Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

When most people think of bustling international travel hubs, airports come to mind. However, cruise terminals in Florida and Texas quietly handle millions of passengers each year—on par with some of the busiest airports in the U.S. Both airports and cruise ports serve a similar purpose: moving people and cargo efficiently across borders and destinations1.

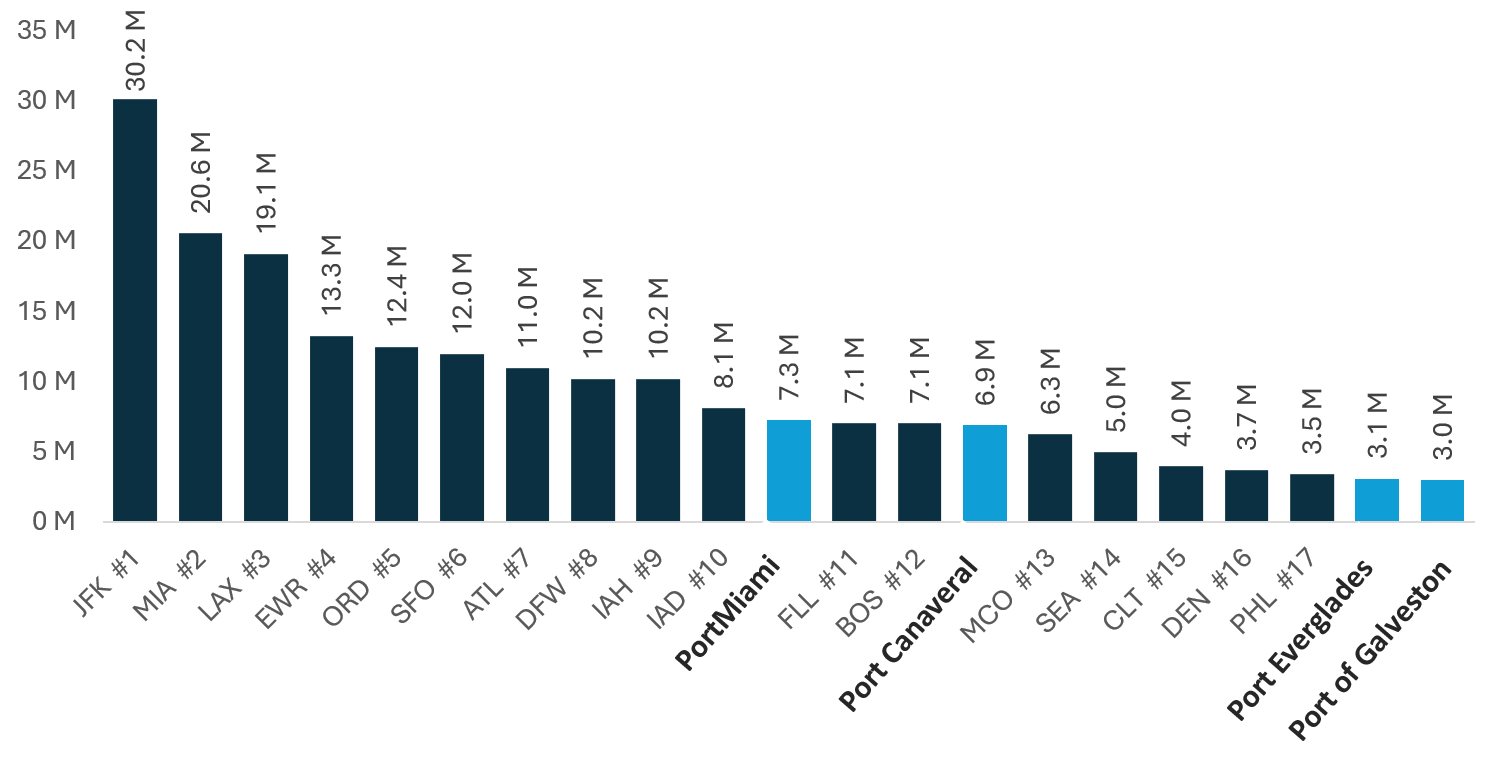

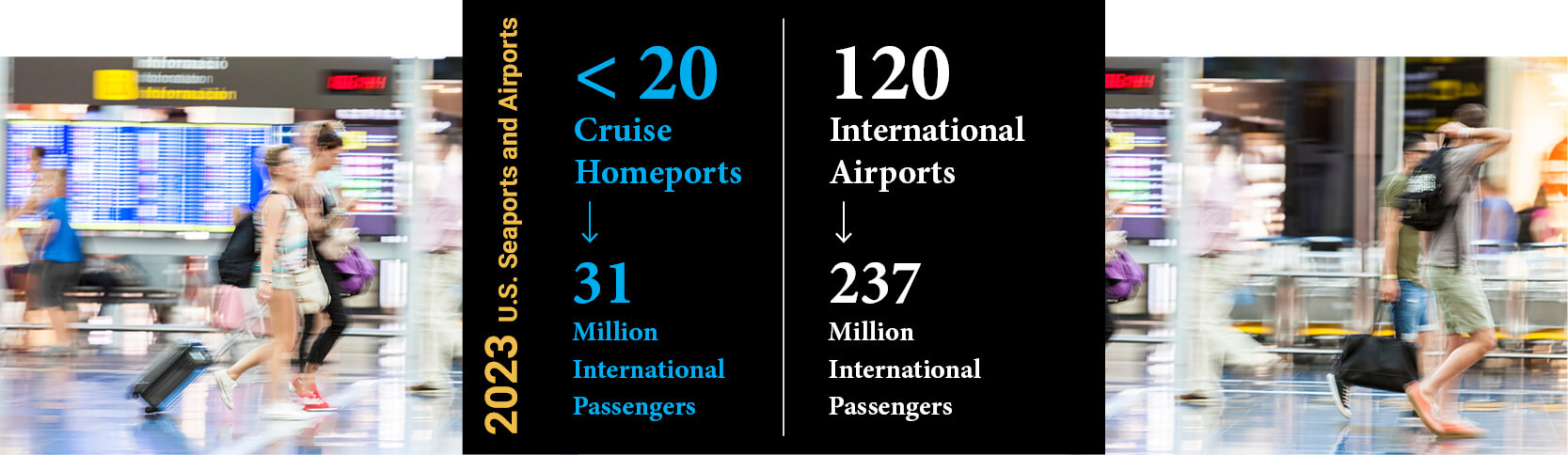

Considering just the numbers, one might assume that international air traffic significantly overshadows cruise traffic. In 2023, 231 million international passengers passed through U.S. airport. In comparison, in the same year, the cruise industry welcomed 31 million international passengers. While these airport figures are higher, it is important to note that these figures reflect the activity in in 120 international airports in the U.S., whereas there are fewer than 20 cruise homeports. This contrast casts a distinct perspective, showing that cruise passenger volumes are closer to air travel figures than one might initially imagine.

This BA Perspective explores how the world’s largest cruise ports compare to their airport counterparts and highlights how cruise ports are emerging as key international travel hubs within the U.S.

