Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

The cruise industry is embarking on a sustainability voyage, seeking innovative solutions to reduce its environmental impact and embrace greener practices. The Cruise Lines International Association (CLIA) has committed to reducing the rate of carbon emissions across the industry fleet by 40% by 2030, aligning with the IMO’s current GHG strategy, and a more ambitious pursuit of net carbon-neutral cruising by 2050.

Ports around the world have also announced additional commitments to reduce emissions. Shore power is being considered by many ports globally to reduce vessel emissions while in port, with the EU’s Fit for 55 legislation requiring certain ship types including cruise ships to connect to shore power in major ports by 2030.

Ports, governments, and ship operators are also investigating the establishment of green corridors for alternative fuel supply and bunkering. The idea of a “green corridor” involves collaborating with various players in the supply chain, including ports, cargo shippers, and ship operators, to speed up the process of achieving zero emissions. Creating a green corridor requires government and industry partnerships to ensure that the appropriate regulatory and investment conditions are in place to promote the adoption of greener shipping approaches.

Overall, the cruise industry is actively working towards reducing carbon emissions through a combination of efforts, such as (i) the deliveries of new ships with greater efficiencies, (ii) advanced ship designs and propulsion, (iii) the exploration of alternative fuels, (iv) implementation of shore power on land and ships, and (v) collaborating with regulatory bodies and ports to achieve these ambitious decarbonization goals. The reduction will take place with both technological innovations together with new alternative fuels.

As such, this bulletin explores the perspectives of the industry and the exploration of various alternative fuel options, shedding light on the commitment to carbon reduction and sustainability.

Alternative fuels play a crucial role in the decarbonization of the shipping industry, and the cruise sector is actively exploring options to replace heavy fuel oil (HFO) and marine gas oil (MGO). While the final solutions are not yet identified, research and testing continue as operators prepare for the future.

According to data from Clarksons, the cruise industry is pushing forward with the uptake of alternative fuels as part of its decarbonization efforts, with 65% of the current order book being capable of running on alternative fuels. Additionally, operators are already testing future fuels on existing vessels in operation today.

Below is a summary of what fuels are currently under consideration by which operator.

Today, LNG offers significant benefits for cruise lines, including a drastic reduction in sulfur emissions by 99-100%, a 25% decrease in carbon dioxide emissions, and a 90% reduction in nitrogen oxide emissions. LNG is currently the cleanest fuel available at scale, and the use of LNG as a transition fuel toward an emission-free future is already a reality. Its presence among ships and cruise ships has increased, paving the way for the use of other, even more, sustainable fuels. As such, adopting LNG as a primary propulsion fuel contributes to environmental goals but emissions are still present while in use.

“While there are alternative fuels that could provide potential solutions in the future and for the next generation of ships, LNG is currently the most environmentally friendly fuel and the only scalable option available that offers significant emissions reductions today.”

