Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

As pressure mounts for cleaner cruise operations, shore power is emerging as a solution to cut greenhouse gas emissions and improve local air quality. The pitch is simple: by plugging ships into the electrical grid while docked—rather than running their engines—ports can eliminate ship-based emissions locally, reducing impacts on neighboring communities. These local air quality benefits occur regardless of how clean the electricity grid is, because the emissions are displaced away from the port.

However, the broader greenhouse gas impact depends on the source of the electricity. If the shore power comes from cleaner or renewable energy, overall emissions are reduced. When that electricity is entirely renewable, the emissions from docked ships can approach zero. But like most things in port development, the promise comes with complexity—and cost.

In this BA Perspective, we take a closer look at what it takes to make shore power work—from the technical and economic challenges to evolving fleet trends and what ports can do to position themselves for success.

The concept of supplying ships with power from shore is not new—it dates back over a century but was originally for military and practical operational reasons, not environmental concerns. In commercial ports, shore power remained rare until environmental regulations and local air quality concerns started gaining traction in the late 20th century. The push for cleaner air in dense urban port areas was a turning point.

When it comes to cruise ships, one of the earliest known applications of shore power was in Juneau, Alaska, around 2001. The city-owned hydroelectric utility had excess capacity and saw an opportunity to sell power to docked ships at a rate lower than what it cost the ships to run their onboard generators. While environmental benefits—such as reducing emissions in the community—were certainly part of the motivation, the primary driver at the time was economic. This arrangement proved successful, and cruise lines with regular calls to Juneau invested in modifying their vessels to accept shore power connections.

Beyond fuel costs, another concern that accelerated attention was the visible impact of emissions—particularly black smoke discharged while ships were docked—drawing complaints from local communities. In California, the issue became more urgent. These areas were federally designated as non-attainment zones for air quality due to geography, population density, and industrial activity. California regulators, notably the California Air Resources Board (CARB), enacted increasingly strict rules to reduce emissions from cars, trucks, power plants, industry, and eventually ocean-going vessels. Shore power was embraced as one of several solutions to reduce port emissions.

As this momentum grew, shore power became more widely requested, sometimes without recognizing its origins in specific environmental and economic needs unique to California and Alaska.

At the same time, the cruise industry began making significant investments in environmental stewardship, particularly focused on reducing emissions both at sea and in port. These investments have included scrubbers to reduce SOX and particulate matter emissions, energy efficiency measures, new fuels such as LNG, and preparations for future fuels and technologies—all contributing to progressively lower emissions from ships.

Ultimately, the shared efforts of ports and cruise lines have led to meaningful improvements in environmental performance. However, the focus should remain on reducing total emissions, not simply applying one solution everywhere. In some regions, shore power may not offer a clear environmental benefit if the local energy grid relies on high-emission power generation, however, over time as the electrical grids decarbonize it will become more beneficial. A balanced, outcomes-driven approach will ensure that solutions like shore power are used where they make the greatest positive impact.

Switching to shore power isn't a plug-and-play upgrade. It requires high-voltage, with infrastructure that connects terminals to regional utility grids and delivers electricity through specialized transformers and heavy-duty outlets—typically operating at 6.6kV or 11kV, in line with international standards.

There are several ways ports can deliver this power to vessels, each with different tradeoffs related to cost, operational flexibility, and spatial constraints:

At Bermello Ajamil, we work with ports to identify the right system for their terminal layout, ship mix, and long-term operational goals—ensuring each solution meets today's needs while accommodating future growth.

Installing shore power infrastructure can cost tens of millions per berth, depending on the location and complexity. That alone is a major hurdle—but so is the cost to operate it.

In many markets, electricity costs twice as much as marine fuel for the same port stay. Without meaningful financial incentives, many cruise lines are reluctant to plug in, especially where shore power is not required by law.

What tips the scale?

