Nassau Cruise Port Global

BA’s design for the waterfront features a completely transformed Port and Welcome Center, additional mega berths to accommodate the largest cruise ships in the world...

Gain deeper insights into the maritime industry with detailed updates on key developments and trends, meticulously curated by our team of specialists.

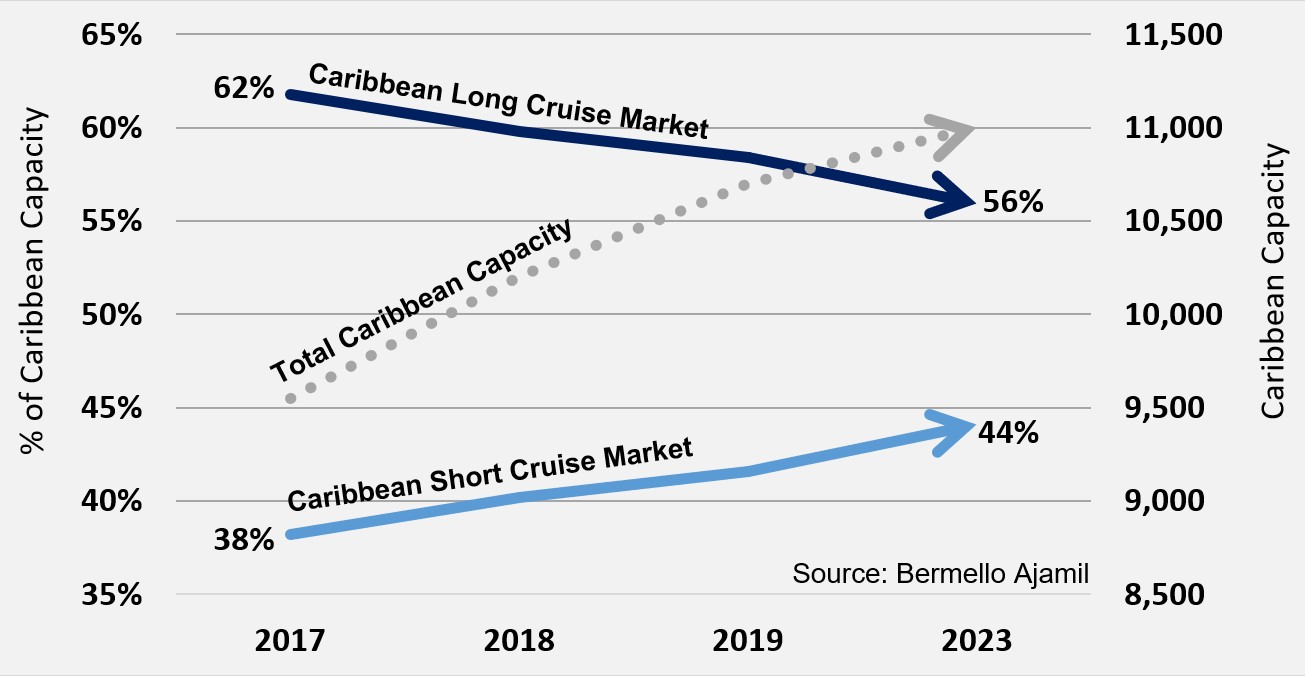

The Caribbean cruise market is experiencing a significant increase in passenger numbers, but it is not only because more capacity is being placed in this market but because a dramatic shift has occurred in the length of the short Caribbean itinerary market. The trend towards shorter cruise patterns, such as 3/4 night and 5/5/4 night programs, is significantly shifting as a percentage of the total Caribbean traffic.

Our last bulletin focused on the shift of lower berth capacity in 2023 to several worldwide markets, particularly the Caribbean. That market continues to grow and is expected to welcome ~41% of global capacity. What has also shifted is the division of cruise lengths within the market.

From 2017 to the scheduled deployments in 2023, the percentage of short Caribbean capacity is expected to rise from 38% of the total Caribbean market to ~44% (“short” defined as a cruise of 5 or fewer nights), or a ~15% increase. For ports and destinations, this shift is huge, as it means that a single ship that used to call once a week now may call twice a week, or a 100% increase. However, this will now shift the location of where this occurs. There will be an impact felt throughout the Caribbean.

Our data indicates that the short cruise market has fueled most of the Caribbean’s capacity growth since 2017, with a CAGR of ~5%. Meanwhile, the long cruise Caribbean market has remained relatively stable since 2017 (~1% CAGR).

