Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

In the second quarter of 2024, the leading public cruise corporations—Carnival Corporation, Royal Caribbean Group (RCG), and Norwegian Cruise Line Holdings (NCLH) — have demonstrated impressive financial performance. Drivers of this success and the current state of the cruise industry are highlighted in more detail and illustrated with graphics in this BA Perspectives.

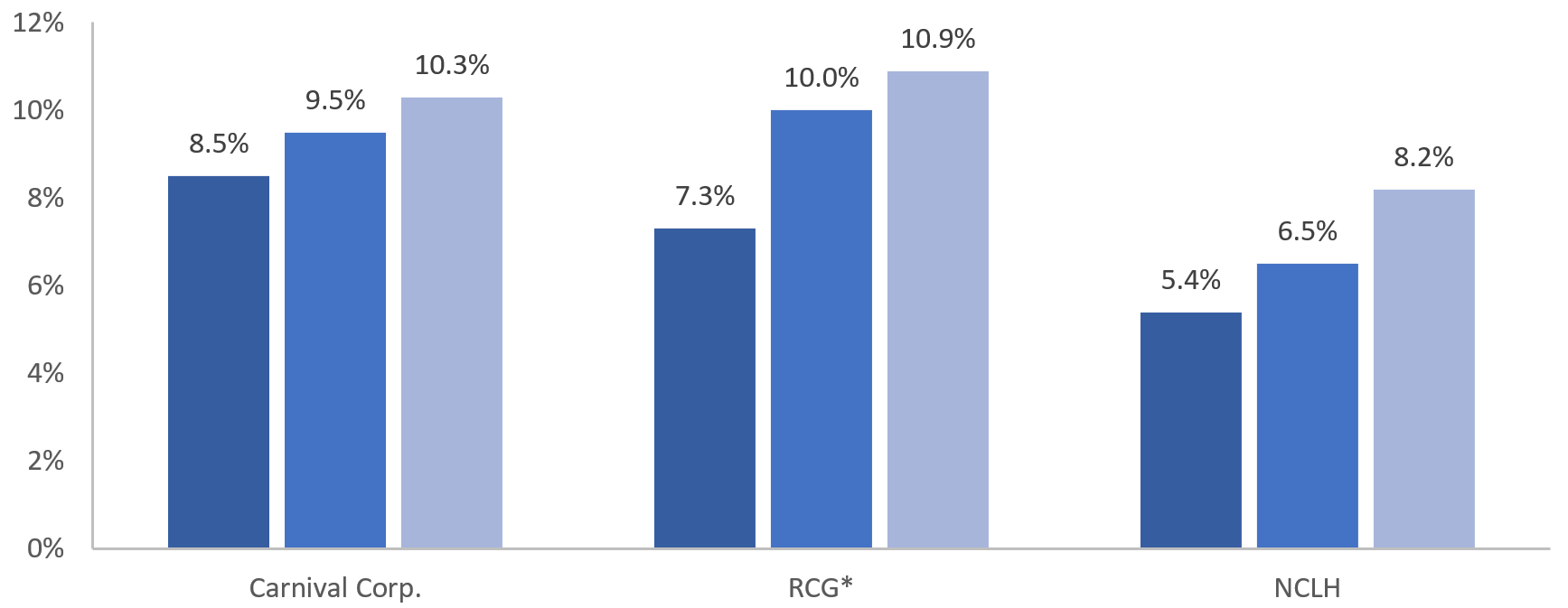

Full-year net yield guidance refers to the companies' projections of revenue per available passenger cruise day, adjusted for operating costs. It is a key indicator of financial performance in the cruise industry, representing the ability to generate profit from operations.

Each quarter, these leading cruise companies significantly revise their full-year 2024 net yield guidance upwards, reflecting a continuously improving financial outlook.

By revising their guidance upwards, these companies signal confidence in their ability to achieve higher revenues and profitability than initially expected. This continued quarter-over-quarter increase in guidance for all three corporations is an extremely positive sign for the industry, indicating robust demand and strong market fundamentals. Key factors contributing to these upward revisions are outlined below for each corporation, with highlights including:

While David Bernstein, Carnival Corp.’s CFO, stated that the "strong 10.25% improvement in 2024 yields is a result of the increase in all component parts: higher ticket prices, higher onboard spending, and higher occupancy at historical levels, with all three components improving on both sides of the Atlantic," it was revealed later in the call that the double-digit increase in net yields is driven almost equally by pricing and occupancy, with a slight advantage from increased occupancy levels (Q2 at 104% and Q1 at 102%).

The company further highlighted its focus on optimizing the bookings yield curve, which they believe is not just a near-term benefit but has also enabled record future bookings, particularly for post-2024 sailings. The unprecedented demand for 2025 sailings, coupled with flat capacity growth next year, is expected by the company to provide significant pricing power, setting the stage for higher per diem improvements in 2025.