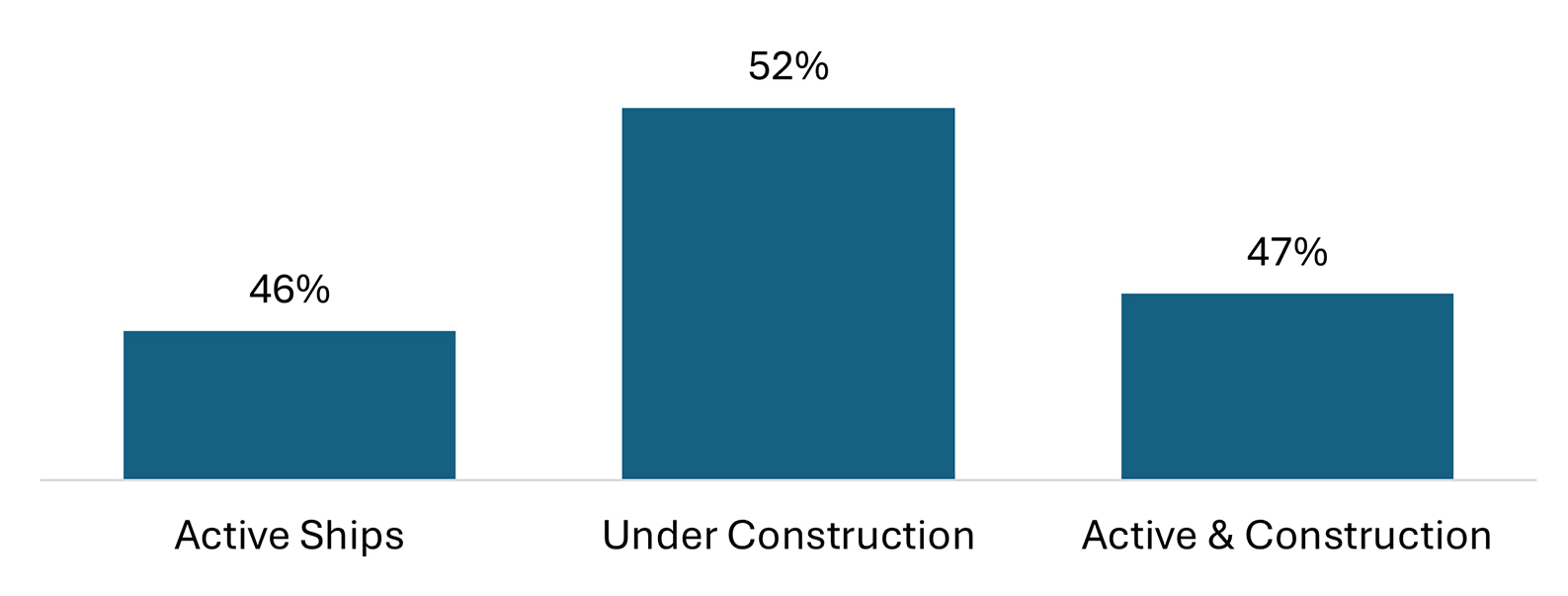

Shore power is quickly becoming a strategic differentiator. Cruise operators are retrofitting existing ships and ensuring that new vessels are shore-power ready. According to Cruise Industry News, 47% of the global fleet—including ships on order—already have or will have shore power capability. Looking closer: 46% of ships delivered through 2025, and 52% of ships currently under construction, are equipped or planned to be equipped with shore power.

This reflects a clear industry shift: newbuild cruise ships are increasingly being designed with shore power systems as a standard feature.

