Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

BA unveils its expansive 2024 cruise itinerary database, spanning 13,700 sailings across 47 brands and 320 ships globally. Our database offers an in-depth perspective on the cruise industry’s landscape for 2024, as each sailing includes insights into the vessel particulars, homeport, port of calls, cruise length, and so much more.

This bulletin spotlights the 2024 trends, focusing on global passenger volumes, regional capacity allocation, and the cruise industry’s top brands.

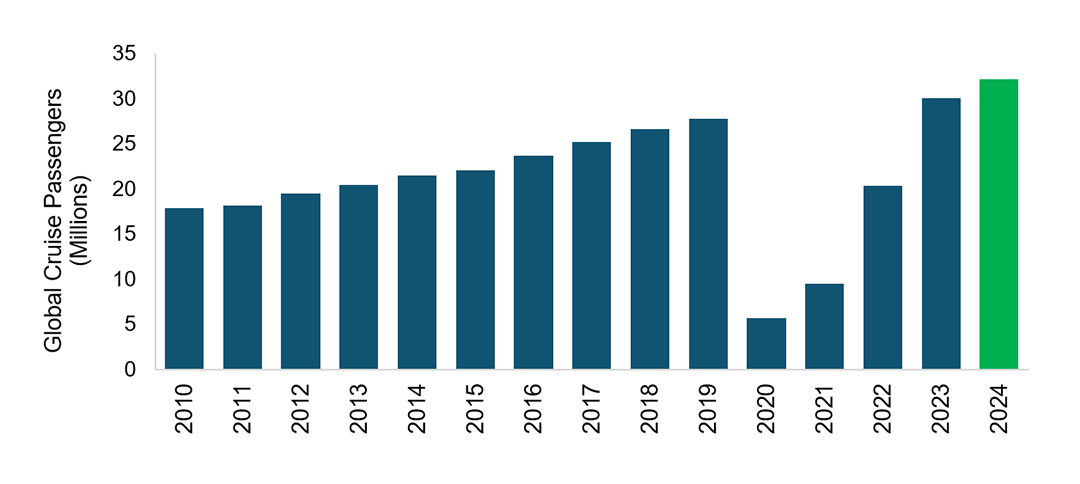

In 2023, the cruise industry not only recovered but surpassed pre-pandemic levels in occupancy, ticket prices, and passenger volumes. For 2024, BA’s database predicts a record-breaking year, with lower berths on 13,700 sailings totaling over 32.2 million. This suggests actual passengers may be even higher in 2024 than the 32.2 million berths when considering higher occupancy rates and contributions from smaller brands not covered in our data.

Source: Cruise Industry News & BA – 2024 Estimated from BA’s database

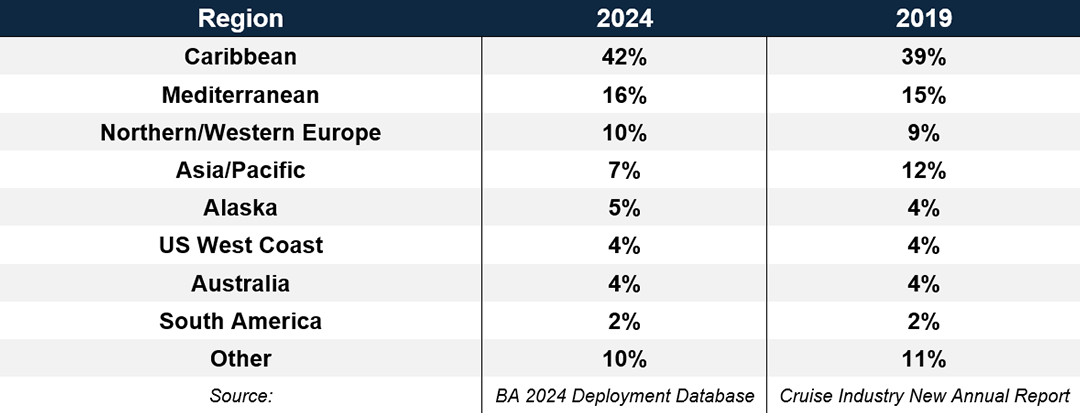

In 2023, BA observed a notable increase in the Caribbean’s market share, fueled by redirected capacity to North American markets. This shift was partially due to China’s gradual reopening and instability in Northern Europe. For 2024, this trend persists with the Caribbean market share expected to remain high at 42% (up from 39% in 2019). In contrast, the Asia/Pacific region is regaining its foothold, projected to exceed 2023 levels, though still below 2019 figures, as international sailings resume in China.

A summary of the lower berth capacity by region is shown below.

The leading brands in the 2024 cruise landscape, as indicated by lower berths, align with the industry’s major players. However, it is worth noting that new entrants such as Resort World, Adora Cruises, and Virgin Voyages have reached impressive levels, marking their debut in the top 15. While these figures represent scheduled berths, actual passenger numbers for each sailing may vary, reflecting real-time demand and operational adjustments.

The leading brands in the 2024 cruise landscape, as indicated by lower berths, align with the industry’s major players. However, it is worth noting that new entrants such as Resort World, Adora Cruises, and Virgin Voyages have reached impressive levels, marking their debut in the top 15. While these figures represent scheduled berths, actual passenger numbers for each sailing may vary, reflecting real-time demand and operational adjustments.

The top brands, poised to dominate the market in 2024, are shown below:

These brands are set to lead the industry in 2024, showcasing a diverse range of experiences and destinations.

Given the extensive breadth and detailed nature of our database, there are myriad insights that BA can unlock to meet your specific needs, which can help unlock potential opportunities for you. For example, are you looking for…

The list goes on! We invite you to reach out to us or visit our booth #2215 at Seatrade if you are interested in exploring these insights more deeply. Let BA be your guide through the evolving world of cruising in 2024, and beyond.

Data reflected in this bulletin is based on BA’s deployment database which includes all available cruise itineraries in 2024 for the majority of key ocean and river cruise companies. Figures are reflective of lower berths, and actual passengers may be higher or lower than lower berths based on occupancy levels. Data was collected in December 2023 and may change if deployments change.