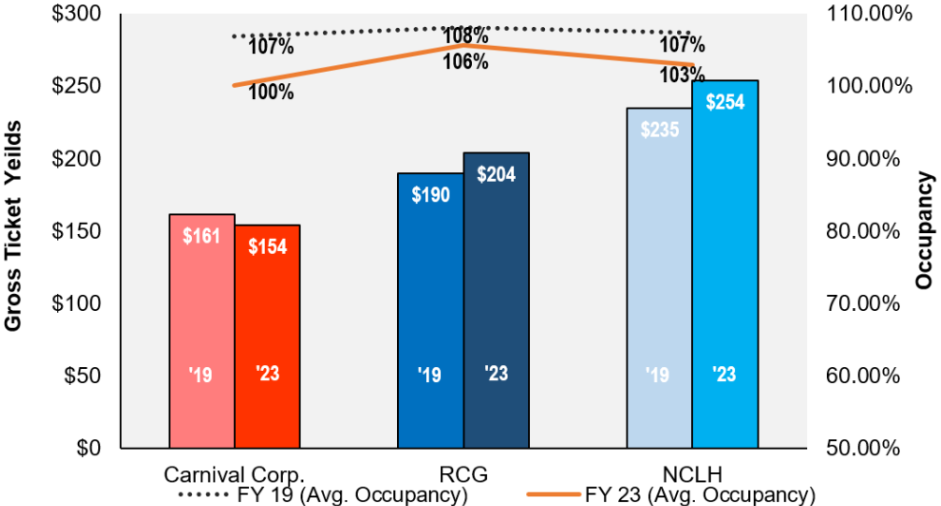

Carnival approached its 2019 ticket yield figures, achieving full occupancy in 2023. On the other hand, Royal Caribbean and Norwegian not only met but exceeded their ticket yield targets, with Norwegian registering the most pronounced growth. This success was in large part attributed to the introduction of new ships and a robust demand environment leading to all three operators continued growth in both profit and capacity in 2024.

The leading cruise operators have shared an optimistic outlook for 2024, projecting significant growth in both profit and capacity. In the Q4 earnings updates, the operators shared this optimism is supported by strategic initiatives, hardware, and a robust demand environment.

Royal Caribbean looks forward to an 8.5% increase in capacity over 2023. With leadership confident in a net yield increase of 5.25% to 7.25% for 2024 compared to the previous year, RCG emphasized exceptional hardware upgrades, improved load factors, increased pricing, the expansion of Perfect Day at CocoCay and further commercial advancements as key contributors to this positive forecast. A strong booking position for 2024, with rates and volume significantly outpacing the previous year, underscores confidence in key markets. Notably, the Caribbean, which accounts for 55% of deployment, was highlighted as a key contribution to the booked position for 2024. The introduction of Icon of the Seas and the upcoming Utopia of the Seas, set to sail year-round in the Caribbean, underscores the brand’s expansion in the key Caribbean.

Carnival anticipates a year of historic occupancy levels and record yields in 2024, forecasting a 5.4% increase in capacity over 2023. This growth is supported by the delivery of three new ships—Sun Princess, Queen Anne, and Carnival Jubilee—and the full-year impact of ships introduced in 2023, including Carnival Celebration, P&O Arvia, and Seabourn Pursuit. With net yields expected to rise by 8.5%, Carnival’s outlook is robust, reflecting a strategic emphasis on expanding its fleet and enhancing guest experiences both on land and at sea.

Norwegian Cruise Line projects a more modest capacity growth of 3.7% for 2024, compared to 2023, with a forecasted net yield increase of 5.4%. This guidance aligns with the company’s strategic objectives of balanced capacity growth and yield improvement. Norwegian anticipates continued strong demand across its brands, with booking positions and pricing for all four quarters of 2024 surpassing last year’s figures. Despite challenges such as redeployments due to cancellations in the Middle East and Red Sea, Norwegian has effectively adapted, maintaining strong demand across all geographies.

Each cruise line’s optimistic 2024 guidance reflects a shared expectation of continued growth. Investments in fleet expansion, enhanced guest experiences, and strategic market positioning are poised to drive profitability and capacity increases, underscoring a positive outlook for the future.