RCG's CEO, Jason Liberty, noted that they have seen "an incredibly robust booking and pricing environment across all our key itineraries, which contributed to the outperformance in the second quarter." Moreover, Q2 2024 occupancy was 108.2% (up from 107.0% in Q1), which Liberty said contributed approximately 3% to yield growth, with the remaining increase driven by prices that were up by 10% across the fleet. He stated, "Our load factors were pretty normalized in the back half of last year. So really, all the yield improvement … is really being driven by price," adding that those higher prices are driven by "exceptional demand for our vacation experiences." With this quarter’s success, RCG became the first U.S.-based cruise operator to reinstate its quarterly dividend, starting in October.

"We're now back to full strength, full financial health," said Liberty.

Mark Kempa, NCLH's CFO, confirmed that "several factors contributed to the exceptionally strong top-line growth in the quarter, which included robust demand for European, Caribbean, and Alaskan sailings, where the majority of our capacity is deployed this quarter; stronger-than-anticipated onboard revenue and close-in sailing demand; and finally, the redeployment of canceled Red Sea sailings was better than our initial expectations." This improved financial performance was primarily attributed to revenue increases, though “disciplined cost savings initiatives across the entire organization” were also cited briefly. Harry Sommer, NCLH CEO, then confirmed, "The entire increase in our guidance is on the back of stronger pricing."

While touched on above, it is worth noting some specifics on how onboard spending patterns are changing across these companies. They are seeing an increase overall in onboard spending, but also in pre-cruise onboard spending, which refers to the rise in purchases made by passengers before their cruise begins, specifically for goods and services such as shore excursions, dining and drink packages, spa treatments, and internet plans. This also includes spending on the companies' private islands, to which they continue to drive more and more traffic. This trend has several positive implications for both the cruise line and its passengers:

Both Liberty and Sommer confirmed that pre-booking is up and that this translates into higher overall spending. Liberty stated, "More than 70% of guests are making pre-cruise purchases before they sail, and they spend more than double compared to those who only make purchases onboard." Similarly, Sommer confirmed, "Pre-booked onboard revenue per capacity day showed solid growth, increasing by 15% as more guests opted for pre-cruise purchases. And as we've seen from prior experience, higher pre-cruise spend typically results in higher overall spend throughout the guest cruise journey."

The fact that onboard spending is up for all companies, and this translates to higher overall spend once onboard, indicates strong purchasing power among those opting for a cruise vacation.

When Sommer was specifically asked if the company was seeing lower ancillary spending like Marriott reported the same morning, he replied, "The short answer is no. We are seeing no, absolutely zero decrease in onboard spend."

Michael Bayley, President of RCI, reported a similar sentiment: "We have the opportunity of taking on 25,000, 30,000, 35,000 bookings a day. You're going to see the cash register ring pretty much every second somewhere in the world on our ships. And I know there might be a group seeking to hear that there's some type of break in the pattern, but there just isn't."