– Tom Strang, SVP, Maritime Affairs, Carnival Corporation

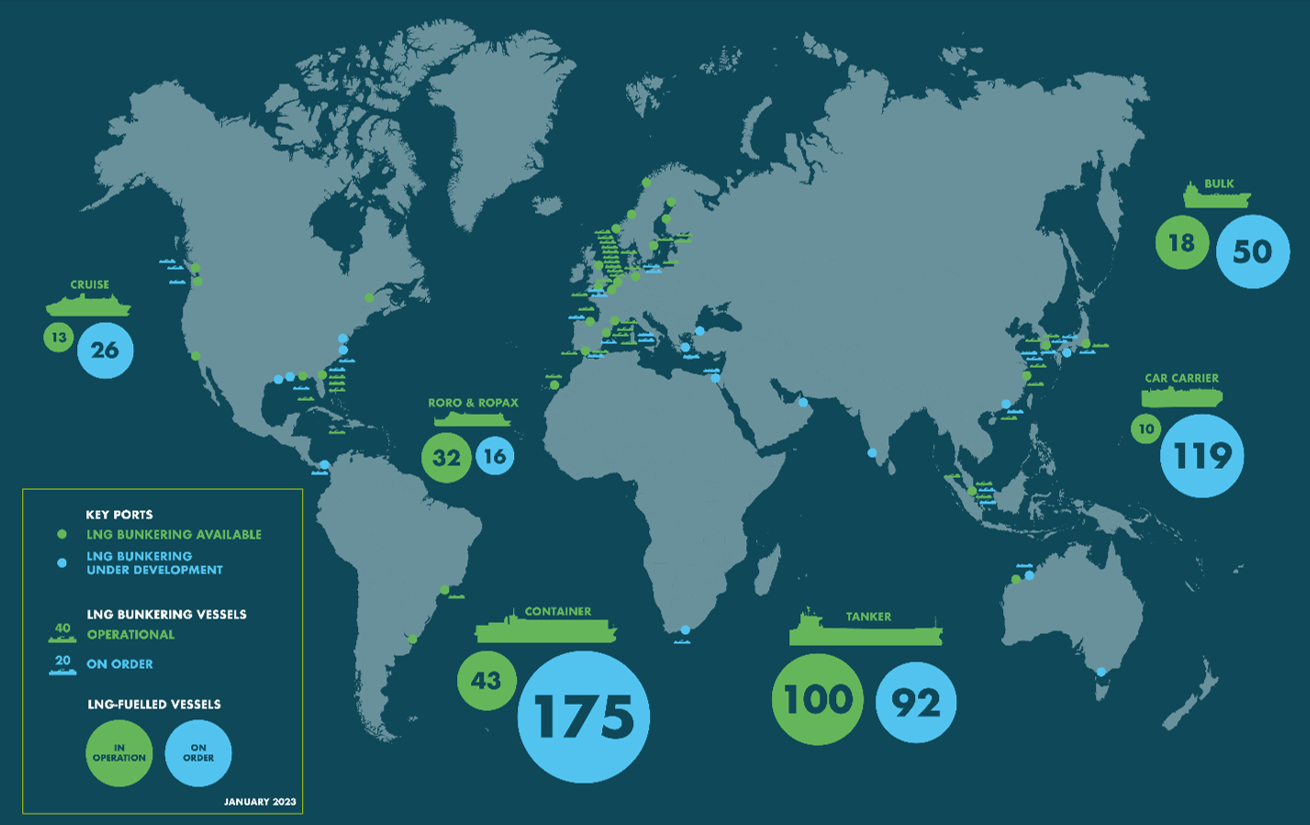

Limited bunkering locations is another obstacle that hampers the adoption of LNG cruise ships, leading to delays. Although there are intentions to establish additional LNG bunkering solutions to cater to these ships, the current absence of such infrastructure dissuades companies from investing in LNG cruise ships. Operators of LNG-fueled vessels are typically required to sign long-term agreements with fuel providers to ensure proper supply.

Other considerations for the adaptation of LNG include more expensive vessels with dual-fuel engines as they cannot be used with an existing fuel oil or diesel engine. Additionally, ships using LNG typically need more space onboard for fuel storage. Methane slip from dual-fuel LNG engines also needs to be minimized to limit its impact on the overall greenhouse gas emissions from the vessel.

Regardless of these challenges, CLIA estimates that 60% of the ships scheduled to debut between 2023 and 2028 will rely on LNG fuel for their primary propulsion. Longer term, these LNG-fueled vessels, and infrastructure can use and deliver bioLNG (biofuel) and renewable synthetic LNG once these fuels become more broadly available.

Source: Sea-LNG.org

Methanol has emerged as another solution in the cruise industry’s shift towards cleaner energy, primarily due to its ease of handling, cleaner combustion, reduced emissions, compatibility with existing infrastructure, and the potential for sourcing from renewable and low-carbon pathways. Today, the fuel option has garnered interest from several cruise companies, who have committed to its use. As methanol is a carbon-containing fuel, achieving low-carbon emissions with its use requires regulations to consider well-to-wake emissions including emissions related to fuel production instead of the current tank-to-wake approach currently used.

