Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

The Carbon Intensity Indicator (CII), introduced by the IMO in 2023, measures the environmental efficiency of ships by evaluating CO2 emissions per nautical mile traveled. This regulation aims to reduce the shipping industry's carbon footprint to combat climate change.

Ships are annually rated from A (most efficient) to E, with progressively stricter standards towards 2030 with a review planned in 2026. If a ship receives a failing grade, it must submit a plan for improvement, though the consequences for ongoing poor performance are still uncertain, adding a level of unpredictability as the industry adapts to these standards.

The CII is problematic for the cruise industry primarily because its formula does not account effectively for the unique operational characteristics of cruise ships. Activities that should theoretically lower emissions, like operating at a slower, more fuel-efficient speed or spending time in port, can lead to worse CII ratings. This paradoxically could encourage cruise ships to increase their speeds unnecessarily or spend less time in port, leading to higher fuel consumption and greater overall emissions, contrary to the intended goal of reducing climate impact.

As Foreship’s article How To Fix Cruise Shipping’s CII Conundrum explained it, “instead of having a peaceful day at sea at 6 knots, current CII regulation could encourage the vessel to zigzag at 12 knots, thus getting a better CII rating but consuming significantly more fuel.”

Outside the cruise industry, similar issues are being raised for cargo vessels, which will score lower CII ratings due to factors out of their control, such as port congestion and weather, negatively impacting a ship's efficiency.

With the first CII reports for ships just due (March 31, 2024), cruise lines continue to evaluate ways to ensure their vessels can adhere to this regulation. While CLIA is advocating to revise the CII calculation to address this misalignment and prevent potential increases in emissions, BA explores what changes may be seen across the cruise industry if the CII remains unchanged for cruise operations.

It is important to understand that this is a ship-specific measure, and an itinerary that may pass CII for one ship, may not pass for another. Here are what cruise operators must consider when planning CII-compliant itineraries.

If the proposed CII remains unchanged for cruise ships, which is not likely to happen before the rating systems come into effect in 2026, several changes are anticipated for itinerary planning impacting cruise regions worldwide – many of which are ports that are already reporting to BA that they are seeing modifications for the upcoming 2025 and 2026 seasons.

