Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

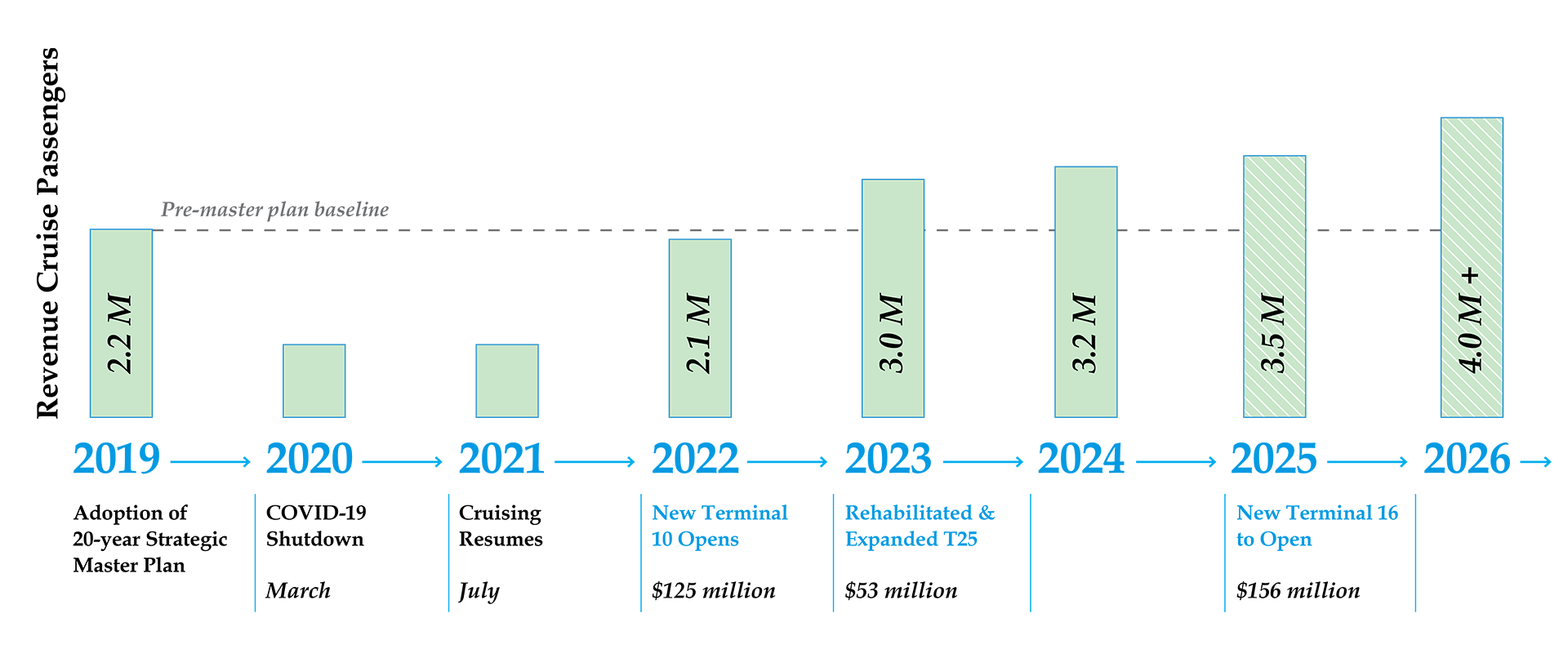

Galveston is the fourth-largest cruise homeport in the U.S. In 2019, the Port of Galveston embarked on an ambitious journey with the adoption of its 20-year Strategic Master Plan. This plan was designed to bring forward a self-sustaining, citizen-owned port to its fullest potential in terms of revenues, jobs, and community benefits.

The document laid the foundation for significant financial and infrastructural growth, transforming the port into a major hub for cruise and cargo operations, with major capital projects totaling more than $600 million.

While just four years in, and a pandemic that severely impacted the port’s operations over more than a year, Rodger Rees, Galveston Wharves Port Director and CEO, has confirmed, “I’m happy to report that we’re working the plan, and the plan is working. This is due to the board’s commitment to following the phased plan, the port’s conservative fiscal approach, recent grant awards, and the cruise industry’s robust growth."

Overall, the port is on track or ahead of schedule, which in turn is helping them expand business and has created quite the success story. This BAPerspective takes a closer look at the remarkable progress and growth stemming from their master plan initiative.

Key Developments Since 2019

Cruise Growth

Built a Third Cruise Terminal in partnership with Royal Caribbean, capable of berthing the world's largest cruise ships.

Rehabilitated, Renovated, and Expanded Cruise Terminal 25 and its parking facilities to accommodate Carnival's new flagship, Carnival Jubilee, one of the largest cruise ships in the world.

Accelerated the Construction of a Fourth Cruise Terminal and parking garage, originally slated for 2031, now set for completion in 2025 due to high demand.

Infrastructure, Traffic, and Safety Improvements

Improve and Expand 1,340 linear feet of piers and bulkheads for cargo and lay ships, with plans to create additional cargo laydown acreage.

Widen and Expand Roads and Improve Drainage

Improve the 25th Street Skywalk and develop a traffic safety action plan.