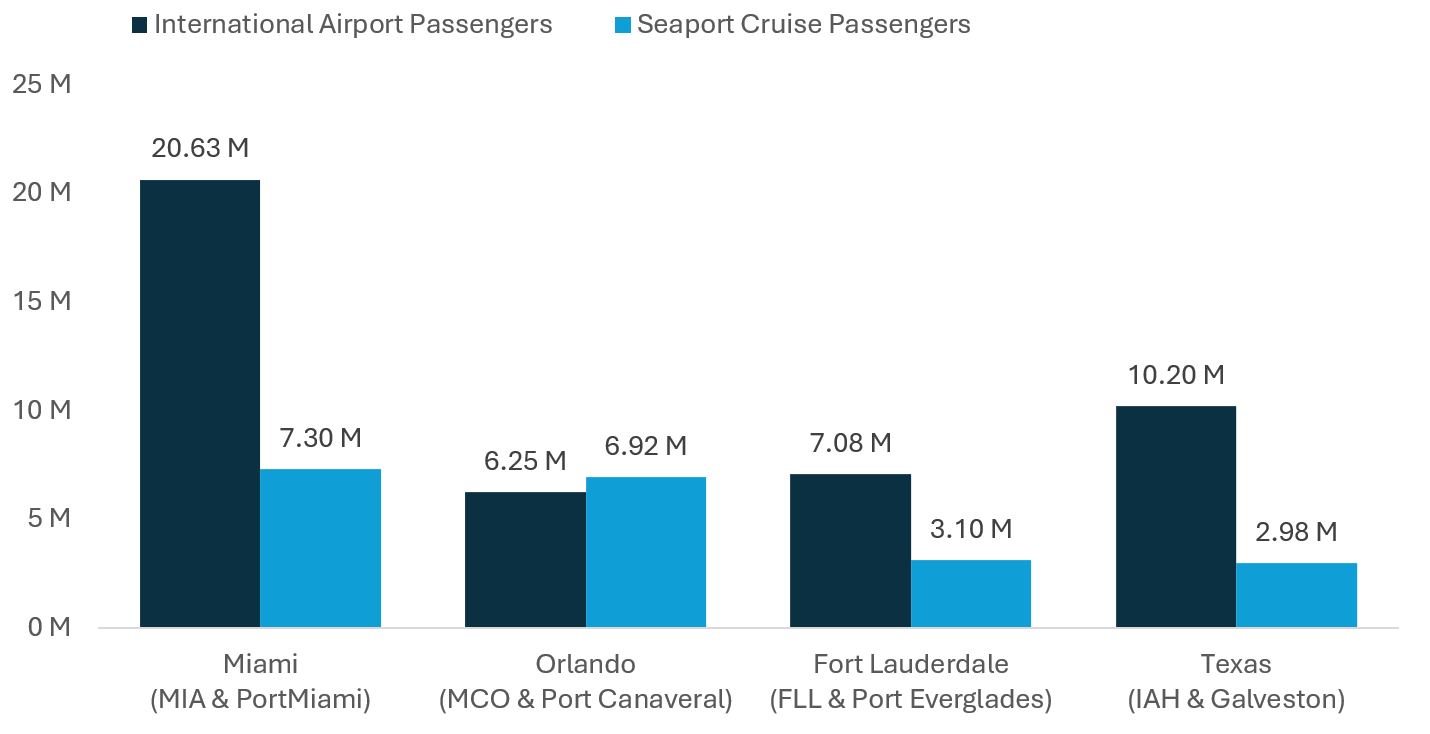

Data shows that the largest U.S. international airports handle significantly more passengers than seaports in terms of volume. However, Florida and Texas boast the world’s four busiest cruise ports—PortMiami, Port Canaveral, Port Everglades, and the Port of Galveston managing a substantial number of international passengers. With planned investments and berthing agreements with major cruise lines, these ports are on track for substantial growth in the coming years.

source: Yahoo finance

Interestingly when comparing cruise homeports with the nearby international airports, cruise ports numbers look very impressive. Port Canaveral, already is surpassing Orlando International Airport (MCO) in terms of international passenger volume, and the port’s traffic is projected to increase cruise passengers from 6.9 million in 2023 to 8.4 million by 2025.

source: Yahoo finance

PortMiami is expected to reach 9.4 million cruise passengers by 2028, up from 7.3 million in 2023. These projected figures will place these ports among the top ten U.S. international travel hubs in the U.S.—a noteworthy achievement for any seaport.

Meanwhile, with the opening of Galveston’s fourth cruise terminal, the port is expected to handle 4 million cruise passengers annually by 2026, putting it in the same league as the 14th- and 15th-ranked airports, Seattle and Charlotte Douglas (North Carolina).