NCL is at the forefront of embracing methanol as a game-changer in the cruise industry. NCL has taken a bold step by modifying its next four Prima class ships with a $1.3 billion change order, increasing passenger capacity, and ensuring methanol-readiness as a key component of its propulsion system.

TUI Cruises, Celebrity, and Disney have plans to introduce new builds on order with methanol capabilities. TUI is adapting the design of its new ship, Mein Schiff 7, to be methanol-ready upon its introduction in 2024. Celebrity Cruises’ fifth Edge-class ship uses a flex-fuel engine with the ability to use three types of fuel – methanol, and two conventional fuels. The vessel is planned for 2024 delivery. Similarly, Disney Cruise Line has expressed its intention to operate the acquired cruise ship, Global Dream , on methanol starting in 2025. These commitments demonstrate the growing recognition of methanol’s potential as an environmentally friendly fuel choice for the cruise sector.

“By incorporating tri-fueled engines, we are ensuring that as alternative, low-carbon-based solutions become more viable, our ships will be ready to adapt and drive the industry forward to a more sustainable and net zero emissions future.”

– Jason Liberty, president/CEO, Royal Caribbean Group

According to Royal Caribbean Group CEO Jason Liberty, “Biofuels will play an increasingly important role in achieving, not only our own, but the entire maritime sector’s decarbonization goals in the short and medium term.”

Biofuel is a fuel that is produced over a short period from biomass, rather than by the very slow natural processes involved in the formation of fossil fuels, such as oil. Biofuel can be produced from plants or agricultural, domestic, or industrial biowaste. There are multiple types of biofuels that are defined based on their feedstock and production processes. The sustainability and scalability of potential biofuels will be critical to better understand their longer-term role within maritime decarbonization.

Testing by several operators is underway, but the need for a robust and scalable supply chain to meet the industry’s demands is needed to further this solution.

Earlier this month, MSC completed the industry-first net zero gas emissions voyage for their newest vessel, MSC Euribia. The company purchased 400 tons of bio-LNG for its inaugural sailing from Saint-Nazaire to Copenhagen.

This summer, RCG is set to use a biofuel blend in Europe during a three-month test across two vessels – Celebrity Apex and Symphony of the Seas. The sustainable fuel will meet part of the ships’ fuel needs while contributing data and research on biofuel’s capabilities and supply chain infrastructure needed to further the cruising’s alternative fuel ambitions. After the trials are completed, the company intends to scale up the use of alternative fuels, including biofuels, across further European summer sailings.

NCLH recently completed a significant biofuel trial, further emphasizing the industry’s commitment to sustainable fuel solutions. The trial aimed to evaluate the performance and viability of biofuels in real-world cruise operations. While the trial successfully fueled two of NCLH’s ships, the Norwegian Star and the Norwegian Epic, with a total of 400 tons of biofuel, it highlighted the need for a robust and scalable supply chain to meet the industry’s demands.

“For us, this particular voyage is a call to action. It’s basically saying, look, we can do it. The growing amount of bio[fuel] means it’s definitely there to be had. It’s more about the cost to us. The solution will come from ‘scaling up,’ and hopes for future government incentives to drive the process.”

– Linden Coppell, VP of Sustainability and ESG, MSC Cruises

As outlined, the cruise industry is making significant strides towards decarbonization, with a goal of achieving net carbon-neutral cruising by 2050. While the exact direction is not yet solidified, the research and testing are well underway. It is also clear that the solution is new, sustainable fuels, and operators and shipbuilders are focused on newbuilds that have built-in preparedness to be ready for future fuels, whichever that may be.

