Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

Alaska is almost halfway through another record-setting season and in full recovery mode. This region is an iconic, bucket-list destination, leading various cruise operators to expand their presence with more vessels and deploy the largest ships ever to the region to meet growing demand from North American and other world consumer markets. BA’s latest perspective takes a detailed look at the region and provides our outlook on what Alaska cruising looks like today and what the latest developments may mean for the future of the region in the years to come.

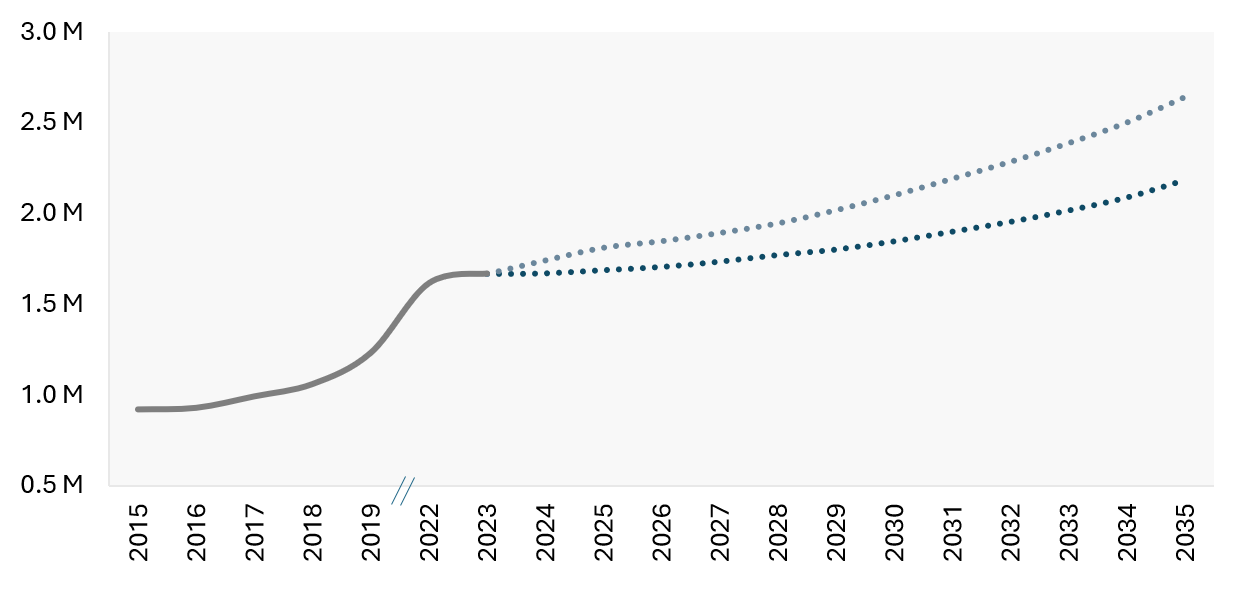

Alaska rebounded significantly from the heels of COVID-19, seeing passenger numbers reach over 30% of pre-pandemic levels in 2022. In 2023, the region returned to its typical annual growth rate of 3%, with 2024 expected to see similar levels of traffic.

This uptick in cruise passengers, coupled with the closure of China, bumped Alaska up to the fourth-largest cruise region globally in 2023, an impressive feat considering its size compared to the larger cruising areas of the Caribbean, Mediterranean, and Northern/Western Europe.

Aside from the instability in larger cruise regions like Asia and Northern Europe, which has given Alaska a competitive advantage as key North American brands sought to redeploy ships to safer areas, several other key factors have significantly contributed to Alaska's cruise industry growth over this period.

However, there are some risk factors that could hinder future growth that should be considered. The region, in terms of port opportunities, is small with limited upland soft tourism support, resources and itinerary options. For example, based on typical Alaskan itineraries, there are only four key homeports in the region: Seattle, Vancouver, Whittier, and Seward. Seattle experiences the most round-trip cruises. Vancouver’s calls are slightly more weighted in round-trip cruises, but they also experience a significant number of one-way voyages to the Northern terminus homeports of Whittier and Seward.