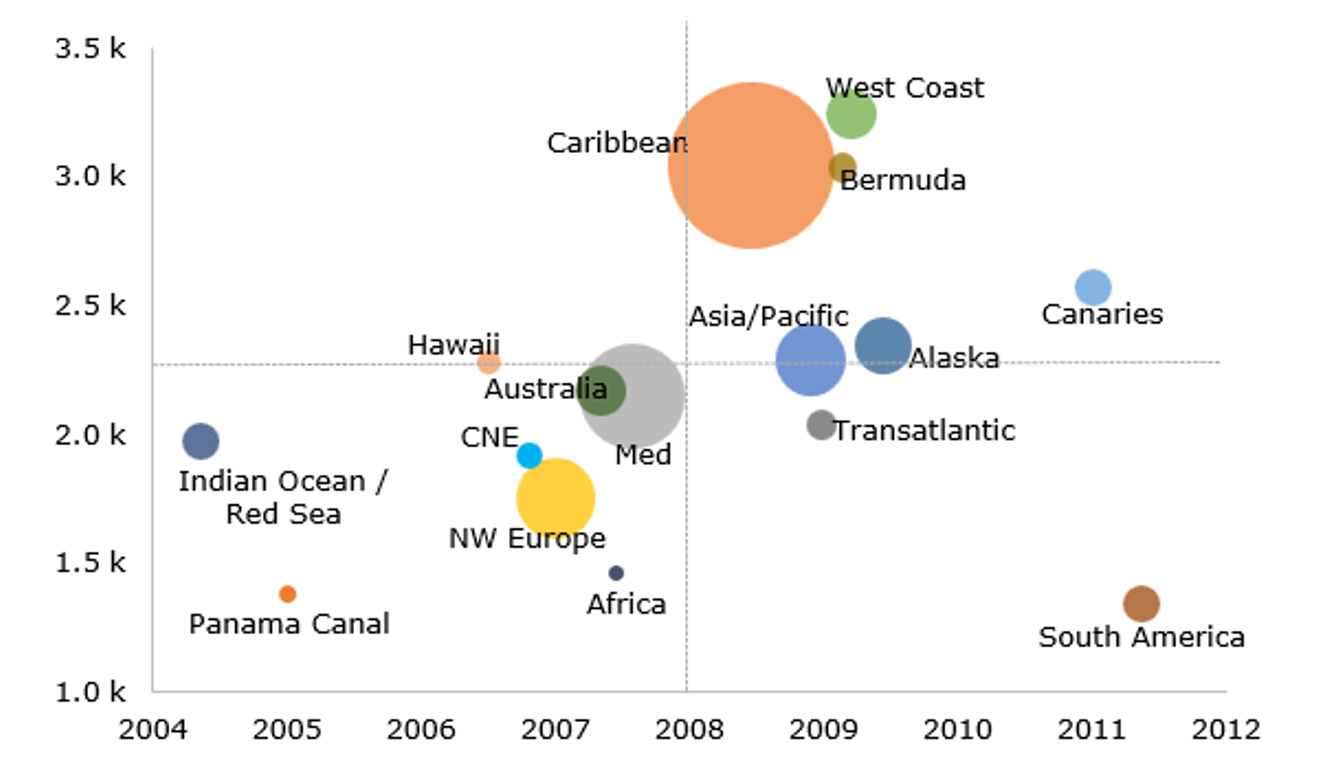

Most Impact on Itineraries with Older, Smaller Vessels. While this is a global industry issue, and will impact regions worldwide, those that typically welcome smaller explorer or luxury or older vessels are expected to experience the most effect from the CII. BA created a graphic that details these impacts by region, with the x-axis representing average vessel age and the y-axis indicating the average lower berths per vessel. The size of each circle on the graph represents the volume of passengers expected to visit the region in 2024.

The graph shows that regions hosting the smaller and older vessels are in the bottom left quadrant. While BA cannot definitively predict negative impacts, it suggests that these regions might undergo more itinerary, and vessel changes due to the CII than other areas globally.

Changes Could Involve Longer Itineraries & Fewer Ports for Impacted Vessels. Extended distance traveled and less time in port in these cases helps to improve the CII by reducing emissions per annual distance traveled. This aspect of the CII calculation can inadvertently incentivize cruise lines to opt for longer routes to achieve better scores, which could lead to higher overall carbon emissions—seemingly counterproductive to the CII's intent of reducing the carbon footprint. We may see a shift of these vessels sailing the longer voyages (transatlantic, world, etc.). Additionally, one solution could be a rise in open jaw itineraries which can cover long distances with varied port content thus potentially lowering CII.

Regionally Complemented Itineraries. The CII rating evaluates ships on annual emissions. This might prompt cruise lines to adjust the seasonality of ships that struggle to achieve satisfactory CII ratings. For instance, if a ship's CII rating is suboptimal in one season/region for six months of the year, the cruise line may reposition it to another region for the second six months where it will yield better CII scores. This way, the cruise line can balance the ship's annual CII outcomes.