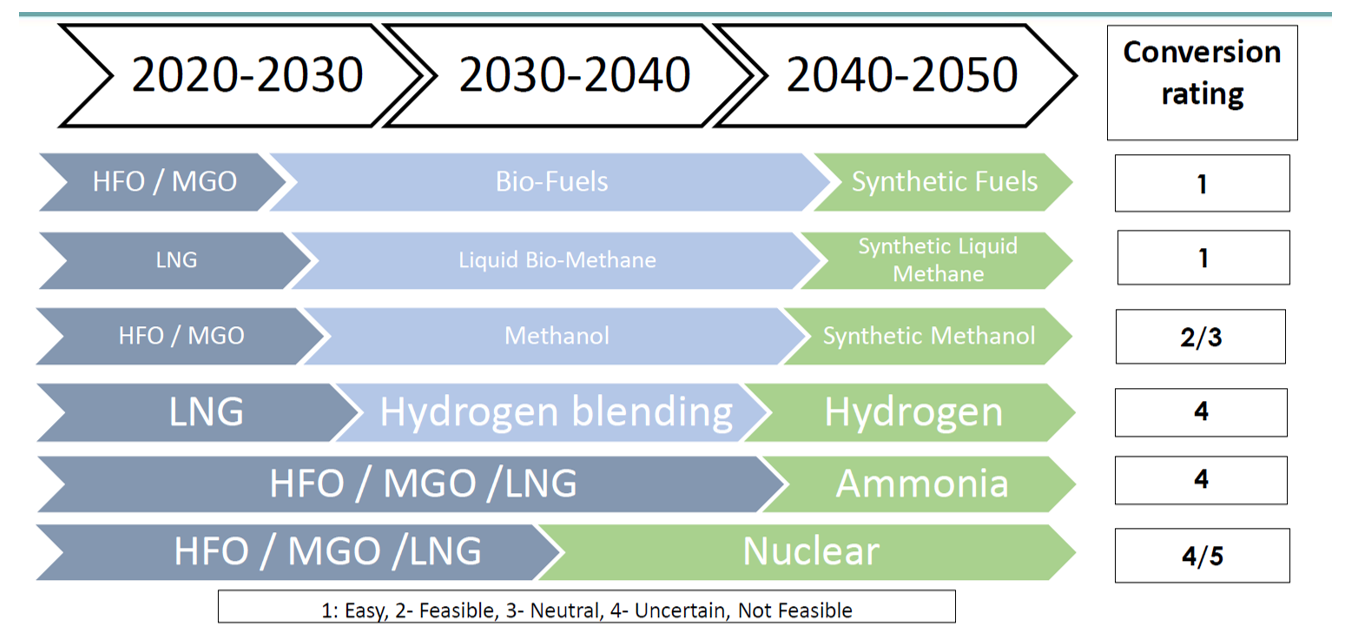

CLIA presented the path to zero and the alternative marine energies. From the actions ongoing today, and this table, it is clear that the fossil fuels (HFO, MGO, and LNG) will be phased out over the next 10-20 years, with newer, greener fuels replacing these fuels in the mid-term, with additional options not explored in this bulletin coming online over a longer period of time.

Source: CLIA

While the industry actively explores sustainable fuel solutions, one critical issue is the availability and accessibility of these new, sustainable fuels. The successful adoption of future fuels requires a reliable and robust supplier network that can meet the industry’s demands. The entire maritime value chain – energy providers, fuel suppliers, governments, financiers, ports, and shipowners – need to collaborate to ensure adequate funding and apply it to the right projects to develop a sustainable and scalable supply chain that can support the widespread implementation of green fuels. Addressing the supply chain challenges will be crucial in realizing the full potential of these future fuels as a long-term solution for reducing greenhouse gas emissions in the cruise industry.

Ports will play a key role in the green maritime transition by serving as energy hubs providing both shore-side electricity and infrastructure for storing and fueling ships with future fuels, as well as supporting the first movers and green corridors.

The cost to invest in these new technologies for future fuels and/or shore power is a large hurdle for many ports, but as a region and/or port, being a first mover in providing future alternative fuels such as methanol and LNG can solidify its leading position or create growth opportunities as a destination for the cruise industry.

Cruise lines will reconfigure sailing schedules where fuel, bunkering, and infrastructure are available. This represents a significant challenge, or opportunity, whichever way you look at it. One precedent to consider is when cruise lines in the Caribbean faced a similar challenge with the availability of quality ship repair yards, which was overcome by joint investment in the Grand Bahama Shipyard in the Bahamas. Similar joint investment projects in bunkering capacity would significantly ease the path toward the transition.