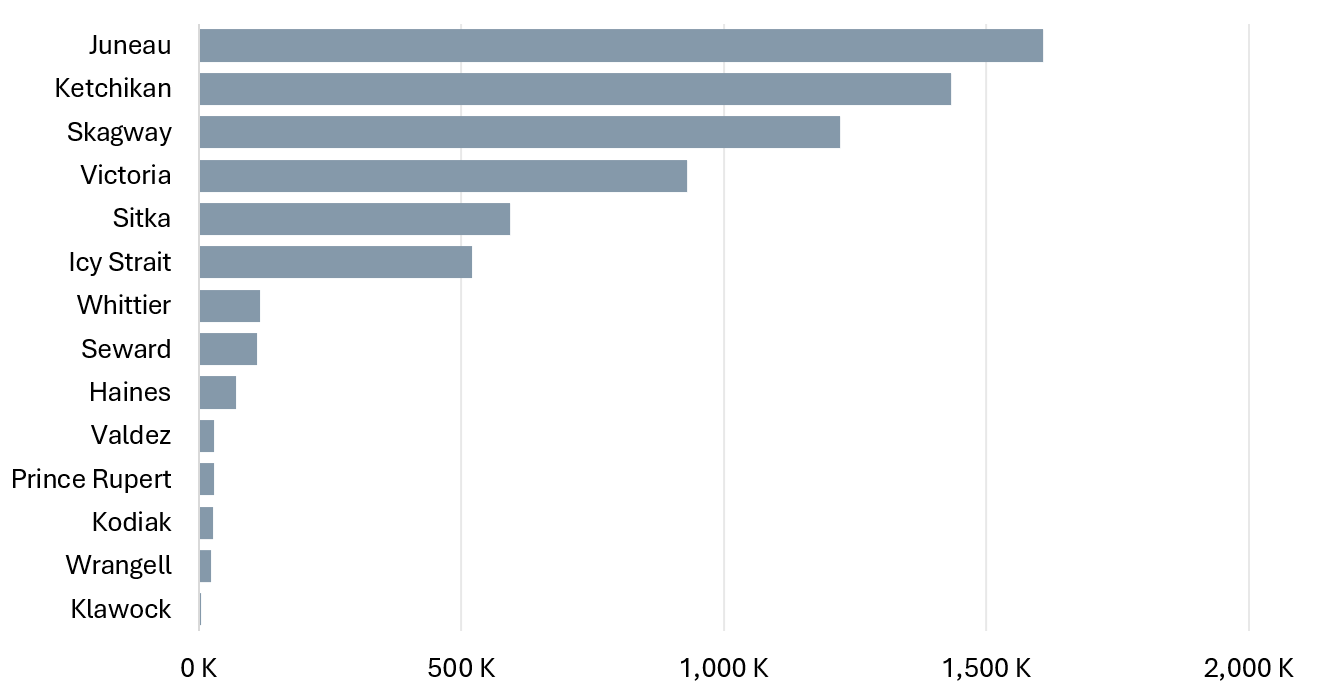

These four homeports support traffic to Alaska’s downstream ports. The “marquee” destinations – Juneau, Ketchikan, and Skagway – receive the majority of regional traffic today. With 1.7 million passengers anticipated to call the Alaska region in 2024, Juneau is expected to capture nearly 100% of all regional traffic. Ketchikan and Skagway are not far behind, with approximately 1.4 million and 1.2 million passengers expected in 2024. These ports, along with almost all other much smaller downstream ports, have recently undergone significant investments to expand or create new cruise infrastructure and upland tourism areas.

Due to this reliance and inflow of passengers across minimal destinations, some of these ports have made headlines recently. This April, Juneau and cruise lines agreed to limit the daily lower berths starting in 2026. The proposed cap aligns with the ability to welcome five vessels simultaneously with a mix of capacities. This, however, will limit cruise lines' ability to berth as many ships as they currently do. This is because today, one ship calls in the morning, and another in the afternoon, as they split the day with a sail through the glaciers before, or after, visiting Juneau.

This development comes after significant investments in the port over the last five years, including the development of a fourth pier in 2017 specifically designed to accommodate XL-sized vessels, with a fifth being developed by Huna Totem following NCLH's donation of a waterfront parcel for purpose in August 2022.

Sitka is another example of a port investment that is being met with pushback from the local community. Sitka, an emerging destination, developed a pier capable of accommodating two Quantum Class vessels in 2021. Despite the new pier and terminal facility, Sitka is evaluating a cap on cruise visitors. However, the situation is more complex due to the private ownership of Sitka’s cruise dock.

This shows that downstream port-of-call development and the creation of new destinations are not always enough to support growth, and that visitor management strategies are another key point of focus required to support the region's growth visitor management strategies are another key point of focus required to support the region's growth. While it remains to be seen what final restrictions will come into effect in these destinations – or if others will follow their lead – it is certain that the development of additional downstream ports, such as Icy Strait, Klawock and likely others, will be needed to provide alternatives to help absorb traffic to the region.

With both the potential upsides and downsides for the region considered, BA estimates growth over the next ten years, with passengers increasing from 1.7 million in 2023 to at least 2.2 million by 2035.

The successful realization of these projections will depend on a balanced approach that combines expanding capacity at key homeports, downstream ports of call, and developing new destinations, all while focusing on sustainable destination management.

Developments in the key homeports of Whittier and Seward are underway. However, it is anticipated that Seattle and Vancouver will also require new cruise facilities to meet the future demand in both vessel volumes and size. These homeports are the critical gateways to Alaska and require facilities that can meet the future demand. Without it, there will be a leveling off of traffic and consumers and the cruise industry will look to new destinations to meet their needs.

Furthermore, future environmental regulations may be a factor. Seattle, for example, has become the first port in the nation to independently require that 100% of all cruise vessels homeported be shore power capable and utilize this power source by 2027. While the majority of cruise ships are shore power ready today, it is a reminder that visitor management strategies may not be the only key steering cruise growth in the region – or industry, overall.

Depending on future regulations, these efforts may make the region more attractive for cruise lines looking to decarbonize operations and meet IMO guidelines. The region’s Pacific Northwest to Alaska Green Corridor project, aimed at decarbonizing cruise operations between the Pacific Northwest and Alaska, has ambitious goals - to have at least four cruise vessels operating on green methanol by 2032 - with the first vessel operational by 2030. At present, this is the only cruise-focused study examining the feasibility and taking action to aid in the availability of alternative fuels for regional itineraries.

Overall, Alaska is well-positioned to grow smartly, leveraging its unique experiences, infrastructure investments, new destinations, and the capture of larger vessels and new brands, all of which position the ports and region for the long-term. As the region continues to further mature, strategic infrastructure investments coupled with sustainable tourism practices are essential to maintaining momentum. These developments will not only enhance passenger experiences but also ensure that the natural beauty and community well-being of Alaska are preserved for future generations.