Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

Viking Cruises, founded by Torstein Hagen in 1997, is a premier cruise line renowned for its luxury river and ocean cruises. Initially focusing on river cruises in Europe, Viking expanded into the ocean luxury cruise market in 2015 with a fleet of expedition and luxury ships focused on destination-centric itineraries and cultural enrichment.

Today, Viking boasts a fleet of over 90 vessels, offering river, ocean, and expedition voyages on all seven continents. The fleet includes ~80 river vessels, each hosting some 190 passengers, and 11 ocean vessels, with nine accommodating 900 passengers and two expedition ships carrying 380 passengers each. Viking is continuing to grow, with 24 new ships on order and options for 12 more in the river and ocean segments. Eight of these ships are ocean-going, meaning Viking will have added 19 ocean ships since 2015, averaging 1.4 new ships per year since their introduction into luxury ocean cruising.

On May 1, Viking Cruises went public, raising USD$1.5 billion. This capital is intended to support various initiatives such as expanding operations, paying down debt ($5.4 billion debt as of December 2023), and potentially expanding into land-based tours and excursions.

Viking's IPO has been deemed successful, with significant capital raised and the stock price rising from its debut price of $24 to as high as $32.63. This indicates strong investor confidence in Viking's potential for future growth and innovation. Investors are betting on the company's ability to dominate its market and drive significant revenue growth. That market includes other high-end, all-inclusive brands such as Oceania, Silversea, Seabourn, and Regent. Other luxury entrants such as Ritz Carlton, Four Seasons, and MSC’s Explora Journeys are also angling for continued growth in this segment.

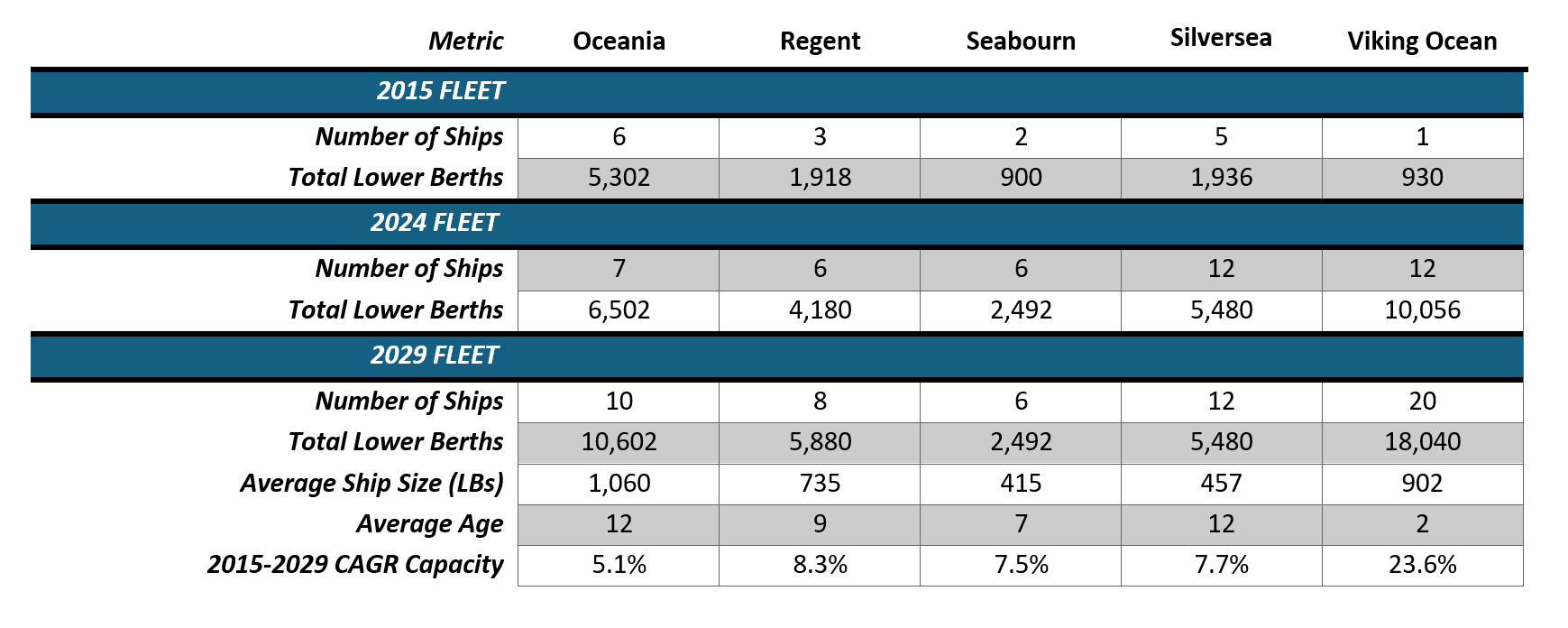

Looking comparatively at these more established luxury operators, Viking has demonstrated a significant history of growth since its inception. With only one ship in operation in 2015, they have already become the largest luxury operator in 2024 – with 12 ships and 10,056 lower berths. By 2029, Viking is projected to double its fleet to 20 ships and 18,040 lower berths, further solidifying its lead. This is double the size of its nearest competitor – Oceania – when looking at total capacity. As a result, Viking also operates the youngest fleet with some of the larger vessels in the category.

This translates into a 24% annual growth rate from 2015 to 2029. Regent follows far behind with the next highest annual growth rate at 8.3% over the same period. Viking's substantial investment into the ocean cruise market reflects confidence in their ability to compete effectively, tied to their robust and well-established river cruise business and name brand recognition Viking brings with it! While other luxury brands have also shown significant growth, Viking’s robust growth acceleration makes them the industry leader in luxury brand cruising.

Unlike Viking, whereas ocean ships are a major component of their total cruise portfolio, other luxury operators are smaller brand components within larger corporate cruise portfolios—specifically those of NCLH, RCG, and CCL. These larger companies have directed major investments towards bigger cruise vessels in the contemporary markets, private island destinations, and additional homeport facilities, reflecting a different strategic focus compared to Viking's approach.

Viking highlighted that their ocean ships are 91% booked for 2024 and 47% booked for 2025, indicating strong demand for their brand, and more generally, for luxury cruises. This is a positive sign for both luxury operators and the cruise industry. Despite having eight ships under construction, the luxury market is just a fraction of the overall cruise industry and will continue to remain supply-constrained. The smaller ships, each with fewer than 1,000 lower berths, will have a limited impact on the overall number of cruise tourism beds to fill, allowing Viking to keep pace with demand.

Additionally, Viking confirmed in its IPO that approximately 90% of its guests are from North America. While many of its itineraries are in Europe and Antarctica, Viking offers routes worldwide. With planned growth and its joint venture with China Merchants already operating in China, a likely next step is to increase capacity in China and other new consumer markets. thus, a focus on sourcing guests from outside North America as global interest in luxury cruise experiences grows.

The increase in luxury vessels also contributes to the industry's sustainable growth. These ships typically offer extended sailings rather than standard seven-night vacations, allowing them to visit ports on off-peak days, increasing port infrastructure utilization.

Overall, Viking's successful IPO debut reflects a positive trend for the cruise industry. It indicates robust demand for cruising across various brand strategies and demographics. It shows that while there are high barriers to entry for the ocean-going market, it is possible and that strong demand exists with proper brand recognition and targeted products. This trend suggests a positive cruise tourism outlook and continued growth across different cruise market segments.