Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

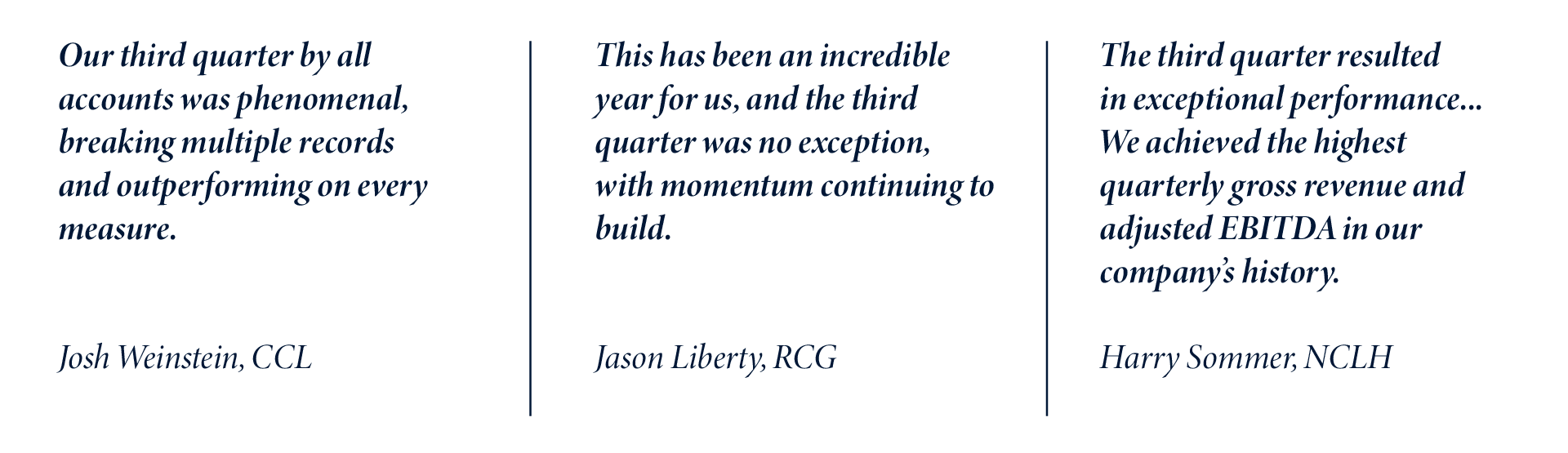

Based on the latest earnings reports of the leading public cruise corporations—Carnival Corporation, Royal Caribbean Group (RCG), and Norwegian Cruise Line Holdings (NCLH) —the cruise industry is thriving, evidenced by strong financial performance, robust pricing, increased onboard spending, and incremental capacity additions.

At the heart of these impressive metrics is a remarkable surge in demand. Several key factors are driving this high demand, as highlighted in this edition of BA Perspectives.

Each company confirmed that the demand for cruising today is no longer attributed to pent-up interest from the pandemic but rather reflects a sustained and growing enthusiasm for cruise vacations.

There is a notable increase in consumer spending on leisure and travel. American households are wealthier than ever, with continued wage growth and low unemployment rates fueling strong consumer spending. This economic backdrop has led to a significant rise in spending on leisure activities, particularly travel, which is anticipated to outpace other leisure categories. According to RCG, their research suggests this trend will continue over the next 12 months.

Meanwhile, this year the U.S. hotel market faced some headwinds from increased competition and softening consumer spending. Josh Weinstein, CCL’s President, Chief Executive Officer, and Chief Climate Officer, remarked, “We are still a remarkable value to land-based alternatives. And maybe land-base is softening because we’re doing better. Who knows? You have to ask them that.”

That’s even accounting for RCG’s confirmation that they are up 26% in “like-for-like pricing” compared to 2019 year-to-date. “And we do not, in any way, see anything, any ingredients that say that we’re hitting some type of [pricing] ceiling,” said Liberty.

CCL stated, “We have almost no capacity growth. So, all of that increased demand is just going to result in who wants to pay the most to get on our ships, and that's what we're driving for.”

Furthermore, at the beginning of the year, NCLH forecast pricing to be flat to down 1% for this quarter. Instead, they’ve seen “strength in both our near term and Caribbean deployments. So we've continued to build upon that… We're now showing pricing up around 5%.” This is a significant improvement transpiring just over the last six months, and a positive trend for not only NCLH, but the industry overall.

The cruise industry is successfully attracting a diverse range of customers, including younger demographics and new-to-cruise guests. RCG confirmed that millennials (ages 28 to 43), families, and active cruisers are all participating in leisure travel and cruise travel at higher rates than the general population.

Jason Liberty, RCG’s CEO, stated, “Our addressable market is growing, and we are attracting more new customers into our vacation ecosystem, particularly younger demographics. In fact, the majority of our guests this year are either new to cruise or new to brand.”

CCL stated that while the average age of their guests across most brands has remained stable over the past decade, Carnival Cruise Lines, in particular, has seen a significant influx of younger travelers, with an average guest age of around 41 years.

