Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

With the last of the big three public companies wrapping up their Q1 2023 earnings reports last week, it’s time for BA’s summary of the key takeaways and themes trending today, and what that means for the future of the industry.

The key themes BA identified are outlined below:

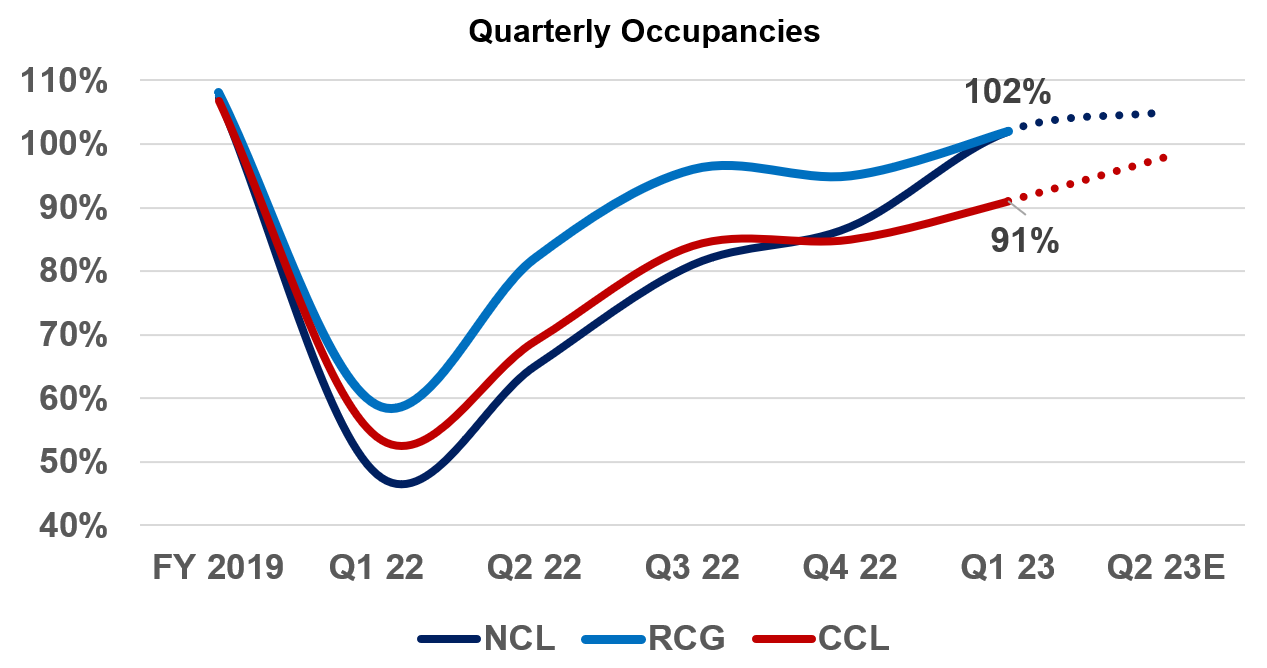

NCL, RCG, and CCL all reported strong occupancy levels, closing in on their previous 2019 occupancy rates (with NCL at 107%, RCG and CCL both at 108%)

Norwegian confirmed its occupancy ramp is complete and expects 105% in Q2 2023. This slightly lags behind their 2019 full-year occupancy. They expect this to persist into the future as a result of its strategy of marketing to fill, accompanied by Regent and Oceania newbuilds, and a shift to longer and more port-intensive itineraries for the Norwegian brand which is expected to drive higher yields but likely at the expense of lower occupancies than it has historically achieved.

Royal Caribbean did not provide an occupancy estimate for Q2 2023 but did comment that they expect to reach historic load factors by late spring. The company has been the quickest to ramp up occupancy due to their relative over-indexing of capacity placement to the Caribbean, in particular voyages to “Perfect Day” at Coco Cay.

Carnival Corporation is lagging behind its competitors, with its Caribbean-based brand (CCL) outperforming, while other brands like Costa are struggling. This is due to a combination of factors, including the ongoing impact of the pandemic, regional differences in demand and customer preferences, and specific challenges facing each brand. In addition, several vessels have been transferred between brands to optimize operations. For example, some ships have been moved from Princess Cruises to rebuild the operations in Australia, and three ships are being transferred from Costa to Carnival Cruise Line.