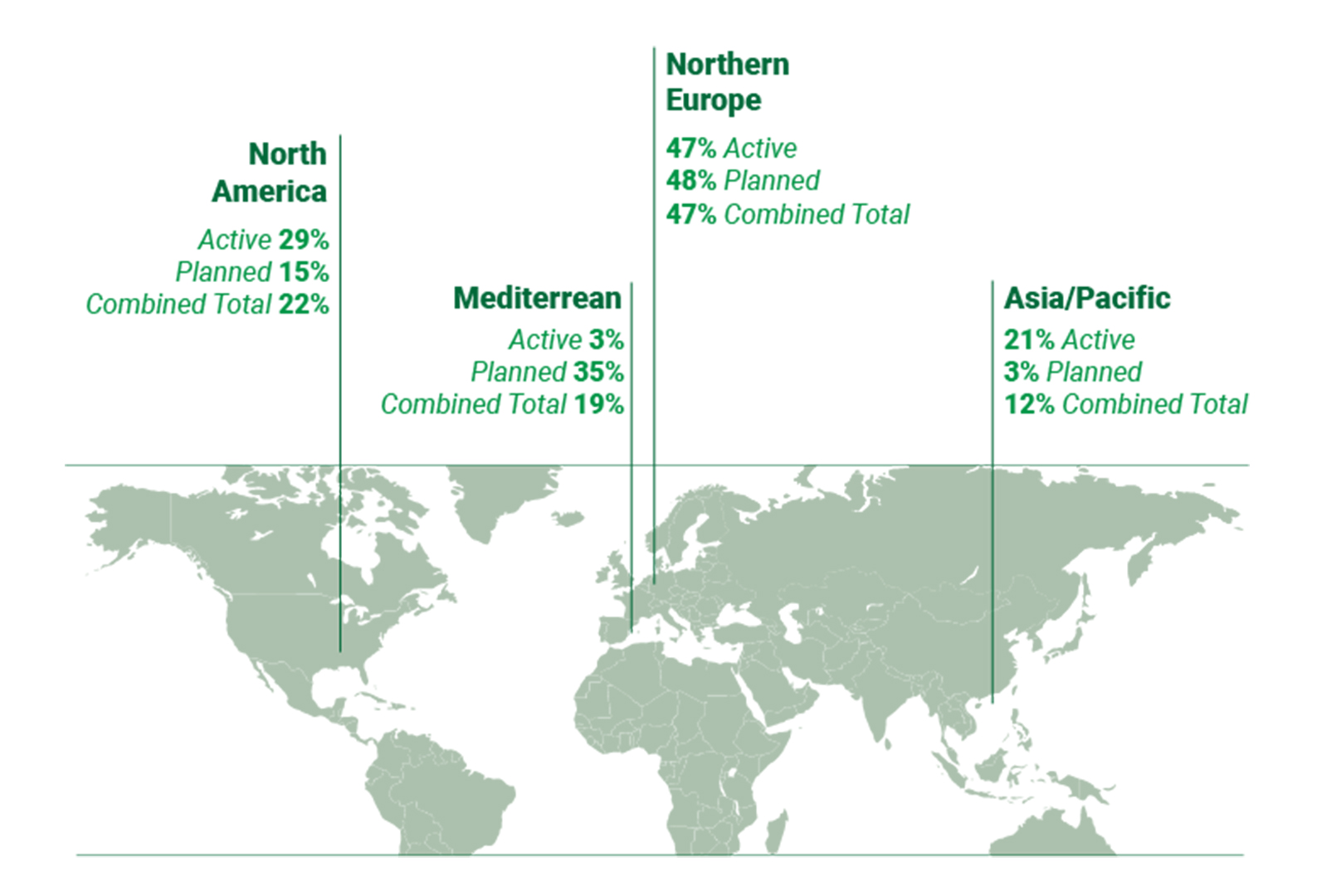

Ports are also racing to keep up. Today, about 40 cruise ports worldwide offer at least one berth with shore power, and another 40 are expected to come online by the late 2020s.

To put that in perspective: in 2024, Royal Caribbean Group reported calling at more than 1,000 global cruise destinations—so the number of shore power–equipped ports is just a small fraction of cruise ports globally.

Active and Planned Shore Power Facilities – Cruise Ports (Late 2020s)

Shore power can make a real difference—but infrastructure alone isn't enough. Widespread adoption requires:

The industry is moving toward cleaner power generation technologies and alternative fuels, including hydrogen-based fuels and nuclear. When these become widely adopted, the traditional role of shore power may diminish, and mandates requiring its use could conflict with the broader goal of reducing emissions.

At the same time, hybrid and electric configurations on vessels of all kinds are becoming more common, requiring charging capabilities on shore. Even some cruise ships are increasing battery capacity onboard their vessels to enable zero-emission cruising for short durations. Ultimately, the focus must remain on achieving the greatest overall emissions reduction.

At Bermello Ajamil, we're proud to help ports build scalable, flexible, and financially viable shore power strategies. Our work with major cruise ports and terminal operators—from PortMiami to Massport to Ports America—focuses on aligning infrastructure with ship readiness, leveraging available funding, and designing systems that adapt to local constraints.

Contact us for more information on how to start thinking if shore power is right for your port.