The growth in the short cruise market is a result of two factors. First, a growing demand for shorter, more flexible itineraries that can fit into busy schedules and allow for more flexible and affordable cruise options for guests.

The second is the desire of operators to optimize ship deployments by shifting itineraries that keep fuel expenses low. Cruise lines are high fixed-cost businesses, and even relatively small changes in fuel prices can significantly impact profits and ship deployments. Fuel is one of the biggest costs of doing business, averaging over 11% of operating expenses in 2019 across the largest four operators.

The short Caribbean cruise market is a solution for both, and its growth demonstrates the effectiveness of operators in optimizing yields while meeting the evolving needs of passengers.

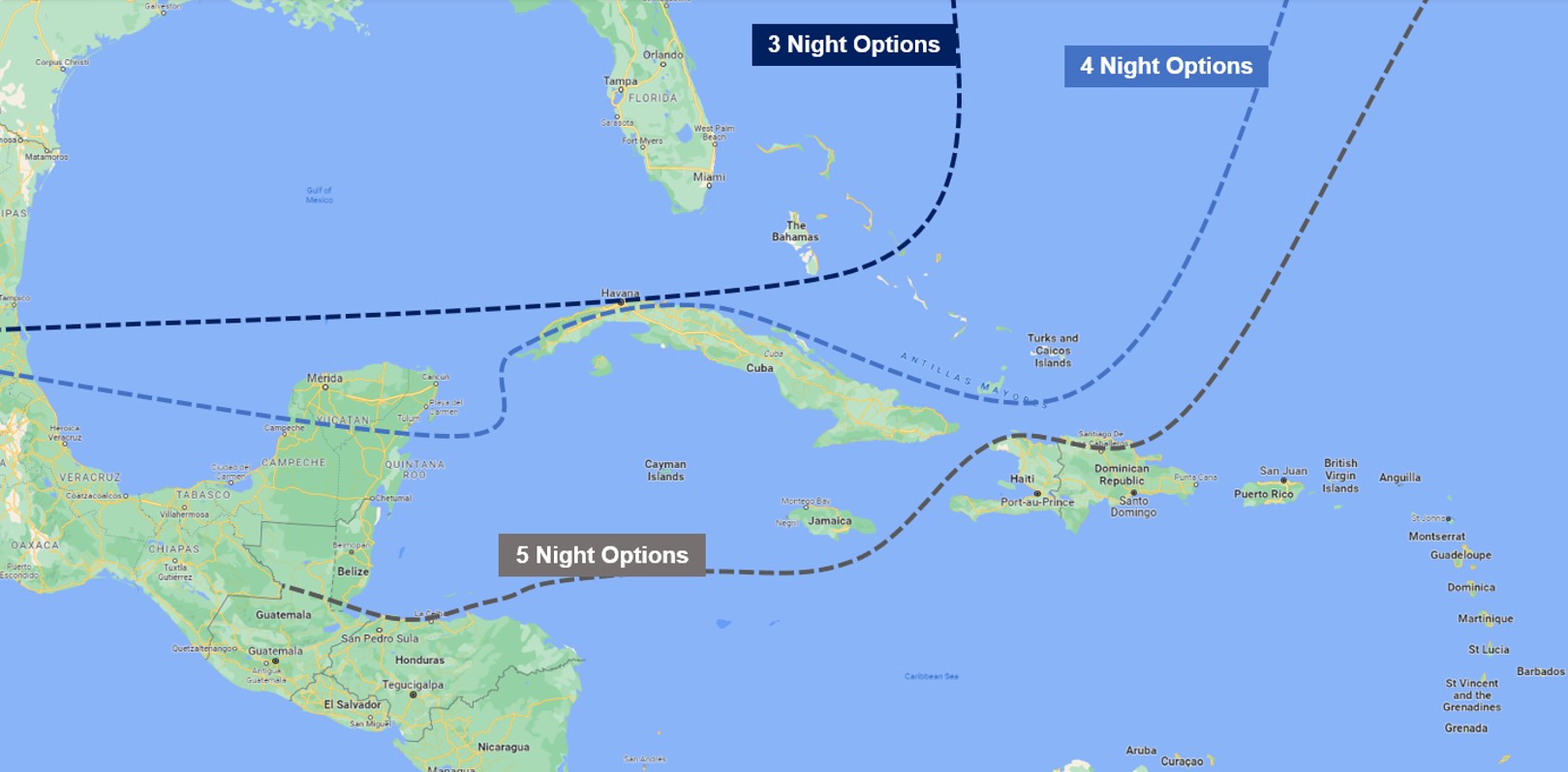

Caribbean homeports with close proximity to foreign destinations in Florida and the Gulf of Mexico are expected to benefit from the growing popularity of short Caribbean itineraries, while ports further away may face logistical and economic challenges due to speed and distance.

