Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

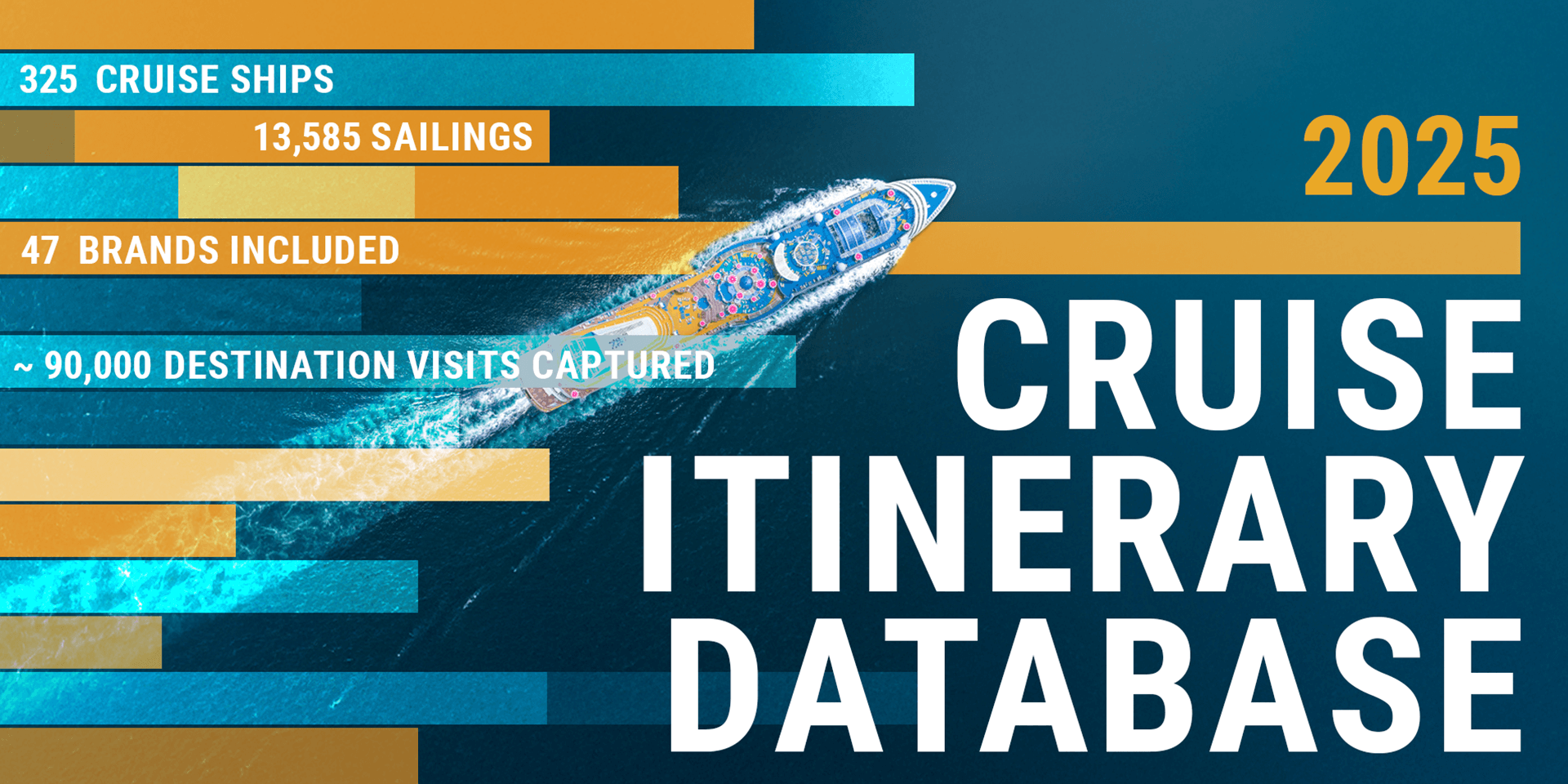

For the past several years, BA has been meticulously building annual cruise databases that offer an in-depth perspective on the cruise industry’s composition and sailing patterns. This extensive effort has enabled us to identify new trends and shifts within the industry over time.

Our database provides comprehensive coverage of almost every ocean (and river) cruise sailing. Key insights include vessel specifications, homeports, port-of-call stops, cruise durations, pricing details, and much more. This depth of information positions BA as an indispensable resource for understanding the ever-evolving cruise industry.

Whether you’re a cruise port, cruise line, industry professional, or simply passionate about the latest in cruise travel, our data offers unmatched insights into cruising's dynamic landscape. Below are some of the key findings shaping 2025.