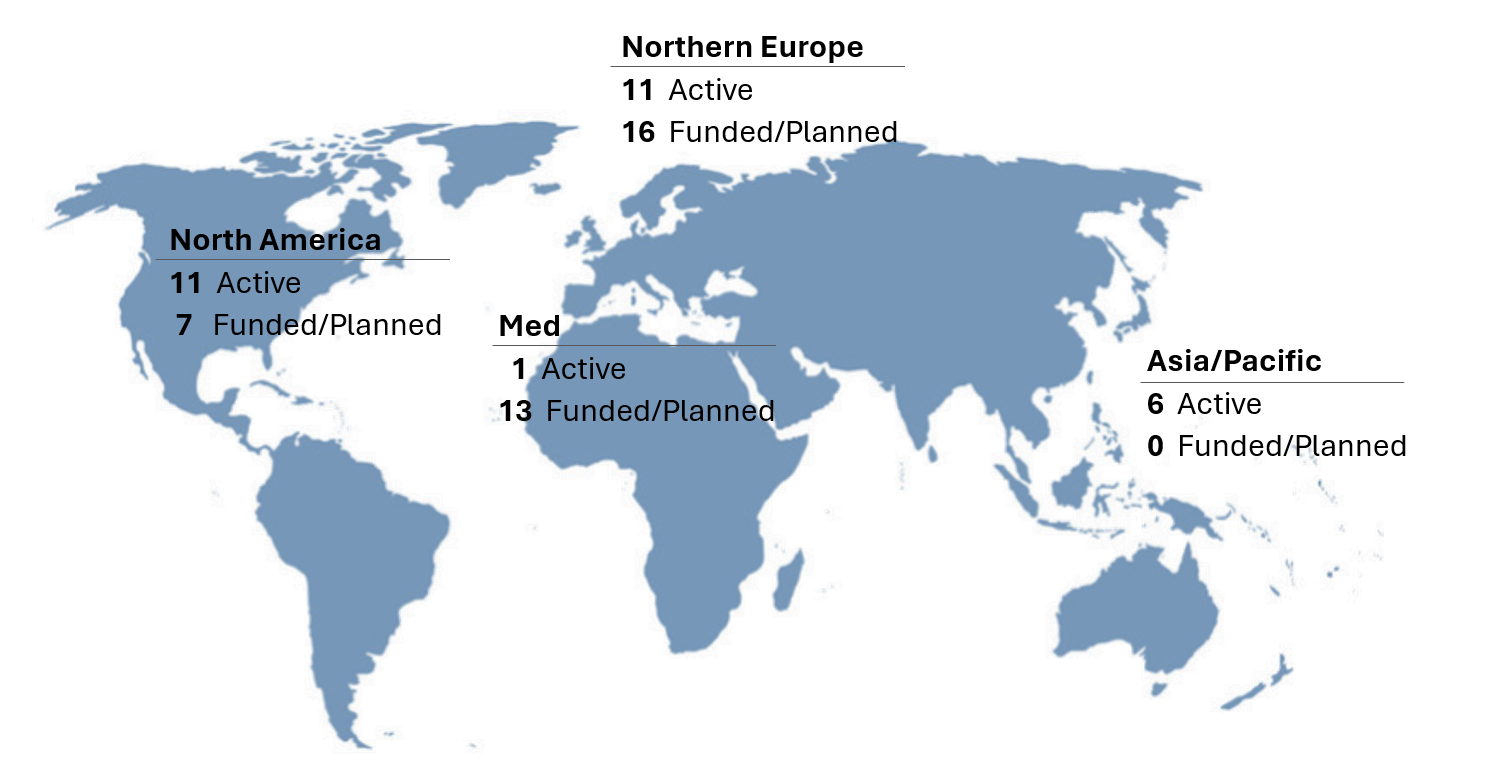

Shore Power Emerges as a Factor. Utilizing shore power in ports can eliminate emissions entirely while a vessel is docked, significantly reducing its carbon footprint. However, relying solely on shore power will not suffice for achieving a favorable CII rating, particularly given the limited global availability of such facilities. Currently, only 29 ports worldwide offer at least one cruise berth with shore power, and another 36 are expected to have similar facilities by 2026. For context, Royal Caribbean reported visiting over 1,000 destinations globally in 2023. Therefore, unless a substantial number of both homeports and ports of call adopt shore power, ships will continue to face penalties for emissions while docked.

What could be interesting to watch is how Europe's 'Fit for 55' program could benefit some ships struggling to meet CII standards in certain regions / itineraries. This is because all ships, including cruise ships, must connect to shore power at major EU ports by 2030, and by 2035, this requirement will extend to all EU ports equipped with shore power. There could be a shift of these older and smaller vessels to Europe, as they would improve their CII ratings from the use of shore power while in all ports.

Currently, CII is not a hard regulation; and no penalties have been defined for the next three to five years. The IMO's Marine Environment Protection Committee (MEPC) plans to review the effectiveness of the CII requirements by January 1, 2026, and will consider necessary amendments based on the initial reporting.

Given this extended timeframe, there is an expectation that CLIA and other industry stakeholders in the shipping industry worldwide will successfully negotiate with the IMO to address the unique challenges posed by the current CII formula as it stands today. A key area of focus to get this changed is that the formula inadvertently increases actual carbon emissions despite aiming for carbon intensity reductions for both cruise and cargo operations.

One proposed solution is to revise the CII formula for cruise ships by potentially removing "annual distance traveled" and considering alternative metrics such as passenger numbers instead of gross tonnage. This adjustment could lead to a more equitable and environmentally effective framework.

It could also be beneficial to look at the measure across an entire fleet, versus a ship-by-ship basis. Stolt-Neilsen argues, “Why consume biofuel on an A-rated ship and pay extra? But what if the abated emissions could be allocated to an E-rated ship? The planet would be happy in terms of overall emission reductions, and at the end of the day, this is what matters most.”

On the other hand, and a real possibility, is that the IMO may not see the need to modify international maritime regulations for a small fraction of leisure travel. If no changes are made to the formula, cruise lines will need to continue their focus and efforts on improving vessel energy efficiency, adopting alternative fuels and shore power solutions, along with adjusting their itineraries or potentially retiring non-compliant vessels.

Despite these challenges, the cruise industry is accustomed to adapting and evolving. Having experienced significant growth and navigated past obstacles, cruise lines seem to be prepared to make the necessary adjustments to ensure cruising continues while complying with evolving environmental standards. However, part of the formula that is not contemplated is how the adjustment of itinerary patterns including length of stay in ports, seasonality, and the other factors cruise operators may need to contend with affects passenger demand, this is the bottom line for the cruise industry for without the continued and increased consumer demand the industry will not thrive.

These regulations cannot be the primary driver of the industry moving forward, thus CLIA and the industry organizations that advocate for cruise tourism must contemplate the impacts now and petition the bodies making these types of regulations to work with the industry accordingly. While cruise operators have shown a strong penchant for business adaptability the implications of the current CII rating system appears to change the fundamental formula for cruise tourism that consumers have grown to appreciate when they cruise. How this will impact what the cruise brands can offer in the tourism market will be a challenge moving forward without any modifications to the existing formula.