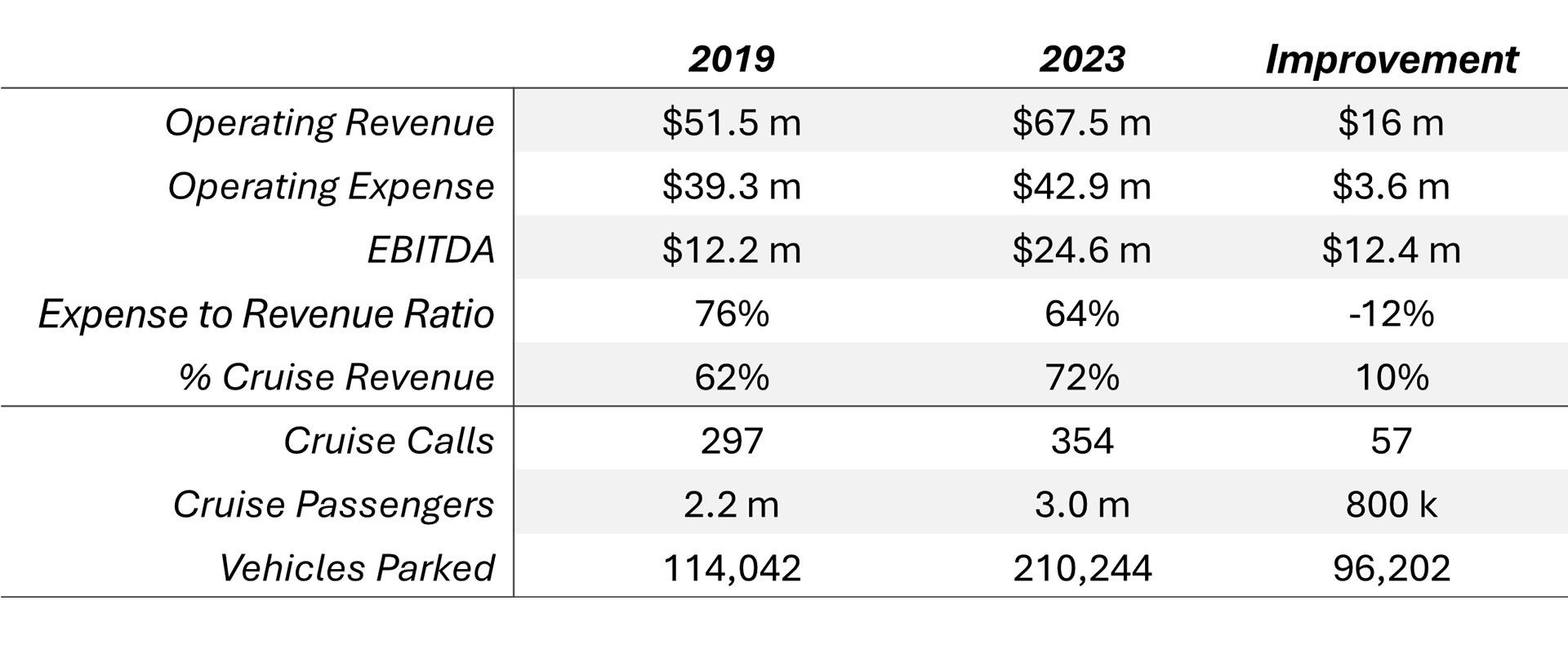

The implementation of the Strategic Master Plan initiatives has boosted the Port of Galveston, and the initial metrics reflect this transformation. Given that most investments to date have supported the expansion of its cruise business, comparing key figures from their published annual reports, focused on cruise, from before the plan's adoption to just four years later, we can see the progress made.

Since the adoption of the Strategic Master Plan, the Port of Galveston has seen significant financial growth. Operating revenue increased from $51.5 million in 2019 to $67.5 million in 2023, with cruise-related revenues rising from 62% to 72% of total revenue. Net income more than doubled, reaching $25 million in 2023. Despite expansion projects, operating expenses were carefully managed, increasing only slightly from $39.3 million to $42.9 million. The port also saw a substantial rise in cruise calls, passengers, and vehicles parked, reflecting that building infrastructure in line with demand and size of the largest vessels can significantly enhance port capacity.

Looking ahead, Galveston is poised for continued growth. The construction of a fourth terminal, with passenger guarantees from both MSC and NCLH totaling nearly one million* by the terminal’s fourth year in operation, is a significant enhancement. Several other external factors will further propel the port’s upward trajectory:

Galveston's success story is part of a larger trend in the cruise industry, where ports are proactively planning for their future and expanding and upgrading their facilities to cater to increasing demand, a growing cruise fleet in both number and vessel size, and the evolving expectations of modern travelers seeking enhanced experiences and amenities.

Other notable projects that have or will initiate significant upticks in passenger numbers across homeports include the following:

Based on this case study, the Port of Galveston's strategic planning and execution have demonstrated how targeted investments and a clear vision can drive substantial growth and success.

The port's ability to expand its infrastructure, manage costs, and increase revenue highlights the effectiveness of its leadership’s vision and motivation to follow their Strategic Master Plan. This success story not only highlights the importance of proactive planning and investment in the cruise industry but also sets a benchmark for other ports aiming to enhance their operations and meet growing demand.

As the cruise industry continues to evolve, the lessons learned from Galveston's experience will be invaluable for ports worldwide, ensuring they can cater to larger vessels, increased passenger numbers, and the ever-changing expectations of modern travelers.

* NCLH: Guarantees 140,000 passengers in the first year (Nov 1, 2025 - Oct 31, 2026), 160,000 in the second year, 180,000 in 2028, and 350,000 annually thereafter; MSC: Guarantees 500,000 passengers in the first year and 600,000 thereafter.