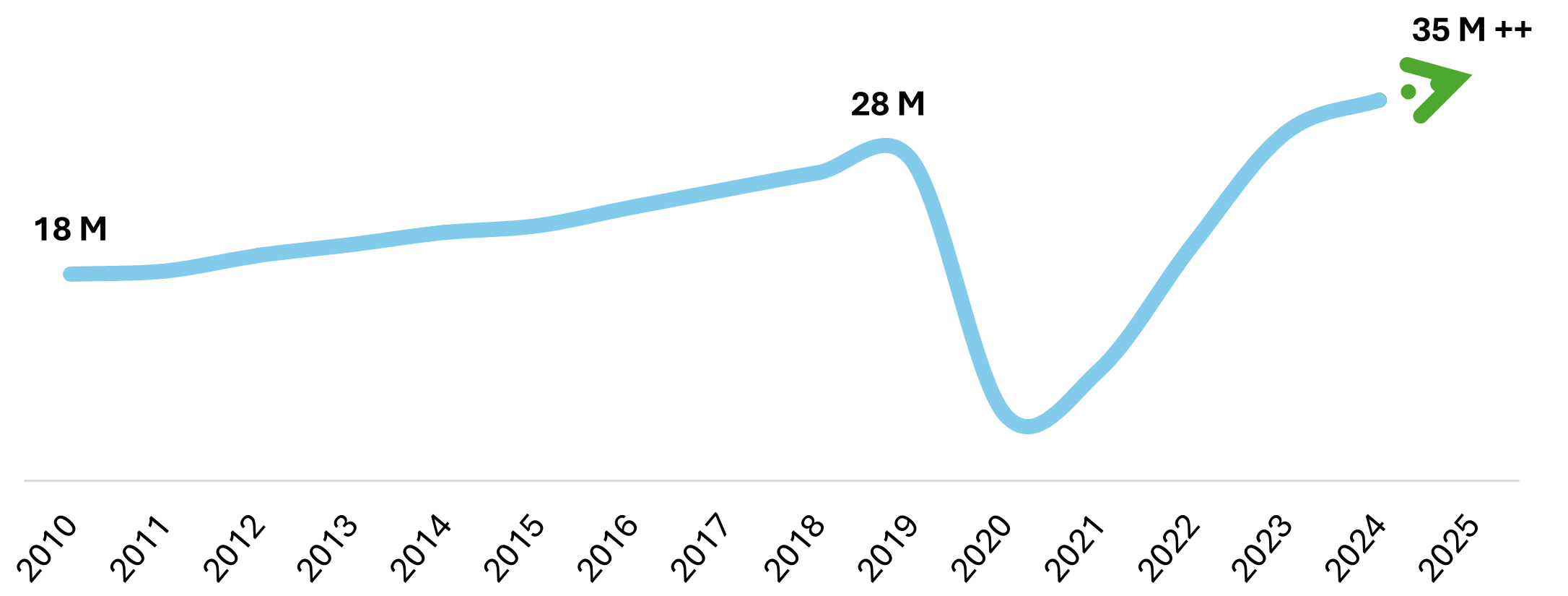

In 2024, the cruise industry achieved record-breaking passenger volumes, with strong performance across ticket prices, occupancy, and overall demand. With 10 new ships entering service in 2024, 2025 is poised to set another high-water mark.

The 2025 itineraries reveal a total lower berth capacity of ~33.6 million. Given occupancy rates often exceed 100%, sailings not yet published as of December 2024, and contributions from smaller or regional brands not fully reflected in our data, actual passenger numbers are expected to surpass these figures.

Source: Cruise Industry News & BA – 2025 Estimated from BA’s database

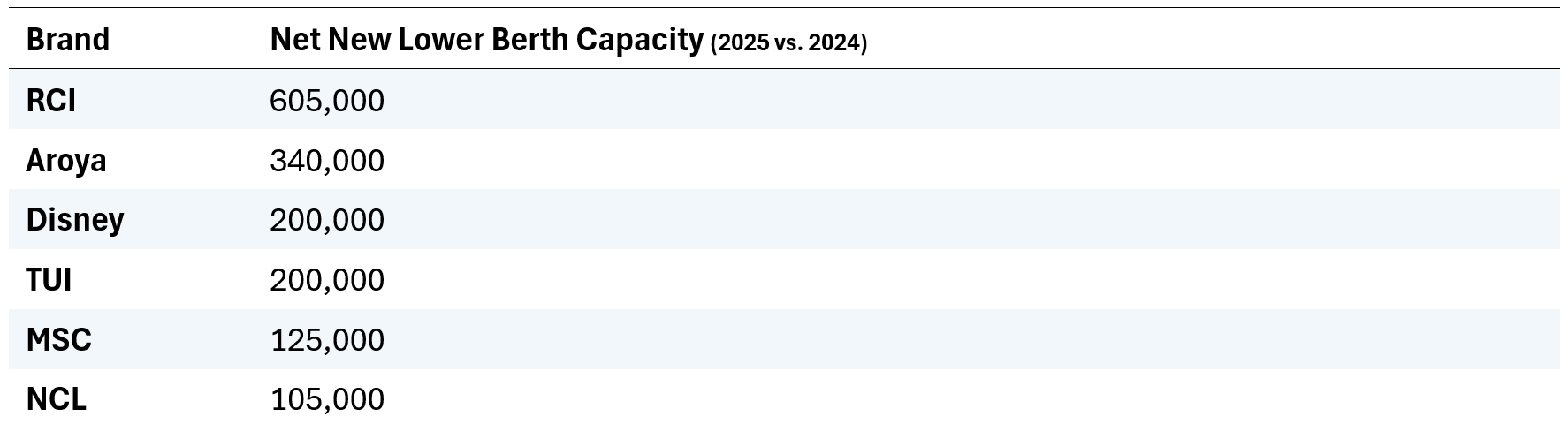

While the new capacity varies year to year based on new builds and deployment changes, BA used its latest database to identify which brands were contributing most to the new capacity entering the market in 2025.