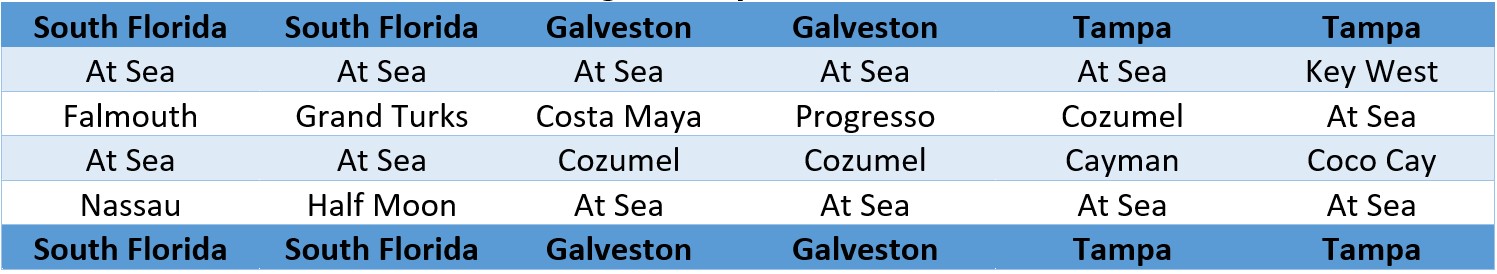

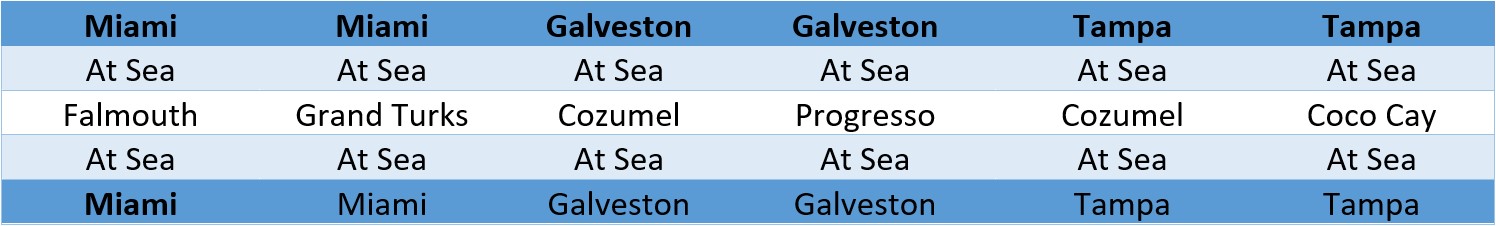

Gulf short itineraries (Galveston, New Orleans & Tampa) are limited to 5/5/4 Night patterns as the nearest foreign ports are one cruising day away. Ports of call within a cruising day in the western Caribbean and the Bahamas (Tampa only) can be included and are expected to benefit.

In comparison, itinerary patterns in South Florida are within next-day proximity to foreign ports. Ports within next-day proximity of South Florida are expected to benefit the most as they must be included on three-night weekend cruises, but they can also be included in four-night voyages. These ports stand to benefit the most as they can welcome ships sailing 3/4 Night itinerary patterns.

Of course, the distance to a port of call in the Caribbean will vary based on a specific homeport, and a port that can welcome 4-night cruises from one homeport may not be able to benefit from 4 night itineraries from another. For example, a 5 night itinerary from Tampa can reach Grand Cayman and Cozumel, but a 5 Night from Galveston can only reach Cozumel or Progresso. Sample 4 and 5 Night itineraries that highlight the issues are shown below.

Additionally, these short cruise itineraries provide more overall passenger days to a port that supports these deployments (whether it be a homeport or port of call). For example, a seven-night cruise sailing year-round in the Caribbean on Saturdays will deliver 52 calls to a homeport. Should that ship switch to a three- and four-night itinerary pattern, i.e., now sailing a Monday-to-Friday cruise, and a Friday-to-Monday cruise, that ship is now calling the homeport 104 times in a year, essentially doubling passenger throughput with this shift. The same will happen for ports of call that welcome ships on these itineraries.

This increase in passenger flows to ports may require additional infrastructure (such as parking) or resources to accommodate the added throughput.