After comparing passenger throughput, it is important to understand how passenger flow differs between cruise terminals and airport terminals. Airports operate on a continuous 24/7 model, with flights arriving and departing around the clock. In contrast, cruise terminals manage large volumes of passengers in concentrated crush periods dictated by cruise ship schedules. A cruise ship carrying over 5,000 passengers will disembark its passengers and crew, then re-embark another 5,000-plus passengers within a few hours. This creates an intense but short-lived surge in traffic to and from the terminal.

This "crush load" demands precise coordination to process passengers and crew efficiently. Today, the expectation is for passengers to move from curb to ship—or vice versa—in just 15 minutes at homeports, highlighting the need for operational efficiency, including baggage check, security, and U.S. Customs and Border Protection (CBP) procedures. For U.S. international airports, after deplaning, a passenger may need to walk up to 15 minutes just to arrive at CBP, depending on the terminal design. CBP processing and baggage retrieval can vary significantly, influenced by factors such as the airport’s infrastructure, time of day, passenger volume, citizenship status, participation in programs like Global Entry or Mobile Passport, and the season.

In cruise travel, passengers typically enter a terminal that serves one vessel, with direct access to the ship, whereas airports serve hundreds of planes through interconnected gate systems, each carrying far fewer passengers than a cruise ship.

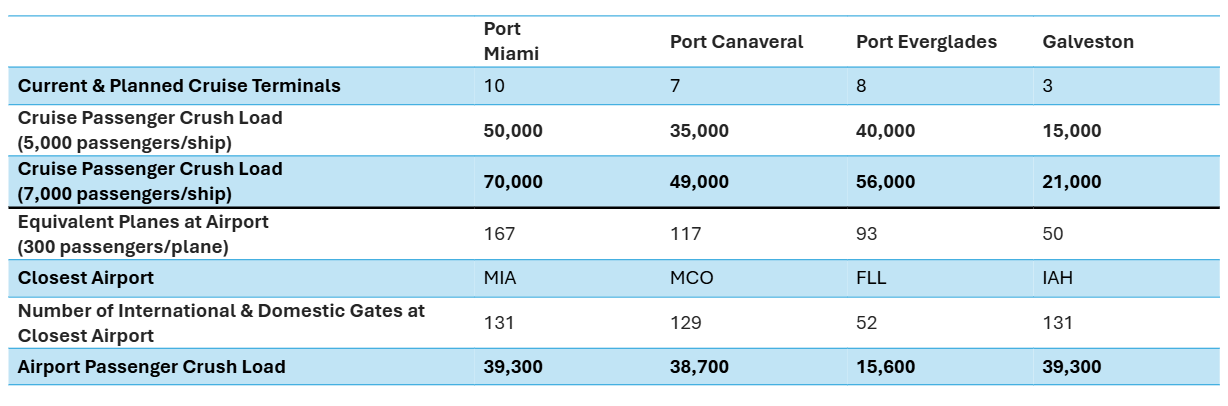

This highlights the space efficiency of well-designed and strategically planned cruise terminals. They are capable of moving passengers quickly and effectively in an expedient manner. To further explore the comparisons, the following table provides a glimpse of the potential crush loads at homeports comparing to the theoretical similar crush at an airport.

The table shows that cruise homeports are required to manage instant crush loads that dwarf those at the largest airports in the U.S. Miami International Airport (MIA), the second-largest U.S. airport for international arrivals, has 167 gates. Assuming an average of 300 passengers per gate, the airport’s instant crush load—if all planes were to arrive simultaneously—would be 39,300 passengers. In comparison, PortMiami can manage a crush load of 50,000 passengers when ten cruise ships are docked, assuming 5,000 passengers per ship (the average today). Looking ahead, with the introduction of larger vessels, that number could reach 70,000 passengers, assuming 7,000 passengers per ship.

For further comparison, Hartsfield-Jackson Atlanta International Airport, the largest U.S. airport by gates, would have a crush load of 58,500 passengers under the same assumptions.