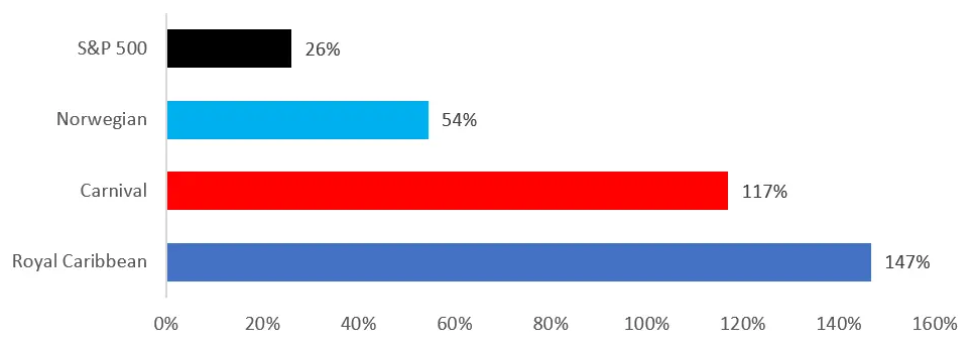

The cruise industry demonstrated remarkable performance growth in 2023, with Carnival, Royal Caribbean, and Norwegian achieving stock returns that significantly outshone the broader market, including the S&P 500. This exceptional performance was driven by high load factors and a notable increase in ticket yields, especially in the back half of the year.

Royal Caribbean led the pack with an impressive 147% return over the year, Carnival followed with a robust 117% gain, and Norwegian rounded out the trio with a 54% increase. This performance starkly contrasts with the S&P 500, which posted a 26% return during the same period, highlighting the cruise sector’s strong relative outperformance.

Despite these substantial gains, the collective market capitalization of Carnival, Royal Caribbean, and Norwegian experienced a 13% decrease, shedding nearly $10 billion in equity value from December 31, 2019, to December 29, 2023 (the last trading days of 2019 and 2023, respectively). This reduction primarily affected Carnival and Norwegian, suggesting lingering investor concerns despite the companies’ operational successes. On the other hand, Royal Caribbean’s market capitalization was slightly higher, possibly reflecting a deeper investor confidence in its business model, financial health, and prospects.

Royal Caribbean’s strategy, particularly its investment in unique, land-based, curated destination experiences such as Perfect Day and the Royal Beach Club in Nassau, as well as the introduction of the Icon class ships, which was highlighted by CEO Michael Bayley as a key driver of the company’s outstanding performance. These initiatives are designed to enhance guest satisfaction and spur further growth in a bid to compete with land-based vacations.

In conclusion, the cruise industry’s performance in 2023, marked by significant stock returns and strategic advancements, showcases a sector on the rebound, ready to capitalize on future opportunities.

Building on the positive momentum observed in the previous quarter, the Q4 2023 earnings reports for Carnival, Royal Caribbean, and Norwegian underscore the cruise industry’s revival and resilience. In 2023, the industry sustained its recovery and continues to set new benchmarks for growth and profitability.

The impressive rebound in ticket revenues per diems during the third and fourth quarters of 2023 not only signifies a return to pre-pandemic levels but also instills optimism for sustained growth in both profits and capacity. The cruise lines’ optimistic guidance for 2024 showcases a strategic focus on growth. Royal Caribbean’s confidence in surpassing trifecta goals, Norwegian’s continued industry-leading ticket-per-diems trajectory, coupled with Carnival’s forecast for record net yields, sets the stage for continued success.

On the back of this optimistic guidance, Carnival and Royal Caribbean have unveiled plans for new ship orders, signaling sustained growth and a bullish outlook. February 2024 saw Carnival and Royal Caribbean announce new ship orders, marking a resurgence in significant investments since the pandemic’s onset. Carnival’s fourth Excel-Class ship, expected to host over 6,500 guests, and Royal Caribbean’s seventh Oasis-class vessel, highlight the industry’s optimistic outlook and continued expansion. Each of the major cruise operators have also recently completed or initiated major private destination development and improvement projects (RCG – Perfect Day at Coco Cay; Carnival – Celebration Key; and NCL undergoing a large-scale master plan and pier development for Great Stirrup Cay) which lays the foundation for enhanced passenger experiences and revenue production in the Caribbean region, where a majority of their capacity is deployed.

With the global cruise fleet projected to grow by 16% in lower berths and 13% in ship numbers, the cruise industry is demonstrating its enduring vitality and capacity for innovation, despite facing past challenges. This substantial growth, alongside strategic investments in guest experiences and environmental sustainability, positions the cruise sector for a bright and dynamic future.

Data reflected in this bulletin is based on BA’s deployment database which includes all available cruise itineraries in 2024 for the majority of key ocean and river cruise companies. Figures are reflective of lower berths, and actual passengers may be higher or lower than lower berths based on occupancy levels. Data was collected in December 2023 and may change if deployments change.