At the end of March, during Carnival’s Q1 2023 earnings report, they announced with the business back in operation, they are generating significant cash flow to service obligations. Having peaked at over $35 billion in the first quarter, Carnival’s debt is expected to be reduced to $33.5 billion by year-end.

They stated, “We have plans in place to support cash generation and expedite the repayment of debt.” One example they gave to start paying down the debt is its lowest ship order book CAPEX in decades (4 large and 1 expedition ship on order).

Last week, NCLH confirmed its plans for meaningful growth in its top and bottom-line results. To achieve this, NCLH aims to grow its premium products with a 7-ship and 19K berth order book. Additionally, the delivery of new builds since 2019, including two Regent ships, one Oceania ship, and two new Prima class ships, are driving increases in ticket sales and overall yields.

Despite an 18% growth in total capacity in 2023 vs 2019, the company expects an 8.5-10% growth in ticket per diems and a 4.5-6% growth in net yields. Overall, NCLH expressed confidence in its ability to continue to drive growth and deliver strong financial results through its focus on premium products and longer, more immersive itineraries, all of which will help repay its obligations.

Also last week, RCG reported a strong revenue outlook and increased its full-year guidance thanks to strong demand for its brands, which is outpacing broader travel. The company cited strong close-in bookings at higher prices (particularly for the Caribbean), continued onboard spending strength (from higher participation and pre-cruise purchases), and timing of operational costs as the primary reasons for the guidance increase. Despite a 13.5% growth in total capacity in 2023 compared to 2019, the company expects a 6.2-7.2% growth in net yields.

In the end, RCG confirmed they are generating significant cash flow now that they are up and running with allows them to “effectively service our outstanding obligations”.

The China market was a significant focus for the cruise industry before the pandemic, with both Carnival and Royal Caribbean dedicating assets to this region. However, in recent earnings calls, both companies acknowledged the challenges posed by the pandemic and the ongoing shutdown of the Chinese market. NCLH had no comments on the China market.

One important differentiator between Carnival and Royal Caribbean’s strategy is the joint venture between China State Shipbuilding and Carnival (CSSC) with Fincantieri playing an important role. Pre-pandemic the joint venture’s brand Adora Cruises would service the market with a combination of former Carnival ships and a fleet of Vista Class new builds constructed in Shanghai Waigaoqiao Shipbuilding company with the support of Fincantieri.

Carnival has stated that they will consider returning to the Chinese market once it reopens, though they have not set any specific plans as of yet. Adora’s two former Costa ships – the Costa Mediterranea and the Costa Atlantica – are laid up in the Mediterranean, while CSSC is still scheduled to deliver two Chinese-built new builds directly to Adora to enter the Chinese market in 2023 and 2024.

Royal Caribbean acknowledged the difficulties faced in the Chinese market due to the pandemic and very recently has shifted its focus to rebuilding its salesforce in China. They have expressed hopes to resume cruising in 2024 and have begun laying the groundwork for future operations in China.

While both companies remain interested in the potential of the Chinese market, they have also recognized the importance of being patient and adaptable in the current climate. Royal Caribbean’s China-dedicated vessel, Spectrum of the Seas, has been deployed year-round to Singapore in lieu of the pre-pandemic deployment to Shanghai and Hong Kong.

Q1 2023 earnings reports of NCLH, RCG, and CCL all showed strong occupancy levels with NCLH confirming the completion of their occupancy ramp-up while RCG and CCL are close to their 2019 levels. Despite the challenges of heavy debt loads and increased costs and complexities of ramping up operations, the overall trend in the industry is optimistic, with strong demand delivering robust financial results.

The industry remains agile, with companies adapting to the changing landscape and shifting their focus to areas of opportunity such as developing premium products and shifting assets strategically to profitable markets. For instance, Royal Caribbean’s $250 million development in “Perfect Day” at Coco Cay reflects the brand’s focus on delivering a premium experience and continues to command a ticket and spending premium.

Another example of the industry’s agility is Carnival’s decision to leverage the strength of its North American brand by shifting several vessels from its Costa brand to Carnival. By doing so, Carnival will better meet the needs and preferences of its guests, while also optimizing its operations and resources.

Similarly, Norwegian has shifted its focus to longer and more port-intensive itineraries, which appeal to travelers seeking more immersive experiences. By offering these types of itineraries, Norwegian can differentiate itself from its competitors and attract a higher value guest. This approach has proven successful for Norwegian, which has seen strong demand for its cruises and has been able to command premium ticket pricing in the cruise travel market.