As the cruise industry continue to grow, cruise ports are cementing their place as major hubs for international travel. Handling millions of passengers with far fewer resources than airports, cruise terminals have proven that they can be just as vital to the global travel network.

It is not just about capacity; the ultimate measure of success is guest satisfaction. Ports must find ways to deliver an exceptional experience while managing what can be an insurmountable logistical challenge. Key innovations include:

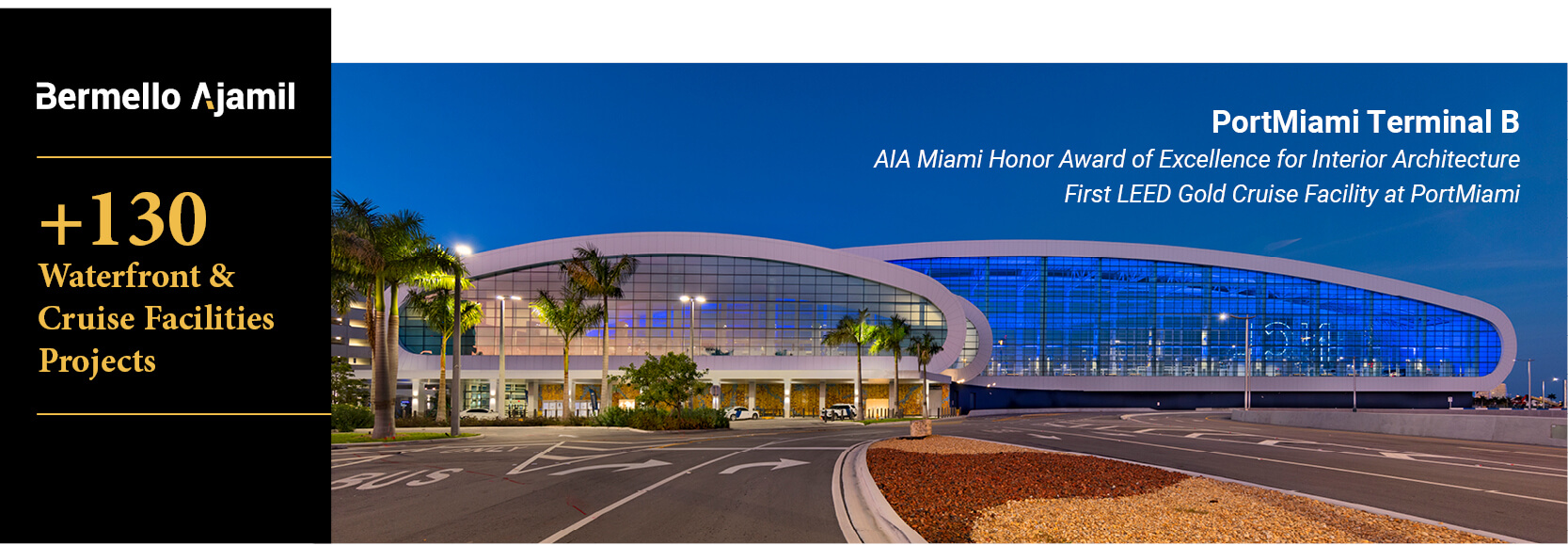

At the heart of this efficiency are the cutting-edge designs of cruise facilities. BA has played a pivotal role in this transformation, streamlining passenger processing through innovative design in all aspects of the terminal design, including cruise CBP facilities, in key cities across the U.S. BA’s work has spanned terminal design in the following ports:

Each of these facilities was designed to streamline the passenger experience, from customs processing to embarkation, while optimizing space and cost. These designs are at the core of why cruise terminals can rival airports in terms of passenger volume yet do so with far fewer resources.

To learn more about BA’s role in shaping efficient cruise gateways, visit our website or contact us at BAmaritime@woolpert.com

1. While this comparison highlights international passenger movements, it's important to note that airports also manage significant domestic travel, and both airports and seaports handle cargo operations—though seaports typically manage more. This adds an additional layer of complexity to their operations.