RCI leads 2025’s capacity growth, driven by the full-year deployment of Utopia of the Seas, delivered in late 2024, contributing 595,000 lower berths across 104 sailings. Additionally, Star of the Seas, launching in August 2025, will add another 100,000 berths. Combined with deployment adjustments across its fleet of 27 vessels, RCI’s net capacity increase for 2025 totals 605,000. Looking ahead, RCI has large ships scheduled for delivery annually through 2028, ensuring similar capacity increases over the next several years.

Aroya, a newcomer launched in December 2024, anticipates 142,000 berths in the 42 sailings currently open for bookings through May 2025. With additional sailings anticipated in the Eastern Mediterranean and the Arabian Gulf (not yet on sale), Aroya could contribute a total lower berth capacity of approximately 340,300 for 2025.

Disney’s fleet growth in 2025 is driven by the delivery of Disney Treasure, contributing 130,000 berths across 52 sailings, and additional capacity from Disney Destiny (newbuild in 2025) and Disney Adventure (shorter sailings). This resulting in over 200,000 net new berths for 2025. With six ships currently in operation and seven on order, the Disney fleet is set to more than double in size by 2031, reflecting a strong growth potential to keep an eye out for.

TUI’s Mein Schiff 7, delivered mid-2024, and the debut of Mein Schiff Relax in March 2025 contribute significantly to its 2025 growth. Together, these ships add 200,000 berths. With delivery of Mein Schiff Flow in 2026, a similar bump is anticipated in 2026.

MSC Cruises has demonstrated consistent growth, delivering 22 ships over the past 23 years. IN 2025, MSC continues its robust growth trajectory with the introduction of MSC World America, adding 205,000 berths in 2025. Assuming continued deployment on seven-night patterns, this ship alone will generate over 280,000 annual berths. With two additional sister ships slated for 2026 and 2027, MSC’s three-year capacity growth will approach 850,000 berths.

NCL’s Norwegian Aqua, launching in April 2025, adds 140,000 berths, primarily on seven-night sailings. Adjustments across the rest of its fleet bring NCL’s net capacity growth to 105,000 for 2025. With the largest order book in terms of lower berths, NCL will be a driver of capacity growth for the industry in the coming years.

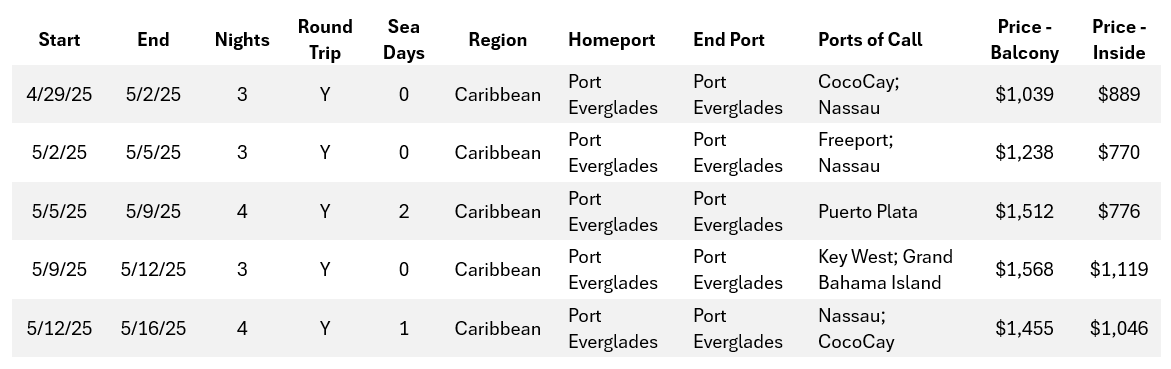

Below is a snapshot of some of the detailed data available for over 13,500 sailings:

Given the extensive breadth and detailed nature of our database, there are a myriad of insights that BA can highlight to meet your specific needs, which can help unlock potential opportunities for you. For example, are you looking for…

Let BA provide tailored insights to help you navigate the opportunities within the evolving cruise industry.

*Data reflected in this bulletin is based on BA’s deployment database which includes all available cruise itineraries in 2025 for the majority of key ocean cruise companies. Figures are reflective of lower berths, and actual passengers may be higher or lower than lower berths based on occupancy levels. Data was collected in December 2024 and may change if deployments change.