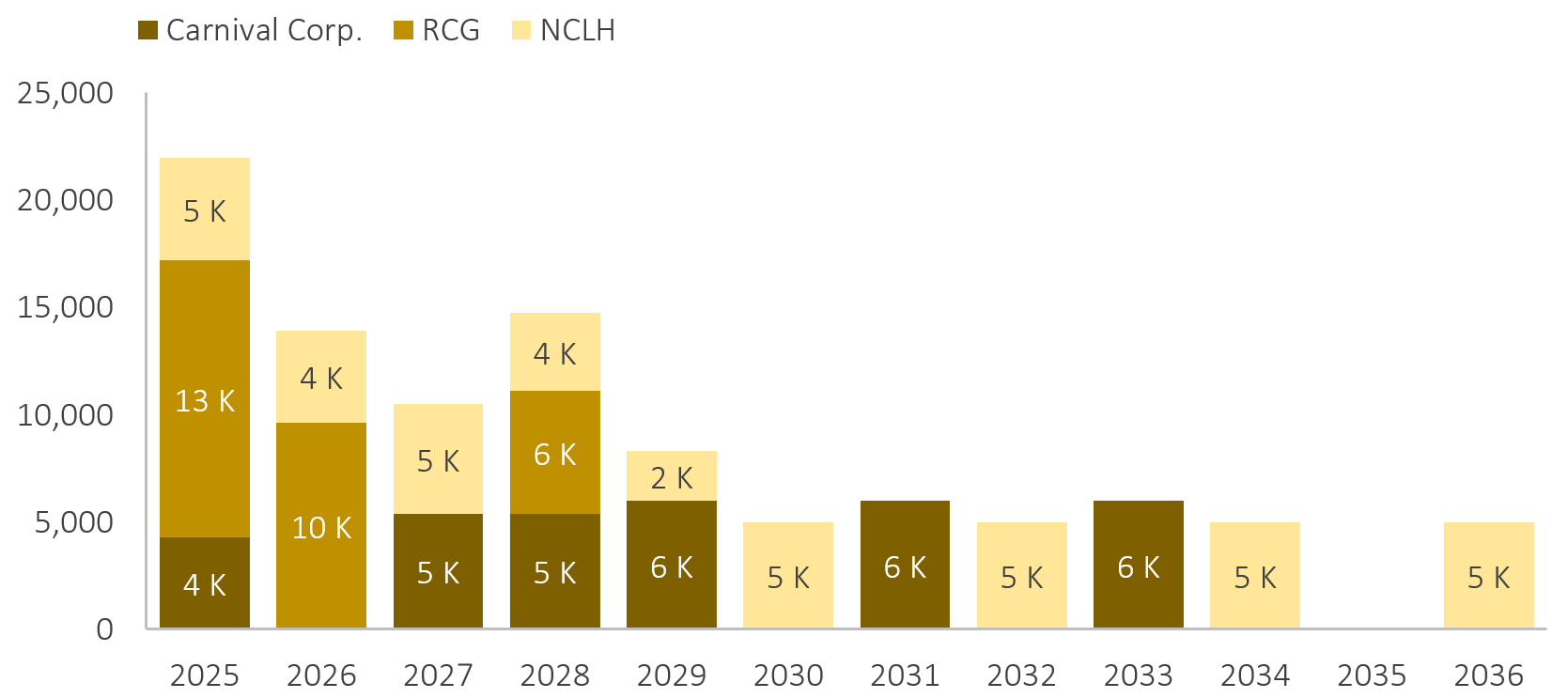

Today, the cruise industry's order book extends further into the future than ever before, with ships scheduled for delivery through 2036. This expansion follows a surge in new ship orders during the first half of 2024, marking a significant renewal of large-scale investments following the pandemic’s end.

NCLH commissioned eight new ships across its three brands, with the NCL brand shifting from the already upsized Leonardo-class ships with 3,600 lower berths to a new class with 5,000 lower berths. Carnival Cruise Line ordered five new ships in 2024. Two of these ships are of their existing vessel class, each with a capacity of 5,400 lower berths. The remaining three ships will belong to a new class, boasting over 6,000 berths and becoming the largest in the Carnival Corp. global fleet, accommodating almost 8,000 guests at full capacity. RCG placed an order for a seventh Oasis-class vessel, which will accommodate 5,700 lower berths.

The orders are detailed below. Among the three operators, NCLH has the largest capacity on order, with just over 40,000 lower berths, representing 40% of the total. Carnival Corp. has 33,100 lower berths on order, while RCG has 28,210. Based on the occupancy levels reported by each corporation in Q2, these orders translate to a combined capacity capable of accommodating approximately 5 million passengers

Behind each company’s order book, the corporations outlined details on their orders and growth optimization strategies. Josh Weinstein highlighted Carnival Corp.'s vision to optimize yields and consolidate operations. Carnival Cruise Line will add nine ships by 2028, including new builds and the transfer of three Costa Cruises vessels and two P&O Australia vessels. These moves will increase Carnival Cruise Line’s capacity by approximately 50% compared to 2019. By 2028, the Carnival brand will comprise 37% of the company's portfolio, up from 29% in 2019.

Liberty confirmed that RCG is focused on moderately growing yields, controlling costs, and expanding the business in a disciplined manner. As part of their mid-to-long-term strategy, the company is planning around the retirement of its older, smaller ships. “We're looking potentially at smaller ships [that] will probably replace some of those older ships.” Liberty said that this is a strategy focused on ensuring that RCG continues to have access to “some of the more unique and bespoke destinations, and to further diversify our footprint around the world”. Currently, the company visits about 1,000 different destinations, and it is continually working to broaden the range of locations available to guests, recognizing that ship size can play a crucial role in where ships can operate.

NCLH's long-term growth strategy focuses on measured capacity growth and fleet optimization to drive strong financial returns. Sommer emphasized that historically, capacity growth has led to substantial increases in revenue and earnings. NCLH expects this trend to continue with the addition of larger, more efficient vessels.

The future of the cruise industry looks promising, buoyed by high single-digit and low double-digit growth in profits (yield) projected by public cruise lines in 2024. This robust financial performance has led to a surge in new ship orders in the first half of 2024, indicating that there is untapped consumer demand that the industry’s existing capacity has yet to capture.

Several factors signal this demand: record-breaking booking levels, increased prices, and strong purchasing power, as evidenced by higher onboard spending. Overall, increased pricing reflects the fundamental dynamics of supply and demand, with higher prices serving as a robust indicator of strong demand and limited supply.

Recognizing this untapped potential, cruise lines have placed orders for 14 new ships in the first half of this year. While there is a clear trend toward deploying larger ships to accommodate more passengers and benefit from economies of scale, as indicated by RCG, smaller ships remain essential for accessing unique destinations that larger vessels cannot reach. The industry will continue to see a demand for these smaller ships well into the future. This strategic balance between ship sizes allows cruise lines to cater to a diverse range of itineraries and customer preferences.

As the industry continues to evolve, these investments in new ships and strategic fleet expansions position cruise companies to meet growing consumer interest and capitalize on emerging opportunities. With further advancements in technology, sustainability initiatives, and enhanced guest experiences, the cruise industry is poised for sustained growth and continued success in the coming years.

The resurgence of the industry will also impact their strategic decision-making over the next 2 to 3 years when it comes to destination investment priorities in the key markets such as their private island expansion and enhancement programs, berth and upland consolidation, and perhaps a more direct partnership role in tourism destination management worldwide to assist in solidifying the continued growth of cruise as a core worldwide tourism product into the long-term.