CCL also confirmed their new-to-cruise segment was up “about 17% year-over-year. That’s not an accident. That’s because our brands are really focused on driving that demand profile… by just doing the basics better.”

He concluded that the industry’s growth potential is unrestricted: “If we keep focusing on commercial execution and doing the right things and doing them better, then there’s a long runway because the one thing that’s never been a question is if we can execute… It’s just a matter of how we convince people to come with us who never have, and I think we’re doing a good job on that.”

While NCLH did not comment specifically on any demographic shifts, this quarter they launched new brand positioning, Experience More at Sea, and unveiled a partnership as the official cruise line of the National Hockey League. These marketing efforts provide a platform for the brand to connect with a broad demographic. According to NHL research, “37% of hockey fans are female, including an eye-popping 26% growth in that demographic since 2016. Most of those new fans are likely within the coveted 18-49 age demographic, too, since nearly 40% of all NHL fans are under 50.”

The cruise industry strategically leverages continuous innovation to enhance the cruise experience, ensuring sustained demand and attracting both repeat and new clientele while effectively managing costs. All three companies are making significant investments in new ships and private destinations, further supporting their growth and profitability.

“We're trying to manage cost… and at the same time, making sure that we make the right investments into the product, making sure that we are investing for the future.” - Naftali Holtz, RCG’S CFO

CCL confirmed, in relation to Celebration Key, “It’s going to benefit us, in particular, in 2026 when we get to ramp up to about 20 ships, which is going to be pretty fantastic.” Their plans are to welcome up to 4 million guests annually by 2028.

Additionally, this quarter, RCG announced Perfect Day Mexico, a new private destination in the Western Caribbean set to open in 2027. They acquired the port and surrounding land for $292 million, with further development costs planned. This move is not surprising, given Liberty’s statement that “Perfect Day at CocoCay has been a gamechanger for both our guests and our business.” If the new destination matches the success of its sister site, which expects 3 million visitors in 2024, it could have a monumental impact on the Texas market and homeports serving the Western Caribbean.

Lastly, during NCLH’s call, Sommer said their deployment mix will skew to a larger share Caribbean due to their new pier at Great Stirrup Cay, confirming an anticipated opening “sometime in Q4 [2024]”. More specifically, Sommer confirmed this shift to take place in 2026, as the pier will allow them to “utilize the island more, specifically, in the winter when it's a little bit more wavy in that region, and plan to double the guests that visit that island starting in 2026 compared to where we are today.” This could mean 800,000+ guests for 2026, up from the 400,000 guests anticipated to visit the island this year.

“But I'll tell you, like with every asset in our portfolio, we are constantly reviewing this balance of roi and rox [return on experience] to see what we can do to get guests a better experience that will drive ROI. Have nothing to announce today, but we continue that analysis and that view towards the future” – Harry Sommer, NCLH’S President and CEO

Each brand also has a significant orderbook. While CCL and NCLH did not comment specifically on new orders, RCG indicated new orders for 2029 and beyond are likely.

Overall, the cruise industry is experiencing robust demand, strategic investments, and a focus on delivering exceptional value and experiences to a broadening customer base. This sustained and heightened demand is not only a testament to the industry’s ability to adapt and thrive in a dynamic market, but it also translates into higher load factors, stronger pricing, continued growth in onboard revenue, and continuously improving financial standings.

Throughout this year, the three corporations have repeatedly revised their guidance upwards, continuing to surprise even themselves with their impressive results.

This current cruise climate is helping operators’ chip away at the debt loads acquired during the pandemic, with many engaging in new investments to keep the momentum moving forward. While these investments reflect individual operators’ commitment to enhancing their offerings and capturing new market opportunities, they bring positive externalities to the industry overall, driving long-term growth and guest satisfaction.

For example, marketing efforts by individual operators, such as the partnership between NCLH and the NHL, increase visibility for the entire cruise industry, helping drive further penetration and awareness. Additionally, the announcement of Perfect Day Mexico (and the Royal Beach Club in Cozumel under development) is significant, as unlike the Bahamas, there are limited private destinations currently in the Western Caribbean. This new focus on growing the Gulf Coast market, particularly Texas, which is larger than Florida, has a similar cruise consideration but only half the penetration.

This could see significant new passenger volume coming to the area, especially since RCG confirmed they plan to “introduce a much larger volume of short product market out of Texas, Louisiana, North Florida, and Tampa” to support these new investments. Given this and past industry learnings, it is likely that this could be the beginning of additional investments in the region if it proves successful.

While the exact outcomes remain to be seen, one thing is certain: continued demand and investment are inevitable, whether in destinations in the Western Caribbean or anywhere else in the world, in ships, onboard experiences, destinations or more. The industry will continuously evolve to set new levels of passenger satisfaction.

I don't want to be irrationally exuberant, if you will, about 2025, but we are absolutely happy with what we're seeing today." – Harry Sommer, NCLH